(Bloomberg) — Russia is finally cutting crude exports, at the most advantageous moment possible.

Most Read from Bloomberg

Moscow has pledged to curb shipments to global markets by 500,000 barrels a day next month. It’s a show of unity with fellow OPEC+ leader Saudi Arabia, but also an attempt to answer months of questions about whether Russia could really have been cutting oil production — as announced in February — while simultaneously raising crude exports.

August gives Moscow the perfect opportunity to make these important gestures at minimal cost. Companies can redirect crude away from export terminals to domestic refiners, which will be running at a higher rate thanks to the end of spring maintenance and a period of generous state subsidies.

In fact, Russia should be able to achieve its export target without needing additional production cuts.

“Seeking to strengthen its ties with Saudi Arabia, Russia is set to fulfill its export cut pledge,” said Viktor Katona, head crude analyst at market intelligence firm Kpler Ltd. “The 500,000-barrel-a-day export cut will be fully absorbed by the domestic refining segment.”

Russian officials have given repeated assurances that the country’s 500,000 barrel-a-day production cut was implemented in March. But there’s no official data to back this up — the figures were classified in April — and tanker-tracking data show exports rising steadily from that month until mid-May.

This was happening just as Saudi Arabia was making additional voluntary production cuts, prompting some markets watchers to conclude that the kingdom was shouldering most of the burden of balancing the global crude market. While Riyadh has never publicly questioned the veracity of Moscow’s output claims, it has urged more transparency.

Saudi Energy Minister Prince Abdulaziz bin Salman said last week in Vienna that Russia’s announcement on August oil flows was ”more meaningful” because it applied to exports.

Seaborne shipments of Russian crude are starting to show signs of falling. Exports from the country’s western ports in the four weeks to July 9 dropped substantially below their average February level for the first time, after volumes surged during the intervening months, according to vessel tracking data monitored by Bloomberg and corroborated by other data sources.

Rystad Energy A/S expects Russia’s daily seaborne oil shipments next month to drop to 3.1 million to 3.2 million barrels, compared with about 3.7 million barrels in April and May. Less crude will be loaded onto tankers for export because of a “seasonal increase in refinery utilization” within the country, according to the consultant’s senior oil markets analyst Viktor Kurilov.

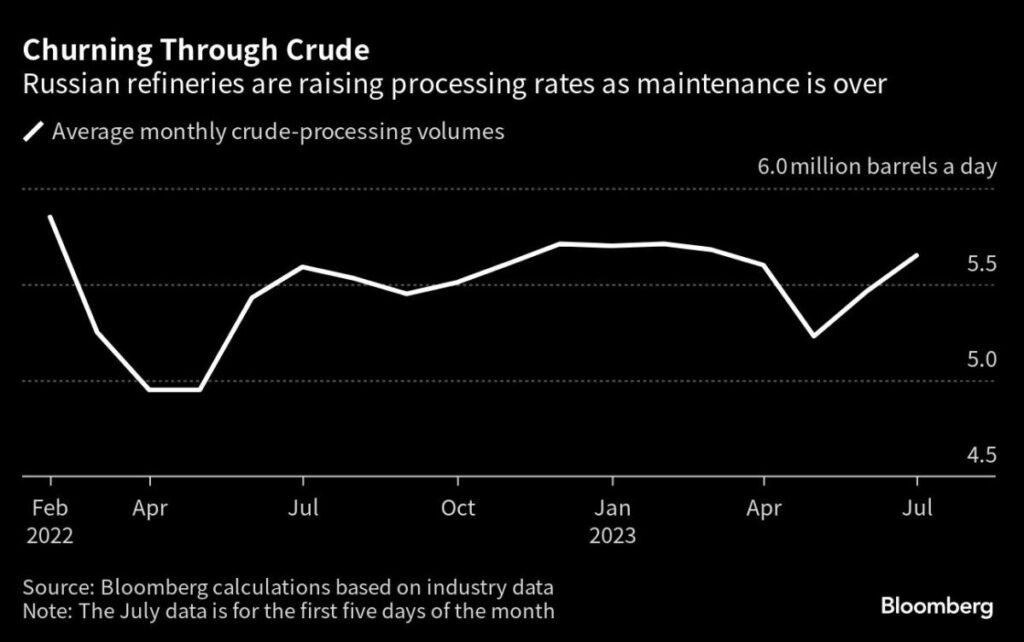

Setting the pattern for August, Russia’s downstream facilities are already churning through crude. As of early July, the domestic oil-processing rates reached a 12-week high, according to Bloomberg calculations based on industry statistics.

Those refineries are receiving state subsidies for selling some of their gasoline and diesel at home that averaged $1 billion a month in the first half of the year, according to Bloomberg calculations based on the ministry’s data.

When Deputy Prime Minister Alexander Novak announced the 500,000 barrel-a-day export cut he didn’t give a baseline for the adjustment. That makes it difficult to assess how much crude the country will actually ship overseas in August, and the resulting impact on prices.

“It comes down to how many Russian barrels get removed,” said Giovanni Staunovo, analyst at UBS Group AG. “If the baseline is the May exports, the impact will likely be modest” because shipments in that month were so high, he said.

If Russia offsets the reduction in crude exports with an increase in shipments of refined fuels from its domestic refineries, the effect could be even more modest, he said.

Oil has risen since Moscow and Riyadh announced the August cuts. Russia’s flagship Urals crude topped $60 a barrel on Wednesday, breaching the price cap imposed by the G-7. Brent crude exceeded $80 a barrel for the first time since May, but the international benchmark is still down this year.

The window of opportunity for Russia to cut oil exports and yet keep output largely intact is short. The real test of Moscow’s willingness to sacrifice sales volumes will come in September. That’s when the nation’s Finance Ministry plans to cut by half the generous fuel subsidies and keep them curbed through 2026, according to Russian newspaper Kommersant.

This change will reduce the appetite for crude among domestic refiners, which will hardly be able to raise domestic prices of gasoline or diesel to compensate for the lost incentives, said Mikhail Turukalov, independent US-based oil-products analyst. As a result, Russian companies will be more interested in selling to international markets, provided the government doesn’t introduce export quotas, he said.

Russia’s refineries will also be at the peak of their fall maintenance season in mid-September, Turukalov said. At that point, the country’s daily crude-processing may drop to 4.76 million to 5.1 million barrels, compared to 5.35 million to 5.57 million in August, he estimated, based on preliminary maintenance plans of the facilities.

These factors would make it more painful for Russia to extending its export cuts beyond August, according to Kpler and Rystad Energy.

Curbing overseas shipments in September “would require further production cuts,” Rystad’s Kurilov said. “As we have seen, Russia cannot do that quickly.”

(Updates with Urals and Brent prices in the 16th paragraph.)

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.