WASHINGTON, Aug 3 (Reuters) – The number of Americans filing new claims for unemployment benefits rose slightly last week, while layoffs dropped to an 11-month low in July as labor market conditions remain tight.

The labor market has largely weathered 525 basis points in interest rate hikes from the Federal Reserve since March 2022, and likely delivered another month of strong employment gains in July. Despite labor market tightness, the inflation outlook continues to improve.

Other data from the Labor Department on Thursday showed a marked slowdown in labor costs in the second quarter, thanks to a sharp rebound in worker productivity. That added to reports last month showing a significant moderation in annual inflation in June as well as wage growth in the second quarter.

These reports are fanning optimism that the economy could avoid a recession. Most economists believe the U.S. central bank will probably not raise rates again this cycle.

“Recession risk is receding,” said Bill Adams, chief economist at Comerica Bank in Dallas.

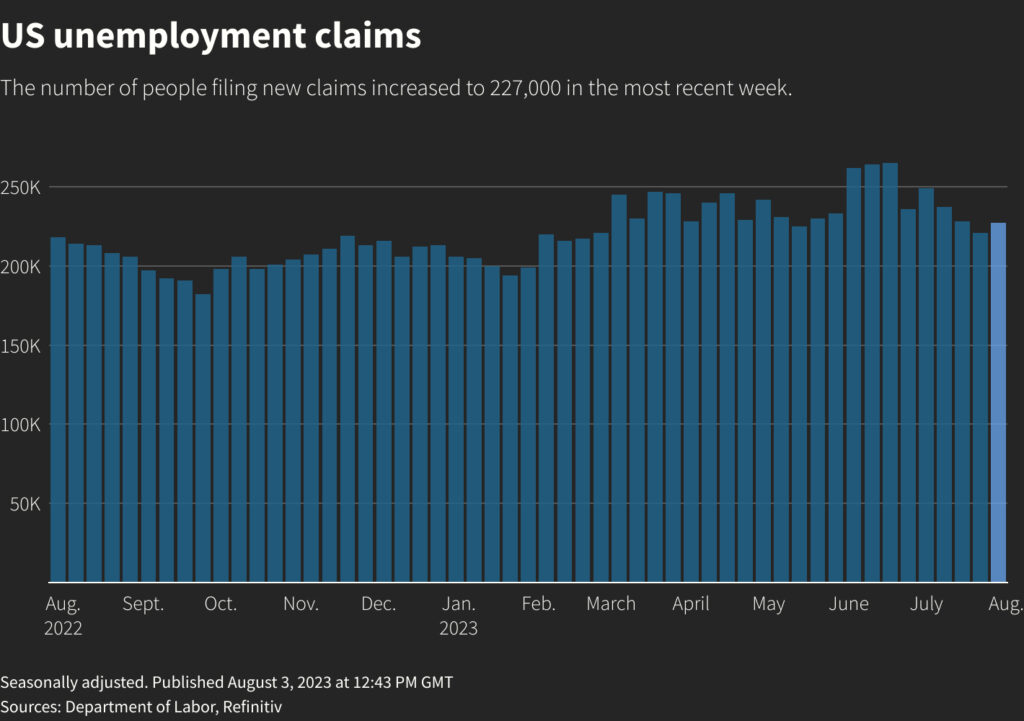

Initial claims for state unemployment benefits increased 6,000 to a seasonally adjusted 227,000 for the week ended July 29, the Labor Department said. The increase was in line with economists’ expectations. Claims are in the lower end of their 194,000-265,000 range for this year, in part benefiting from difficulties adjusting the data for seasonal patterns.

Automakers typically idle plants in July to retool for new models. But these temporary closures do not always happen around the same time, which could throw off the model the government uses to strip out seasonal fluctuations from the data.

Unadjusted claims dropped 8,485 to 205,012 last week amid sharp declines in California and Ohio. There were also notable decreases in Texas and Georgia. These more than offset a jump in applications in Missouri.

Technical issues aside, the overall labor market remains strong as employers hoard workers after struggling to find labor during the COVID-19 pandemic. While there have been high-profile layoffs in the technology and finance sectors, small businesses are still boosting headcount after being squeezed out by large enterprises snapping up workers.

Labor shortages remain an obstacle for some services businesses. The Institute for Supply Management (ISM) reported on Thursday that its measure of services industry employment fell last month.

Businesses reported they “have a need but cannot recruit fast enough.” Other said “we are hiring but also losing employees to other firms that offer higher compensation.”

But softening demand was also an issue. Some companies reported they were “not replacing turnover,” to match capacity to lower demand. The slowdown in employment growth contributed to restraining the services industry’s expansion in July.

Stocks on Wall Street were trading lower. The dollar was steady versus a basket of currencies. U.S. Treasury yields rose.

LOW LAYOFFS

The number of people receiving benefits after an initial week of aid, a proxy for hiring, increased 21,000 to 1.700 million during the week ending July 22, the claims report showed. These so-called continuing claims remain low by historical standards, indicating that some laid-off workers are experiencing short spells of unemployment.

The Labor Department reported on Tuesday that there were 1.6 job openings for every unemployed person in June, little changed from May. The claims data have no bearing on July’s employment report, which is scheduled to be released on Friday.

Nonfarm payrolls likely increased by 200,000 jobs in July after rising by 209,000 in June, according to a Reuters poll of economists. The unemployment rate is forecast to be unchanged at 3.6% in July.

Despite the softer ISM employment readings, strong job growth in July was supported by the ADP’s national employment report on Wednesday, which pointed to solid private hiring last month. The Conference Board’s consumer confidence survey showed households bullish on the labor market.

That was reinforced by a separate report on Thursday from global outplacement firm Challenger, Gray & Christmas showing U.S.-based employers announced 23,697 job cuts in July, the lowest number since August 2022. Layoffs were down 42% from June.

Workers were more productive in the second quarter, which helped to curb growth in labor costs.

Nonfarm productivity, which measures hourly output per worker, increased at a 3.7% annualized rate in the second quarter after declining at a 1.2% pace in the January-March quarter, the Labor Department said in a third report.

Economists had forecast productivity increasing at a 2.0% rate. Productivity grew at a 1.3% pace from a year ago. It had declined for five straight quarters on a year-on-year basis.

Productivity, however, remains lackluster. Since the fourth quarter of 2019, it has grown at a 1.4% rate, far below the long-term historical average rate of 2.1% going back to 1947.

Sluggish productivity is partly the result of worker hoarding. Unit labor costs – the price of labor per single unit of output – rose at a 1.6% rate in the second quarter. They increased at a 3.3% rate in the prior quarter and logged a 2.4% growth pace from a year ago. The moderation bodes well for bringing inflation down to the Fed’s 2% target.

“The improving trend in productivity along with slowing nominal wage growth points to inflationary pressures from the labor market starting to subside,” said Sarah House, a senior economist at Wells Fargo in Charlotte, North Carolina.

Reporting by Lucia Mutikani; Additional reporting by Safiyah Riddle; Editing by Paul Simao and Andrea Ricci

: .