Most folks would never see wealth to the tune of $60 billion in their entire lives. Yet, that’s precisely how much India’s influential billionaire baron, Gautam Adani, lost over the last few days as his net worth halved from a high of $120 billion.

That mayhem was caused by shocking allegations of stock manipulation and money laundering by the American short-selling firm, Hindenburg Research, who accused Adani and his businesses of pulling “the largest con in corporate history.” The allegations sent Indian markets into a tizzy as Adani’s group of companies lost over $110 billion in value and his fresh stock offering was scuppered.

Stock markets typically recover from shocks as the passage of time forces a reckoning and evens out speculation. But for India, the problem runs far deeper and poses several tests of long-term credibility.

Perhaps far more dangerous than the possible fraud committed by Adani is the fact that nobody is allowed to ask any questions about it.

In its official response to the allegations, the Adani Group said that the report was a “calculated attack on India, the independence, integrity and quality of Indian institutions, and the growth story and ambition of India.” Its chief financial officer later likened the stock market collapse to the 1919 massacre of unarmed Indians at the Jallianwala Bagh in Amritsar by a British army officer.

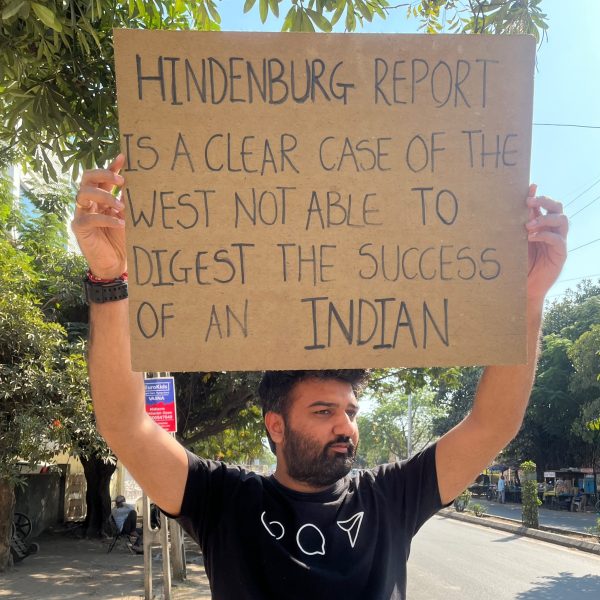

Then, several influential public personalities in India unleashed a barrage of jingoism, claiming that there was a coordinated Western assault on India and its booming economy.

Much of this rhetoric seems to be borrowed straight from the emotive victimhood narrative that is today a staple of Hindu nationalist politics in India. Not by coincidence, Adani’s statement echoed the Indian government’s own response to a controversial BBC documentary on Prime Minister Narendra Modi. Asked about that film, the spokesperson of India’s external affairs ministry, Arindam Bagchi, said that “a continuing colonial mindset is blatantly visible.”

As far as foreign investors are concerned, however, whether there really is a neocolonial Western assault on a proud, rising India is beside the point. The very fact that both the government and India’s foremost industrialist believe that this is a credible defense raises questions over whether India’s state institutions will objectively investigate Hindenburg’s claims — or even other allegations against similarly influential corporations in the future.

As columnist Andy Mukherjee summed up in Bloomberg, “To project oneself as the flagbearer of a proud, self-reliant India is increasingly seen as a ticket to avoiding scrutiny by the media, regulators or environmental groups, all of whom can be denounced for not being on board with the chauvinistic chest-thumping.”

Adani also poses other tests of credibility, especially in terms of the role he has played in India’s foreign policy. In early December last year — even before Hindenburg’s allegations — a Washington Post report revealed that Adani was building a coal-fired power plant to sell electricity to Bangladesh at several times the market price in that country. That agreement was signed years ago during Modi’s visit to Bangladesh, but in the aftermath of that report and the more recent fracas, Bangladeshi authorities asked for a review of those prices. Further reports suggested that the Adani plant was favored over a far more economical deal with Bhutan.

Meanwhile, in Australia, political influence was reported to have green-lit a controversial coal mine in Adani’s name.

For years, analysts and observers have rung the alarm over Adani’s potential capacity to bend and co-opt India’s state institutions by leveraging his close ties to Modi. In 2014, during his first electoral campaign for prime minister, Modi flew around on an aircraft that bore Adani’s name. Later, the billionaire accompanied the prime minister on several of his overseas trips. Modi has since further consolidated his grip on Indian politics, thereby making concerns over that influence far more pressing.

None of this is to say that India’s economic state institutions are now discreditable and compromised. But the more that Adani and others use nationalism as a way to deflect and shut down questions, the more those doubts will grow and linger amongst foreign investors.

If it is serious about its economic growth aspirations in the long term, India cannot afford to market itself overseas as little more than a leap of blind faith — as an inevitable alternative to China, with the promise of youth, in an environment where you can’t ask uncomfortable questions or receive any answers.