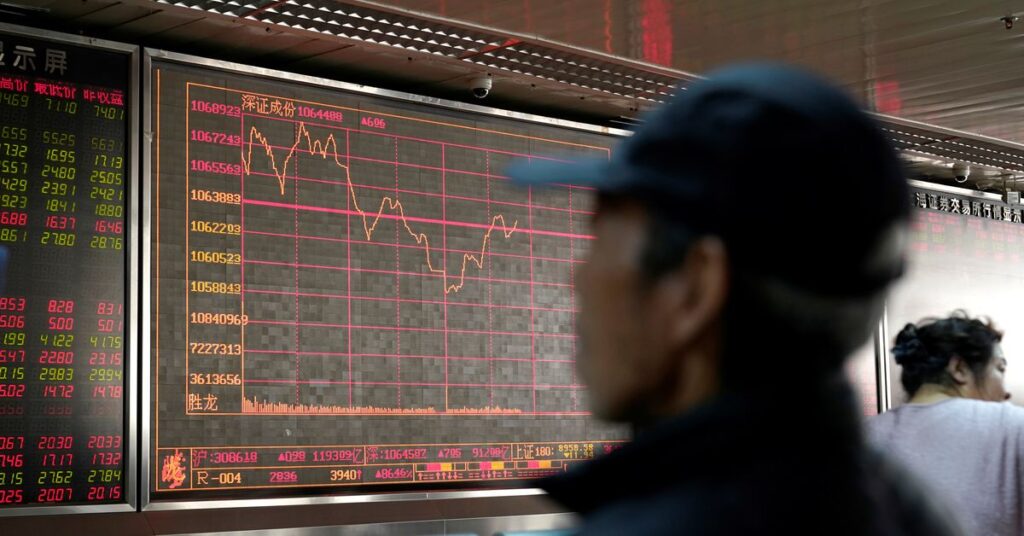

SYDNEY, July 17 (Reuters) – Asian shares slipped on Monday as a mixed bag of Chinese economic data were not as bad as some feared, but still fanned market impatience with the lack of major fiscal stimulus from Beijing.

China reported economic growth of 0.8% in the second quarter, above the 0.5% forecasted, while the annual pace slowed more than expected to 6.3%.

Industrial output topped forecasts with a rise of 4.4%, while retail sales missed by a tick at 3.1%. That followed figures out over the weekend showed China’s new home prices were unchanged in June, the weakest result this year.

“The data suggests that China’s post-COVID boom is clearly over. The higher-frequency indicators are up from May’s numbers, but still paint a picture of a bleak and faltering recovery and at the same time youth unemployment is hitting record highs,” said CBA economist Carol Kong.

“Markets have already adjusted lower their expectations (for stimulus), and our base case is that there won’t be a substantial package.”

Chinese blue chips (.CSI300) were down 1.0%, while the yuan was a fraction lower . MSCI’s broadest index of Asia-Pacific shares outside Japan (.MIAPJ0000PUS) fell 0.2%, though that follows a 5.6% rally last week.

Japan’s Nikkei (.N225) was closed for a holiday, though futures were trading 0.3% lower.

EUROSTOXX 50 futures and FTSE futures both slipped 0.5%. S&P 500 futures and Nasdaq futures were both off 0.1%, but that followed hefty gains last week.

Tesla is the first of the big tech names to report this week, while a busy earnings schedule includes Bank of America, Morgan Stanley, Goldman Sachs and Netflix.

Data on U.S. retail sales are expected to show a rise of 0.3% ex-autos, continuing the slower trend but solid enough to fit into the market’s favoured soft-landing theme.

“We continue to look for a modest contraction to take hold toward the end of the year, but the path to a non-recessionary disinflation is starting to look more plausible,” said Michael Feroli, an economist at JPMorgan.

“We expect Fed officials cheered the latest inflation developments, but declaring victory with sub-4% unemployment, and over 4% core inflation, would be reckless.”

PRICED FOR 2024 POLICY EASING

As a result, markets still imply around a 96% chance of the Fed hiking to 5.25-5.5% this month, but only around a 25% probability of yet a further rise by November.

They have also priced in at least 110 basis points of easing for next year, starting from March, which saw two-year bond yields down 18 basis points last week.

That predicted policy easing is considerably more aggressive than what is priced in for the rest of the developed world, a major reason the U.S. dollar has turned tail.

The dollar was softer at 138.45 yen , but still up from a trough of 137.25, after a loss of 2.4% last week. The euro was firm at $1.1223 , having also surged 2.4% last week to clear its former top for the year at $1.1096.

Sterling stood at $1.3089 , having risen 1.9% last week, with investors anxiously awaiting UK inflation figures later in the week where another high result would add to the risk of further sizable rate hikes.

The dollar index hovered at 99.989 , after shedding 2.2% last week.

The drop in bond yields was underpinning non-yielding gold at $1,952 , after boasting its best week since April.

Oil prices have also been supported by cuts in OPEC supply, seeing crude gain for three weeks in a row before running into profit taking. Prices were also pressured as Libya resumed production over the weekend.

Brent dropped 71 cents to $79.16 a barrel, while U.S. crude fell 66 cents to $74.76.

Reporting by Wayne Cole; Editing by Lincoln Feast.

: .