[1/2]The German share price index DAX graph is pictured at the stock exchange in Frankfurt, Germany, June 28, 2023. REUTERS/Staff

NEW YORK, June 29 (Reuters) – U.S. stocks were mixed and benchmark Treasury yields jumped on Thursday as robust economic data helped stave off recession fears, but also raised the likelihood that the Fed will keep its restrictive policy in place for longer than expected.

Financials (.SPSY) led the gainers after the Federal Reserve’s stress test showed U.S. lenders have adequate capital to weather an economic storm.

The Dow was up most among the three major U.S. stock indexes, the S&P 500 was up only nominally while the Nasdaq lingered in negative territory, weighed down by interest rate sensitive megacaps.

Smallcaps were clear outperformers, with the Russell 2000 well ahead of the pack, up 1.2%.

“What we have seen year-to-date is a very narrow rally that is occasionally punctuated by participation from the smaller stocks,” said Michael Green, chief strategist at Simplify Asset Management in Philadelphia. “I believe we’re ahead of where we should be, and most observers are perplexed by the failure of valuations to retreat.”

A surprise drop in initial jobless claims and a sharp upward revision in first-quarter GDP underscored U.S. economic resilience and further cemented the likelihood that the Fed will raise interest rates at least once, and maybe twice more, this year.

“Good news is bad news,” Green added. “So long as the economic data remains strong it becomes easy for the Fed to continue raising rates or at least maintain restrictive policy for longer.”

Financial markets have priced in an 87% probability that the central bank will implement another 25 basis point hike to the Fed funds target rate at the conclusion of its upcoming July policy meeting, according to CME’s FedWatch tool.

The Dow Jones Industrial Average (.DJI) rose 137.45 points, or 0.41%, to 33,990.11, the S&P 500 (.SPX) gained 1.7 points, or 0.04%, to 4,378.56 and the Nasdaq Composite (.IXIC) dropped 40.47 points, or 0.3%, to 13,551.28.

European shares moved higher as better-than-expected U.S. data helped calm jitters over a global economic slowdown and over hawkish signals from world bank leaders.

The pan-European STOXX 600 index (.STOXX) rose 0.11% although MSCI’s gauge of stocks across the globe (.MIWD00000PUS) was flat.

Emerging market stocks lost 0.60%. MSCI’s broadest index of Asia-Pacific shares outside Japan (.MIAPJ0000PUS) closed 0.57% lower, while Japan’s Nikkei (.N225) rose 0.12%.

Treasury yields rose after economic reports painted a picture of a solid U.S. economy, promoting the “higher for longer” scenario with respect to restrictive monetary policy.

Benchmark 10-year notes last fell 35/32 in price to yield 3.8461%, from 3.712% late on Wednesday.

The 30-year bond last fell 55/32 in price to yield 3.9035%, from 3.804% late on Wednesday.

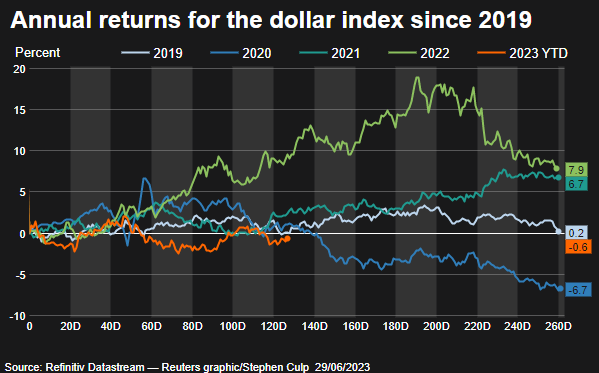

The dollar gained ground against a basket of world currencies, boosted by the upbeat economic data.

The dollar index (.DXY) rose 0.31%, with the euro down 0.22% to $1.0887.

The Japanese yen weakened 0.10% versus the greenback at 144.66 per dollar, while sterling was last trading at $1.2617, down 0.18% on the day.

Oil prices extended fuelledday’s gains, as the solid economic data suggested strong demand and a steeper-than-expected drop in U.S. crude inventories.

U.S. crude rose 0.96% to $70.23 per barrel and Brent was last at $75.05, up 1.09% on the day.

Gold prices hovered around the key $1,900 level, its gains hampered by the strengthening dollar.

Spot gold added 0.3% to $1,912.29 an ounce.

Reporting by Stephen Culp; Additional reporting by Marc Jones in London; Editing by Susan Fenton

: .