The state of Oklahoma will no longer work with 13 financial firms after state Treasurer Todd Russ determined they were boycotting energy companies, the Daily Caller News Foundation has learned.

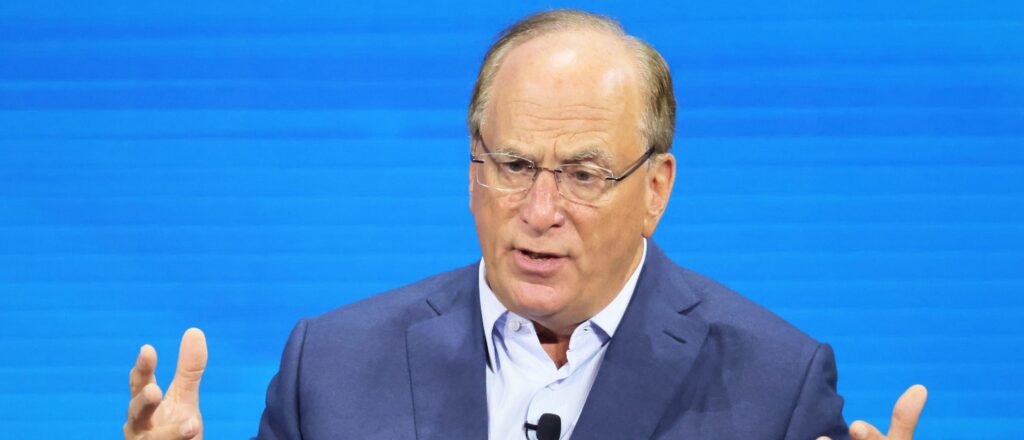

The decision — which was first reported by Fox News — follows a monthslong probe by Russ into the environmental, social and governance (ESG) policies of financial institutions that worked with the state, and is the most aggressive anti-ESG action taken by a Republican state. Under Oklahoma law, the affected institutions, which include Bank of America, WellsFargo, JPMorgan Chase, State Street and the world’s largest asset manager, BlackRock, will lose access to the billions in funds they manage for the state. (RELATED: BlackRock CEO Scales Back Emphasis On Climate Investing: ‘Not … The Environmental Police’)

“The energy sector is crucial to Oklahoma’s economy, providing jobs for our residents and helping drive economic growth. It is essential for us to work with financial institutions that are focused on free-market principles and not beholden to social goals that override their fiduciary duties,” said Russ in a statement shared with the DCNF. “Our state’s financial partnerships should reflect our priorities and values, and it is our responsibility to partner with companies that share our vision for a strong and prosperous Oklahoma economy, and that includes our energy sector.”

ESG is an anti-American political agenda.

Thank you, @Heritage_Action for having me on to discuss how Oklahoma is fighting back against these policies that discriminate against oil and natural gas producers. pic.twitter.com/5Vp7uUgg67

— Governor Kevin Stitt (@GovStitt) February 23, 2023

JPMorgan Chase characterized the decision as “baseless” in a statement to the DCNF.

“[A]s the nation’s largest bank, we are among the top financers across the energy sector, including traditional energy sources,” the company said. “Between 2021 and 2022 we provided over $2 billion in financing and other services to 40 Oklahoma companies in the oil and gas space. Our business practices are not in conflict with this anti-free market decision, and we look forward to continuing to serve customers and communities in Oklahoma.”

The move was similarly criticized by a BlackRock spokesperson, who told the DCNF that blacklists “undermine free-market competition and choice for investors.”

“BlackRock is a leading investor in the Oklahoma energy sector,” the spokesperson said in a statement. “On behalf of our clients, we have invested over $15 billion in public energy companies based in Oklahoma and approximately $320 billion in public energy companies globally, including investments in both traditional energy sectors like oil and gas and in renewables. … We believe lists like these ultimately raise costs for Oklahoma taxpayers and reduce returns for firefighters, teachers, and state employees seeking to retire with dignity.”

When Russ launched the state’s probe, he noted that BlackRock managed more than 60% of the Oklahoma Public Employees Retirement System (OPERS), according to Fox. As of Dec. 31, 2022, OPERS held $10.2 billion in total assets, according to the agency’s website.

ESG investing strategies have been the target of significant scrutiny from Republicans, who allege that the practice violates financial firms’ fiduciary duties by placing greater emphasis on social issues than financial success. Some ESG investors have been criticized by Democrats and environmental activists, who allege that the practice can be used to cover up a bank’s failure to properly combat climate change.

State Street, Wells Fargo and Bank of America did not immediately respond to a Daily Caller News Foundation request for comment.

This article has been updated with comment from BlackRock.

All content created by the Daily Caller News Foundation, an independent and nonpartisan newswire service, is available without charge to any legitimate news publisher that can provide a large audience. All republished articles must include our logo, our reporter’s byline and their DCNF affiliation. For any questions about our guidelines or partnering with us, please contact licensing@dailycallernewsfoundation.org.