Netflix just kicked off its big crackdown on illicit password-sharing users this spring — but co-CEO Greg Peters says there’s still a long road ahead of the company on this front.

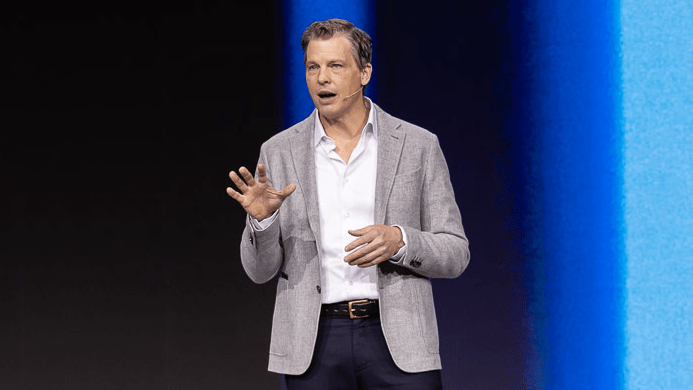

“We’ll be in the password-sharing business for some time,” Peters said, speaking Tuesday at the 2023 Goldman Sachs Communacopia + Technology Conference.

According to Peters, Netflix “built an elegant solution” to address the issue of informing users who were piggybacking on someone else’s account that they would need to pay for their own plan (or get added as an “extra member” for an additional fee).

“If you’re borrowing Netflix, you’re not thrilled about the idea that we’re gonna charge you,” Peters noted. Netflix continually tested and iterated its paid-sharing programs and messaging as it saw how consumers were responding. “We always had a deliberate approach… to make sure we were learning and we were getting it right,” he said.

For Netflix, clarifying the messaging was a key component of that, Peters said. “There was a lot of confusion about what use cases we were trying to prevent,” he said, adding that Netflix made a point of telling customers that using the streaming service while traveling is totally OK.

During the second quarter, Netflix gained 5.9 million net new subs — more than double Wall Street expectations — and the company said it expects to add about the same number in Q3. A big driver was the company’s paid-sharing initiative, which it launched broadly in 100-plus countries in May. The streaming giant counted 238.39 million global subscribers as of the end of June.

Peters said people who use shared passwords have fallen into two categories: Those sharing in a casual way (i.e., they borrowed their boyfriend’s account) and those who were sharing a single account for “a more economic reason.” For the first category, “As soon as we said, ‘You have to get your own account,’ they did,” according to Peters. (Netflix calls such a new subscriber a “spin-off account.”) On the second, Netflix assembled various “extra member” add-on pricing approaches to cater to price-sensitive members who were sharing their account. “Part of it was, we had to come up with a set of solutions that solved for those needs,” he said.

While the paid-sharing rollout will continue over the next few years, Peters said that in the grand scheme of things, “I think of that as a more transitional situation.” By comparison, Netflix’s entry into the advertising business “is a longer-term, multi-decade business,” where the company needs to achieve scale and introduce the right price points and features to really “unlock the potential for connected TV,” Peters said.

Netflix in July eliminated the lowest-cost option with ads (the Basic plan, $9.99/month in the U.S.) for new members in the United States and the U.K. in a bid to drive up subscriptions to the $6.99/month ad-supported service as well as to the Standard $15.49/month plan without ads.

Peters said Netflix will continue to expand the range of features and prices it offers to hit the broadest addressable market as possible. “We ultimately want to have quite a wide spread of price and offerings,” he said. “We want to be accessible to the vast majority of the world’s population.”

Peters was named Netflix co-CEO — alongside Ted Sarandos — in January 2023 after Reed Hastings stepped down from the role. Previously, Peters, a 15-year veteran of the company, served as chief product officer and chief operating officer.

At the Goldman Sachs conference, Peters said the transition into the co-CEO role has “been relatively seamless and incremental,” noting that he has worked with Sarandos during his entire tenure at Netflix.