[1/4] Goldman Sachs CEO David Solomon speaks during the Goldman Sachs Investor Day at Goldman Sachs Headquarters in New York City, U.S., February 28, 2023. REUTERS/Brendan McDermid/

NEW YORK, June 15 (Reuters) – Goldman Sachs Group Inc’s (GS.N) managing directors were invited to meetings this month to receive an ominous message: take even more painful steps to cut costs, according to four sources familiar with the situation.

Belt-tightening on the agenda for meetings of Goldman’s top executives is another sign that the firm’s ongoing push to cut $1 billion in costs is now accelerating as managers target smaller and smaller line items and contemplate more job cuts, sources said.

Previously, employees were able to spend on subscriptions for websites that provide data and information. They could book a business trip to see one client and expense pricey meals. Now senior managers are needed to sign off on expenditures and travel requires seeing multiple clients, the sources said.

If revenues don’t bounce back alongside the aggressive cost-cutting measures, more employees can expect to be laid off this year, one of the sources said. The bank has let go of 3,700 employees since September.

Managing directors will also be given goals for budget reductions and be held responsible for delivering them, one of the sources said.

“We have repeatedly emphasized our focus on expense management in this environment, and are delivering on the $1 billion plan we laid out at investor day to drive efficiencies and deliver for shareholders,” a Goldman Sachs spokesperson said in a statement.

The latest round of penny-pinching comes as Goldman Sachs management grew more pessimistic about an economic recovery and dealmaking this year. Investment banking revenue for the industry is so far down nearly 46% in the second quarter from same quarter a year earlier, preliminary data from Dealogic shows for the period April 1 to June 6.

Goldman Sachs investment banking revenue is down 52% in that same period, the Dealogic data showed. Goldman declined to comment on the data.

Goldman’s trading revenue, which recorded its second-best year in 2022 at $25.67 billion due to market volatility, is also shrinking.

But it is the firm’s ill-fated foray into retail banking that has captivated the industry because it is a rare, and public, flop for the bank.

When Silicon Valley and Signature banks failed in March, Goldman staff joked that the turmoil was a blessing in disguise for CEO David Solomon because it drew attention away from the company’s travails, three sources familiar with the situation said.

Now, the bank is preparing to lay off just under 250 people, including partners and managing directors in its most senior ranks. The cuts have already begun, two sources familiar with the matter told Reuters. Since the dismissals affect fewer than 250 employees globally, Goldman Sachs does not have to issue an advance notice to employees of layoff plans under U.S. law, one of the sources said.

Goldman Sachs said in February it aims to reduce payroll expenses by $600 million, a figure that President John Waldron said earlier in June it could exceed by the end of the year.

Goldman is not alone in curbing costs. Morgan Stanley is cutting 3,000 staff this quarter, Lazard Ltd (LAZ.N) plans to reduce 10% of its workforce and Citigroup Inc (C.N) also intends to pare down. But Goldman’s January layoffs were its biggest since 2008, and it is seen as a bellwether for Wall Street’s fortunes because it often occupies top rankings in banking and trading.

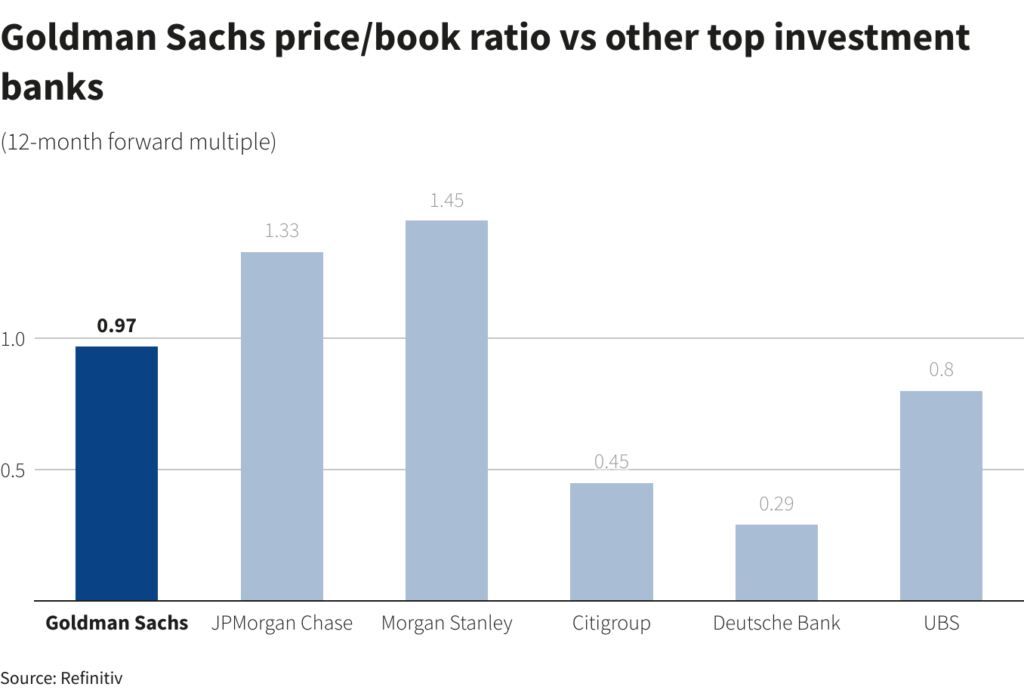

The bank’s financial woes have put a dent in its valuation. Goldman Sachs trades at 0.97 times its book value, lagging rivals Morgan Stanley and JPMorgan Chase & Co (JPM.N) which trade at 1.45 times and 1.33 times, respectively, according to Refintiv data.

Investors are assessing whether Goldman’s strategy — to expand asset management alongside its traditional mainstay of trading — will bear fruit.

“Goldman does have a very cyclical business,” said UBS analyst Brennan Hawken. “There’s no denying the headwinds they’re facing. It’s a clear realization that this is not temporary.”

The headcount reductions and cost cutting do not solve Goldman’s fundamental challenges: its reliance on investment banking and trading.

That compares with Morgan Stanley (MS.N), where profits from wealth management have provided a cushion against weakness in dealmaking.

“It feels pretty difficult out there right now, and challenging,” Waldron told investors at a conference on June 1. “We’re more cautious. We’re running the firm tighter.”

Reporting by Saeed Azhar, Lananh Nguyen and Tatiana Bautzer; additional reporting by Andrea Januta in New York and Niket Nishant in Bengaluru; Editing by Anna Driver

: .