(Bloomberg) — The year of the bond is in danger of hitting a wall.

Most Read from Bloomberg

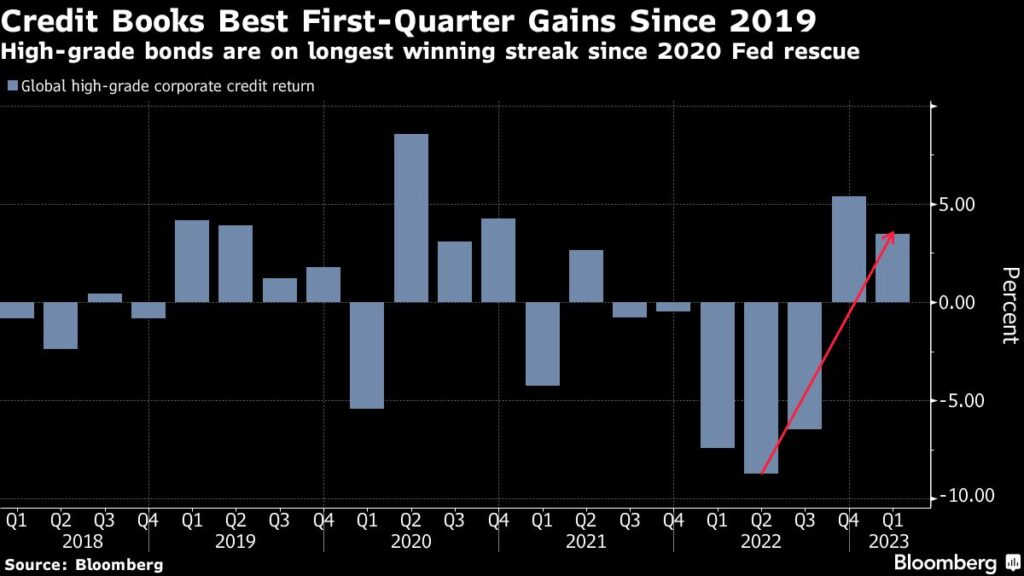

Global credit markets just wrapped up their second consecutive quarterly win as buyers piled in, betting that the US could tame inflation while also avoiding a hard landing. The best first-quarter gains since 2019 follow the worst year ever for high-grade bonds, and the rest of 2023 looks increasingly challenging.

The crisis that toppled Silicon Valley Bank and Credit Suisse Group AG raised concerns about the stability of the global economy, just as recession odds rise while inflation remains stubbornly high. Tighter monetary policy meanwhile piles pressure on the riskiest companies by jacking up borrowing costs.

“The fastest rate hikes on record are bound to cause disruptions and dislocations,” said David Knutson, head of US fixed income product management at Schroders. “The market is not sure yet who will be left without a chair when the music stops.”

Even high-quality companies will struggle if households, concerned about the future, pull back on spending. That could create a negative feedback loop for credit, said Knutson.

“There is a lot of complacency about the risks that come from financial tightening,” said Gordon Shannon, portfolio manager at TwentyFour Asset Management. “Banks increasing lending standards, lending less, lending at higher rates and demanding more security — all of that translates into serious downside for the real economy.”

The good news is that most investment-grade companies are still considered to be in a relatively strong position with elevated cash levels to support them through a downturn. Some may well fall to junk — though not at the same pace as during the pandemic — but the higher duration characteristics of investment-grade bonds mean investors will benefit if the hiking cycle pauses or reverses.

“Given the combination of still elevated volatility and a likely decline in rates and steepening of curve over remainder of the year, our preference is for Asian investment grade,” said Todd Schubert, head of fixed-income research at Bank of Singapore.

But pressure is building on junk companies, which are forced to raise funding at higher interest rates, even as earnings are slowing. The premium the lowest-rated companies need to pay to issue new debt compared to high grade jumped in March.

“We’re already seeing some signs under the surface of levels of distress picking up in the credit market,” said Amanda Lynam, head of macro credit research at BlackRock, in a Bloomberg TV interview on Thursday. “The market is signaling that there is some concern now that’s largely concentrated at the low-quality end of the spectrum.”

For more on distressed debt, listen to the Credit Edge podcast

BlackRock is cautious on companies from sectors like retail, restaurants and health care that have high variable costs and limited pricing power, said Lynam. The heap of distressed bonds and loans in the Americas, meanwhile, is elevated and companies are filing for bankruptcy at the fastest pace since 2009.

Elsewhere:

-

For all the soothing words from bank regulators and politicians, the controversial writedown of Credit Suisse’s risky debt has caused big ripple effects in the $256 billion additional tier 1 market. Yields have stayed near record highs amid growing concern that banks will break with convention by no longer buying back these notes, leaving investors stuck with the debt.

-

JPMorgan Chase & Co., Goldman Sachs Group Inc. and Barclays Plc are among the major banks looking to start trading private credit loans as they seek an entry point into the lucrative world of direct lending. If successful, the move could end up reshaping the largely buy-and-hold market.

-

German real estate firm Aroundtown SA launched a discounted bond buyback offer — and suspended its dividend — amid violent swings in its share price as investors fret over the impact of rising interest rates on leveraged European property companies. It’s looking to buy back as much as €400 million ($434 million) of its notes for 71 to 83 cents, a price that typically reflects a credit in distress.

-

In a sharp reversal, state-backed Chinese developer Sino-Ocean Group paid the coupon on a perpetual dollar bond after an earlier decision to defer payment sent its offshore bonds tanking to distressed levels. The bonds notched up record gains in response, lifting China’s high-yield market.

-

Sunac China Holdings Ltd., once among the country’s five biggest developers, laid out details of a debt-restructuring plan 10 months after default. Holders will receive new debt that matures in two to nine years, while being able to swap debt into shares of listed entities.

-

Adani Group executives met US investors as part of plans to market privately-placed bonds for some of its group companies. The meetings were part of a global roadshow that reached US cities including New York, Boston, Los Angeles and San Francisco, as Adani seeks to reassure international investors that the ports-to-power empire’s finances are under control.

-

Vedanta Resources Ltd. is studying its options, including selling a minority stake in Vedanta Ltd. in a bid to shrink the commodities business empire’s massive debt load. It has close to $2 billion of bonds to settle in 2024 — half of which is due in January.

–With assistance from Alice Huang, Catherine Bosley, Bruce Douglas and Diana Li.

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.