NEW YORK, April 14 (Reuters) – Investors are awaiting earnings reports from consumer discretionary companies in coming weeks for a read on how the U.S. economy is faring amid persistently high inflation and the Federal Reserve’s most aggressive rate hiking cycle since the 1980s.

Consumers have largely held strong over the last year even as interest rates raised costs for mortgage loans to credit card financing. Yet widespread layoffs in the first quarter have hit affluent technology workers while the recent regional banking crisis has pulled back available credit for households, potentially squeezing the outlook for spending on entertainment, restaurants, autos and hotels.

“We’re in this narrative tug of war between a hard landing and a soft landing for the economy, but if we see some strength in the consumer it could bolster the story that some of these worst-case scenarios won’t play out,” said Garrett Melson, portfolio strategist with Natixis Investment Managers Solutions. He is bullish on homebuilders and appliance makers in anticipation of a rebound in the housing market.

Corporate results and outlooks are taking on added importance this earnings season, as investors gauge whether monetary tightening and last month’s banking sector mess are denting overall growth.

Big banks’ kicked off the earnings season on Friday, with JPMorgan Chase & Co (JPM.N), Citigroup Inc (C.N) and Wells Fargo & Co (WFC.N) beating Wall Street expectations. Companies in the consumer discretionary spending sector reporting next week include Tesla Inc (TSLA.O), Netflix Inc (NFLX.O) and AutoNation Inc (AN.N). Amazon.com Inc (AMZN.O), a major component, is expected to release earnings on April 27.

Growing recession fears over the last year have already prompted many consumer discretionary companies to cut costs to boost margins, which may lead to positive earnings surprises this quarter, Melson said.

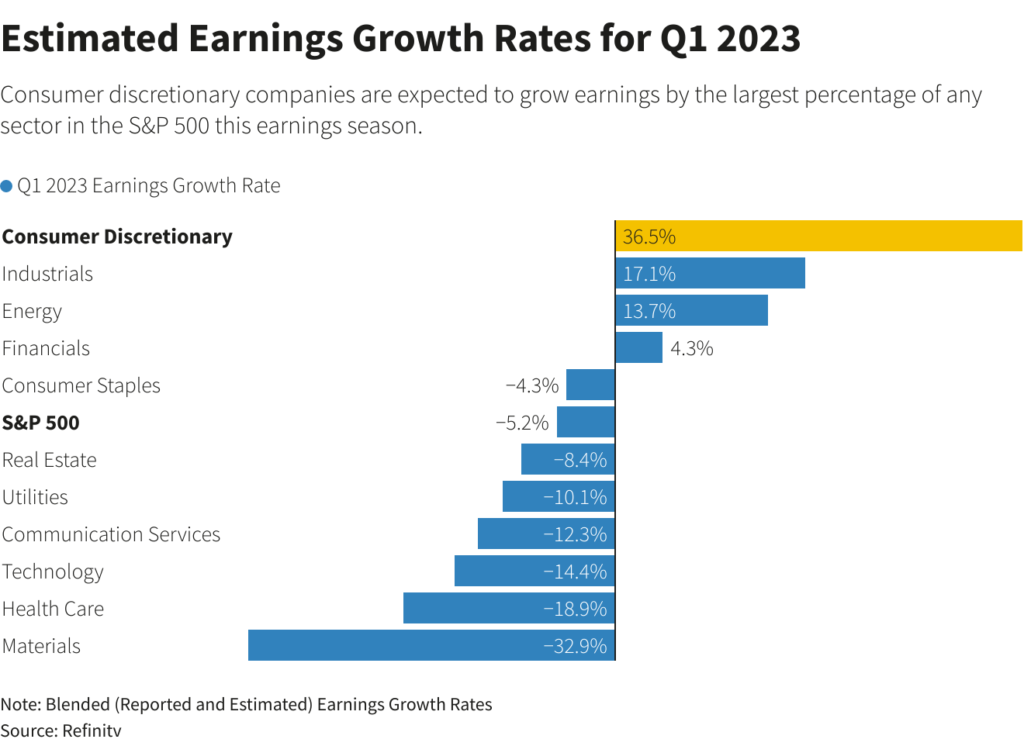

Overall, analysts expect companies in the S&P 500 consumer discretionary sector (.SPLRCD) to grow earnings by 36.5% in the first quarter of 2023 compared with a year earlier, the greatest increase of any sector, according to Refinitiv data. That compares with an expected 5.2% decline in earnings growth for the S&P 500 overall.

Part of that expected growth comes from a job market that has remained robust, helping buoy consumer spending, said Jamie Cox, managing partner for Harris Financial Group.

“Consumers are still traveling and spending money on high-end merchandise and people are still living it up,” he said.

The sector, with nearly 40% of its weighting in Tesla and Amazon, is up around 14% for the year to date, nearly double the almost 8% gain in the broad S&P 500. Shares of Tesla are up nearly 50% for the year to date, while Amazon is up nearly 22%.

At the same time, the Consumer Discretionary Select SPDR ETF (XLY.P) has posted positive inflows in five of the last six weeks as investors sent a net $229.1 million to the fund, its largest six-week net inflow since August, according to Lipper data.

Some investors, however, believe estimates may be too rosy, especially after last month’s crisis in regional banks fueled worries over a sharp cutback in lending.

“I think there’s a lot of optimism embedded in this sector because of this notion that consumers will stay strong forever, but that’s ignoring what’s happened in the last month and a half,” said Kevin Gordon, senior investment strategist at Charles Schwab.

Data on Friday showed U.S. retail sales fell more than expected in March as consumers cut back on purchases of motor vehicles and other big-ticket items, suggesting the economy was losing steam at the end of the first quarter. Meanwhile, U.S. consumer sentiment inched up in April, but households expected inflation to rise over the next 12 months.

Sandy Villere, a portfolio manager at Villere & Co, has winnowed his holdings of consumer discretionary stocks in anticipation of a recession later this year.

While still bullish on shares of companies such as Caesars Entertainment Inc (CZR.O) and Swiss-based shoe company On Holding AG , Villere has trimming allocations to the sector overall. Once it is clear a recession has taken hold, he hopes to buy shares of retailers hit by the slowdown.

“We’re expecting the market to look rougher in July and August, and if you did see discretionary retailers get hit and oversold that’s usually an opportunity where we would switch and play offense,” he said.

Reporting by David Randall; Editing by Ira Iosebashvili and Richard Chang

: .