It’s fair to say Raymond James’ CIO Larry Adam is a big Rolling Stones fan. Either that or Adam just finds their songs to be perfect analogies for the trends exhibited across the investing landscape right now.

Against a backdrop of interest rates reaching levels last seen in 2008, Adam says income investors can now ‘Get What They Want’ although the equity markets are just wishing for the Fed and inflation to ‘Get Off Of Their Cloud.’

As for the Fed itself, it ‘Can’t Get No Satisfaction’… until recently, that is. And that might be the key point here. Investors have been looking for some emotional rescue in the wake of last year’s bear and the recent banking crisis, but luckily, says Adam, time is on our side. Because, from here on in, he thinks the outlook is set to improve.

“We believe that we are nearing the end of the equity bear market, peak yields, and Fed hawkishness,” Adam explained. “This should be welcome news for investors, particularly as we expect the current volatility to lead to robust performance for most asset classes over the long term.”

So, it’s time to load up. Adam’s colleague at Raymond James, 5-star analyst Brian Gesuale, has identified a pair of stocks as ‘Strong Buy’ picks. And he’s not alone in showing confidence in these names. According to TipRanks, the world’s biggest database of analysts and research, both of these stocks are also rated as ‘Strong Buys’ by the analyst consensus. Let’s see why they are drawing plaudits across the board.

V2X, Inc. (VVX)

The world is a complex place, and the interconnections of the digital age, which we often take for granted, have only made it more complicated. This is where V2X comes in, a technology company dedicated to streamlining operations where the digital and physical realms meet. This includes smart buildings, smart cars, even smart military bases. V2X offers a range of solutions for an ever-increasing array of issues, working to ensure readiness while improving performance and reducing costs.

V2X’s work has found customers in both the defense/national security realm and the civilian commercial sector. For the former, the company provides smooth links between the command center and the front line, improved data analysis and management, cybersecurity, and training. On the civilian side, V2X provides managed learning solutions to develop an engaged and educated workforce in order to drive business efficiency.

In an announcement earlier this month, V2X revealed a major win – a $440 million contract with the US Navy to provide aircraft maintenance support for two squadrons of Naval Test Wing Pacific, which are dedicated to weapons development and testing. V2X will be responsible for flightline maintenance, logistics, and technical support.

That announcement followed the early March release of the company’s 4Q22 numbers, which showed solid y/y gains at the top line. The company’s quarterly revenue came in at $978.2 million, growing 20% from the prior year – and edging over the forecast by $7.58 million. At the bottom line, V2X saw its non-GAAP EPS hit 92 cents; while only 2% better than the year-ago figure, it came in 3-cents higher than expected.

Stepping back and taking a wide-angle view of VVX, Raymond James’ Brian Gesuale writes, “Given a spate of contracts wins, favorable macro trends and a low rate of re-competes in 2023, V2X is uniquely primed to outperform expectations and deliver a multi-year MSD rate of organic growth… All in, we are encouraged by the recent contract activity and see the 5% organic growth target as well within reach given 90%+ of 2023 revenue can be accounted for by existing contracts — typically companies guide ~80% coverage from existing contracts.”

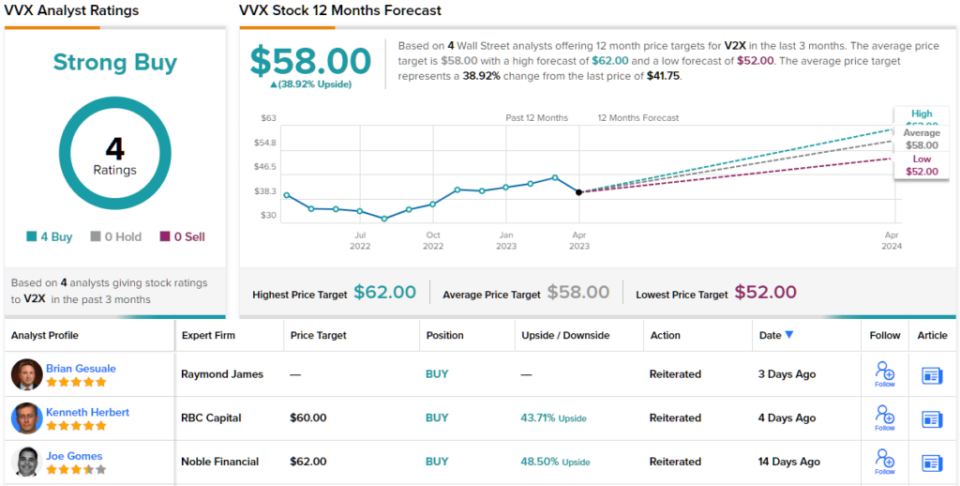

To quantify this stance, the analyst sets a Strong Buy rating and a $60 price target, indicating his confidence in a 43% upside for the coming year.

Overall, all four of the recent analyst reviews on this stock are positive, giving it a unanimous Strong Buy consensus rating. Currently trading at $41.75, with an average price target of $58, VXX has a potential upside of ~39%. (See VXX stock forecast)

Byrna Technologies (BYRN)

Next up, we’ll examine an investment opportunity within the micro-cap stock category, featuring Byrna Technologies. This tech firm, with a market cap of just $124 million, is a leading innovator in less-than-lethal self-defense.

Byrna’s products include gas cartridges, pistol- and rifle-designed launchers with magazines, and projectiles. The company also offers training projectiles and real pepper powder rounds. Byrna Technologies offers a range of projectile weapons based on CO2 gas propellants and non-lethal pepper powder projectiles designed to incapacitate an attacker without the use of lethal force.

Byrna’s non-lethal weapons are specifically designed for close-in work, and have found applications in both the law-enforcement and civilian markets. Law enforcement officers find it useful to have a medium-ranged non-lethal weapon option available, while civilians can choose Byrna’s weapons as an alternative to traditional firearms.

When it comes to the company’s finances, however, the most recent quarterly report was disappointing. While revenue rose by 5.4% year-over-year to $8.4 million, the figure fell short of consensus expectations by more than $3 million. At the bottom line, the company’s GAAP EPS at a 10-cent loss per share was 2 cents below expectations, while the non-GAAP result, a 3-cent loss, was 6 cents better than the forecast.

Checking in with Raymond James’ Brian Gesuale, we find that he is upbeat on Byrna for the long term. Despite acknowledging current difficulties, he notes the strong business model within a growing market segment.

“The positives of the quarter are integral to the model and provide new insight to the long-term direction of the company… End demand is solid, product innovation pushes a favorable product cycle thesis in 2023, and profitability could track better than modeled as revenues recover. Likewise, fundamentals are solid and company should be cash flow positive in 2023 with no outstanding debt,” Gesuale opined.

Going ahead from this stance, the analyst puts a Strong Buy rating on BYRN shares, and his $15 price target implies an impressive 12-month gain of 176%. (To watch Gesuale’s track record, click here)

Turning now to the rest of the Street, other analysts echo Gesuale’s sentiment. 3 Buys and no Holds or Sells add up to a Strong Buy consensus rating. Going by the $13.95 average target, the shares will climb ~157% higher over the one-year timeframe. (See BYRN stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.