First quarter earnings season will ramp up rapidly in the week ahead.

After big bank earnings unofficially got the proceedings underway on Friday, results from high-profile stock market winners this year like Netflix (NFLX) and Tesla (TSLA) will highlight a busy schedule for investors tracking corporate results.

The economic calendar will offer some reprieve for those more closely keeping tabs on macroeconomic developments and the impact this data could have on the Federal Reserve next month.

All three major indexes logged gains last week with the Dow Jones Industrial Average rising 1.1% to pace the week’s gains. On Friday, JPMorgan (JPM) led a rally in bank stocks, rising more than 7% for its best day since 2020.

“This week, the initial earnings from a few very large banks suggest that the quick work of the FDIC and Federal Reserve in the wake of Silicon Valley Bank’s failure [has] prevented broader damage,” strategists at Bespoke Investment Group wrote in a note to clients on Friday.

“Lenders including PNC Financial, JPMorgan, Wells Fargo, and Citi reported Friday, and the sigh of relief from markets was palpable.”

JPMorgan’s results revealed the bank “has been a port in the storm,” wrote Wells Fargo analyst Mike Mayo in a note on Friday. Mayo said the set of results released Friday left him asking — What banking crisis?

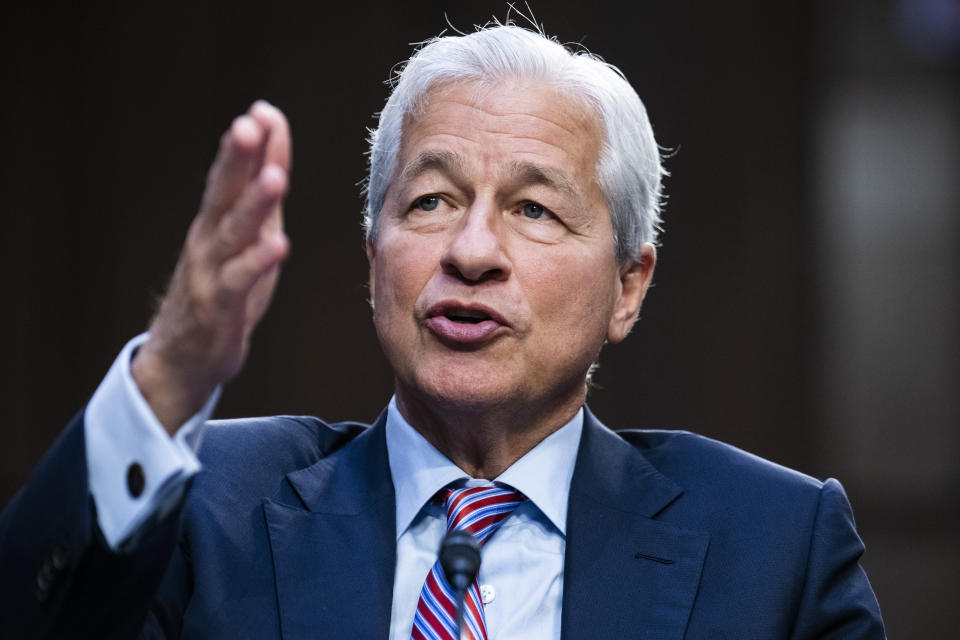

JPMorgan CEO Jamie Dimon even went so far as to tell an analyst during Friday’s conference call, “I wouldn’t use the word credit crunch, if I were you.”

Still, Dimon cautioned the US economy will face challenges in the months ahead, writing in the company’s earnings release, “the storm clouds that we have been monitoring for the past year remain on the horizon, and the banking industry turmoil adds to these risks.”

Higher rates, the war in Ukraine, and geopolitical tensions are among the factors Dimon cited as posing risks to the economy.

The financial sector will remain in focus in the early part of the week ahead, with results from Charles Schwab (SCHW) on Monday providing a key look at how some firms at the center of last month’s bank crisis fared during the quarter. During the peak of March’s bank crisis, Charles Schwab felt compelled to come out publicly and reassure investors its liquidity remained strong.

Shares of the brokerage firm have lost nearly 40% so far this year, including a more than 30% drop in March alone. Investors have feared pressure on Schwab’s deposit base as clients move money from “sweep accounts” into higher-yielding alternatives that could impact the company’s immediate access to capital.

Bank of America (BAC) and Goldman Sachs (GS) results out Tuesday morning will offer another read on how larger lenders and investment banks fared during turmoil that centered on smaller, regional lenders.

Investors will face a lighter schedule on the economic data side, as the monthly run of housing data picks up with homebuilder sentiment, home prices, and housing starts data all set to cross the wires.

Wednesday’s Beige Book report from the Fed will also set the table for the Fed’s discussion of the economic environment at its next policy meeting, which is set to begin in just over two weeks on May 2. Data from the CME Group showed that as of the end of last week investors were placing a nearly 80% on the Fed raising rates by 0.25% in its next policy announcement.

Last week’s key economic report came Wednesday morning when the Consumer Price Index (CPI) for March showed headline inflation cooled to an annual rate of 5% in March while “core” inflation — which excludes the more volatile costs of food and energy — rose 5.6% over the last year.

Retail sales and industrial production data out Friday, in addition to Thursday’s initial claims reading, however, suggested the economy is softening on the margins and will likely weaken further in the coming months.

“Incoming data signal the economy ended the first quarter on a weak note, with consumers less willing to spend, labor market conditions softening, and industrial sector output on a negative track,” wrote Oren Klachkin, lead US economist at Oxford Economics, in a note to clients on Friday.

“We believe Q1 will end up being the best quarter this year for the economy as tighter credit conditions and elevated interest rates slow GDP growth to a crawl in Q2 and spark a recession in the second half of the year. The weaker economy will ease price pressures, but not enough for the Fed to achieve its 2% inflation target anytime soon.”

This combination of a slowing economy and stubborn inflation is likely to make investor debate about the Fed’s next move even more robust in the coming months as the central bank balances risks that each call for the opposite policy response.

As Barclays economist Marc Giannoni wrote in a note to clients on Friday: “Fed communication earlier this week suggests that the debate about the course of policy is about to heat up.”

—

Economic calendar

Monday: Empire Fed manufacturing, April (-18 expected, -24.6 previously); National Association of Home Builders sentiment index (45 expected, 44 previously)

Tuesday: Building permits, March (-6.5% expected, +13.8% previously); Housing starts, March (-3.5% expected, +9.8% previously)

Wednesday: MBA mortgage applications; Federal Reserve Beige Book

Thursday: Initial jobless claims (240,000 expected; 239,000 previously); Philly Fed manufacturing index, April (-19.5 expected, -23.2 previously); Existing home sales, March (-1.8% expected, +14.5% previously); Leading index of economic indicators, March (-0.6% expected, -0.3% previously)

Friday: S&P Global flash US manufacturing PMI, April (49.0 expected, 49.2 previously); S&P Global flash US services PMI, April (51.5 expected, 52.6 previously)

Click here for the latest stock market news and in-depth analysis, including events that move stocks

Read the latest financial and business news from Yahoo Finance