(Bloomberg) — A selloff in Chinese equities is deepening as traders weigh a barrage of economic and geopolitical risks, with global funds accelerating their exodus.

Most Read from Bloomberg

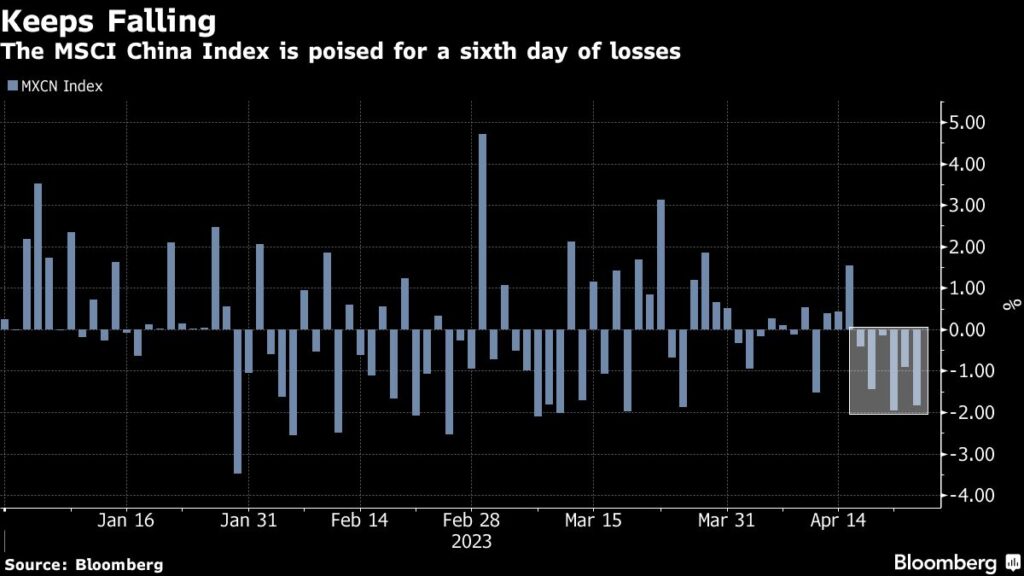

The MSCI China Index lost as much as 2% Tuesday, heading for a sixth day of declines, which will be the longest losing run since October. Foreign investors were set to be net sellers of onshore China shares for a third straight session, while bond yields have dropped.

Traders continued to cite geopolitical tensions as a key deterrent even as the US plans last week to limit investments in key parts of China’s economy were of little surprise. While a consumption-driven recovery is taking hold — the economy grew at the fastest pace in a year in the first quarter and retail sales soared last month — the nation’s top leaders have highlighted risks to the rebound.

READ: Why a China Bull Case Built on Growth Isn’t Working: Macro View

“Investors seem to be having concerns about the sustainability of the recovery in China and the heightening of geopolitical tensions,” said Redmond Wong, strategist at Saxo Capital Markets HK Ltd.

The Hang Seng China Enterprises Index of Chinese stocks listed in Hong Kong has lost more than 5% this month to be the second-worst performer among more than 90 global equity gauges tracked by Bloomberg. That’s a far cry from earlier this year. The measure was among the world’s top performers in January amid an extended rally following the nation’s reopening from Covid-19 curbs late last year.

Overseas funds sold a net $754 million worth of onshore China stocks via trading links with Hong Kong on Tuesday, adding to an outflow of about $1.7 billion in the previous two sessions.

Meanwhile, investors have sought refugee in sovereign bonds, with the 10-year yield falling for three days on the interbank market to Monday.

Investors ‘Frustrated’

The April meeting of the Communist Party’s Politburo, the nation’s top decision-making body, is expected to turn its policy focus to boosting business confidence and increasing jobs without adding extra stimulus. The People’s Bank of China has already signaled it will begin dialing back the pandemic stimulus.

“European investors that we met last week are frustrated with the sluggish performance of the China markets, similar to HK/China investors,” Bank of America Corp. strategists including Winnie Wu wrote in a Monday note. However, given geopolitical tensions, people are unsure about the long term, and are reluctant to “buy and wait,” they added.

Investors are also questioning the accuracy of the macro data as corporate earnings and guidance remain soft, the note said.

Tech and pharma stocks were the biggest losers on the HSCEI gauge on Tuesday. The Hang Seng Tech Index slid more than 3%.

The market is facing “a raft of negative geopolitical noises with little positive catalysts,” including Biden’s executive order to restrict investments and comments by the Chinese ambassador in France about ex-Soviet states, said Vey-Sern Ling, managing director at Union Bancaire Privee.

READ: UBP Cuts China to Neutral Amid Geopolitical Risks Over Taiwan

–With assistance from Ishika Mookerjee.

(Updates with bond moves and the upcoming politburo meeting.)

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.