Jackyenjoyphotography | Moment | Getty Images

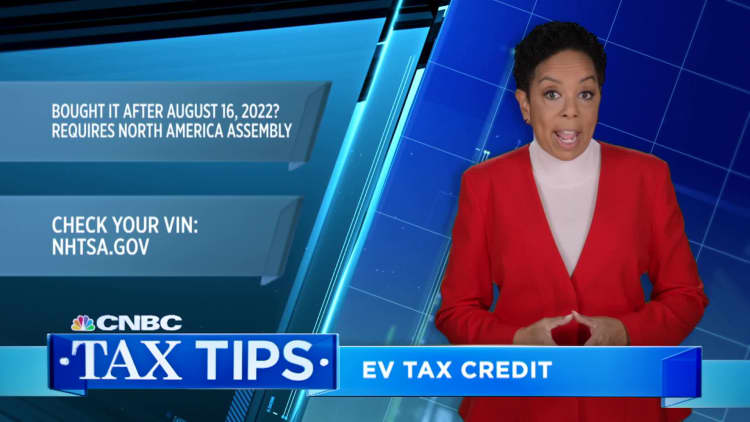

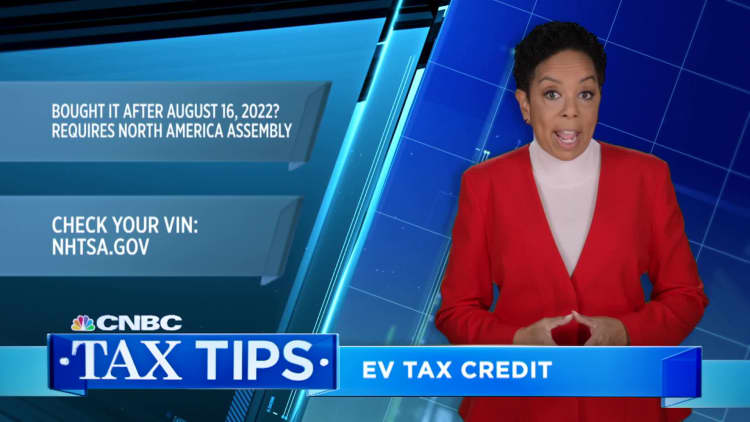

Why the new EVs credit may be harder to claim

As of Aug. 17, for example, final assembly of the car had to take place in North America.

The final two requirements — which apply to the sourcing of car battery components and critical minerals — will kick in on April 18 and phase in over a few years, according to the Treasury Department.

More from Personal Finance:

Are you tax-savvy? Take our quiz to find out

What the IRS $80 billion funding plan means for taxpayers

Here’s a decade-by-decade guide to building wealth

Lawmakers’ aim is to encourage carmakers to build batteries with domestic supply chains instead of relying on countries like China for essential parts.

In the short-term, though, it’s expected that the current list of cars that qualify for the $7,500 credit will fall in number, at least until manufacturers are able to meet the new battery rules.

The IRS will update that list of qualifying EVs on April 17. At that time, the cars that currently qualify for a tax break may be associated with a smaller tax credit or none at all, perhaps just temporarily.

$4,000 credit for used EVs has fewer conditions

Krisztian Bocsi/Bloomberg via Getty Images

The Inflation Reduction Act also created a tax credit for consumers who buy used electric or fuel-cell vehicles.

The tax break for used cars, which took effect in 2023, is worth $4,000 or 30% of the sale price, whichever is less.

This “previously owned clean vehicles credit” doesn’t carry any of the manufacturing rules tied to new EVs — amounting to a potential workaround for consumers who are in the market for an electric vehicle and want to maximize their tax savings.

“If the new vehicle you want isn’t eligible [for the $7,500 credit], you might be able to save some money [by buying a used EV] and get a tax credit,” said Ingrid Malmgren, policy director at Plug In America.

The used vehicle credit applies to a broad selection of cars, she said. Consumers can consult an IRS list to verify which used vehicles qualify.

Here are some of the major criteria for cars and consumers to qualify for the credit:

- The car must be purchased from a licensed dealer.

- The car’s model year must be at least 2 years old.

- The sale price must be $25,000 or less.

- It’s only available to individuals, not businesses.

- Buyers are ineligible for a credit if their annual income exceeds certain thresholds: $75,000 for singles, $112,500 for heads of household and $150,000 for married couples filing a joint tax return. Buyers assess income for the year in which they acquired the car or the prior year, whichever is less. (Income is measured as “modified adjusted gross income.” You can consult these FAQs to determine how to calculate modified AGI.)

Those income limits are “much lower” than the one that applies to the $7,500 tax credit for new vehicles, however, said Katherine Breaks, a managing director in KPMG’s tax credit and energy advisory services group. The income thresholds associated with new cars are double those for used EVs.

Both the new and used credits are nonrefundable, meaning car buyers need to have a tax liability to get any value from the tax breaks.

“If I don’t have $4,000 of tax liability, what’s the tax credit worth to me? Not much,” Breaks said of the used-vehicle credit.

Starting in 2024, however, a new mechanism will kick in for new and used cars whereby buyers can transfer their tax credits to dealers — perhaps allowing dealers to turn the tax break into a point-of-sale discount for consumers instead of a benefit that can only be claimed when filing an annual tax return, experts said. The IRS plans to issue additional guidance about this transfer provision.

A $7,500 tax break for leasing a new EV

Matt Cardy | Getty Images News | Getty Images

Alternatively, consumers also appear poised to get a tax break worth up to $7,500 for leasing new electric passenger vehicles.

And this tax benefit doesn’t carry the manufacturing requirements attached to purchases of new cars, Malmgren said. That means a larger number of vehicles are likely to qualify at first — making the provision somewhat of a loophole for consumers who’d like to lease a car.

“There are very few restrictions that apply,” Malmgren said.

The Inflation Reduction Act created this “qualified commercial clean vehicles credit” for business owners. Car makers have affiliate leasing or financing arms that buy electric vehicles for commercial purposes and then lease the cars to consumers — at which point they may pass on the associated tax break, Malmgren said.

“Most of the manufacturers have been indicating really clearly they’ll pass the whole amount through [to consumers],” Malmgren said of the $7,500. “But you need to check. Because not all of them are passing it on.”