(Bloomberg) — Add central banks to the wall of worry for global credit markets.

Most Read from Bloomberg

This year’s rally in risk assets is more to do with a $1 trillion central bank liquidity injection than any improvement in the economic outlook, according to Citigroup Inc.. That massive tailwind — enough to lop 50 basis points off the investment-grade risk premium — may soon become a huge drag as policymakers get back to quashing inflation, having extinguished the banking-sector fire.

“With peak liquidity past, we would not be at all surprised if markets were now to experience a sudden pressure loss,” Matt King, Citi’s global markets strategist, wrote in a note. “Keep watching the liquidity data — and buckle up.”

Corporate debt markets had the best first quarter since 2019, despite proliferating concerns about the economy as central banks kept raising interest rates. Credit extended the rally in recent weeks, erasing losses caused by banks collapsing.

“We now expect almost all of them to stall or go into outright reverse,” King wrote in the note published April 18, referring to central banks shifting back to a tighter policy stance after the bank-spurred turmoil subsided. “This could subtract $600 billion-$800 billion in global liquidity in coming weeks, undermining risk in the process.”

Read more: China Central Bank Hints It Will Dial Back Pandemic Stimulus

The return to tighter policy may already be underway, according to King, who adds that “markets, with the partial exception of US real yields, haven’t noticed yet.” The only thing that might halt the cash exodus is another run on financial institutions, which looks highly unlikely.

Junk bonds are most likely to suffer from this reversal after swiftly recouping losses caused by the recent banking crisis. Despite robust demand for the debt, aided by relatively easy financial conditions, rates ratcheting higher and major economies like the US teetering on the brink of recession — or even stagflation — don’t bode well for highly-indebted borrowers.

Read more: Citi Sees Tightening Credit Conditions Weighing on Risky Assets

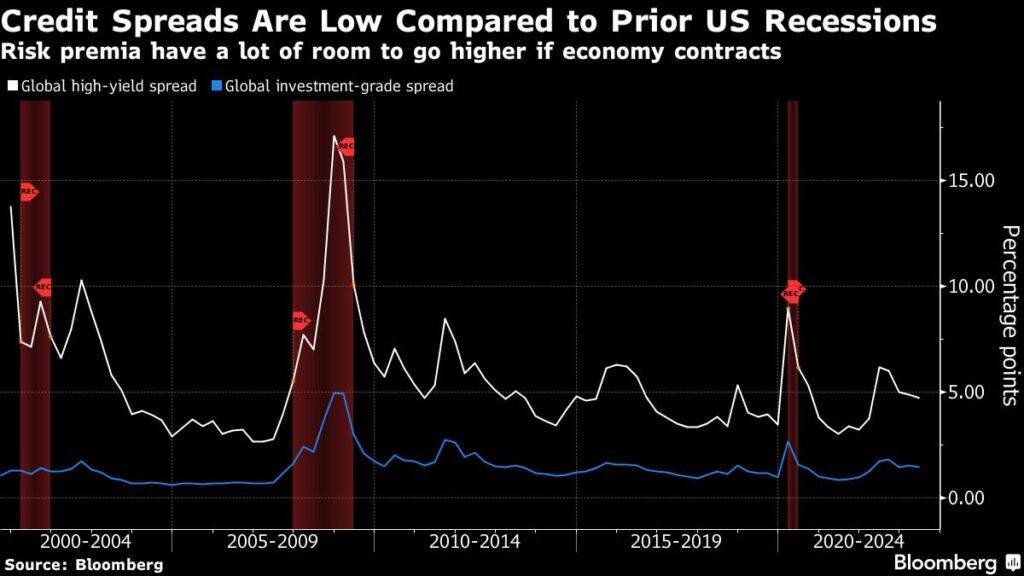

Average global high-yield spreads have tightened to about 485 basis points, significantly less than the 543 basis points they struck during the height of the banking crisis. That’s less than the one-year average of about 500 basis points, and much lower than where risk premiums typically balloon to during a US economic contraction.

Stubbornly high inflation will force central banks to keep the tightening pressure on, which would cool demand while also boosting debt-service costs, thereby hurting the weakest companies most. An economic slowdown also means earnings will suffer, and that hasten credit downgrades, defaults and distress.

For more on the distressed debt outlook, listen to the latest Credit Edge Podcast

Elsewhere:

-

The market for Additional Tier 1 bonds is beginning to reopen just weeks after Credit Suisse Group AG’s collapse set off a global fire sale of the debt.

-

Redwood Capital Management, Saba Capital Management and Ellington Management are among firms endorsing China Evergrande Group’s restructuring deal.

-

Dealmakers in US collateralized loan obligations are counting more than ever on an old friend: Japanese banks.

-

Bond buybacks from European real estate companies like CPI Property Group SA, Aroundtown SA and Sweden’s Heimstaden Bostad AB have been met with intense investor demand, as pessimism about the outlook for the sector drives away other potential buyers.

-

Europe’s asset-backed debt market is having its busiest spell in months, as borrowers offer deals that were put on ice during turmoil in the banking sector.

-

Chinese high-yield dollar bonds are nearing 2023 lows, as worries about several developers sour sentiment more broadly about the sector despite recent home-sales improvement. Leading the past week’s decline was a unit of Dalian Wanda Group Co. as loan concerns emerged.

–With assistance from Bruce Douglas and Kevin Kingsbury.

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.