The markets have experienced a period of volatility over the past month, raising questions about where they might be heading next. Has the year’s strong rally hit a brick wall, or is it just a pause before the next leg up?

It’s a question that has been fielded to Goldman Sachs’ chief U.S. equity strategist David Kostin. The good news for investors is that going by the direction the wider economy is taking, Kostin makes some reassuring noises on the matter.

Decelerating inflation data offers confirmation that “disinflation is well under way,” while investors now see less of a risk for a recession given economic growth data has “remained robust.”

These positive developments point toward an outcome desired by stock market participants. “As the US economy nears a soft landing,” Kostin says, “investors have room to further increase their exposure to equities.”

If it’s time to expand exposure to equities, the next question naturally is: which equities exactly?

The analysts at Goldman have an idea about that too. They have pinpointed an opportunity in two names, and it looks like the rest of the Street is onside as well. According to the TipRanks database, both are rated as Strong Buys by the analyst consensus. Let’s find out why they are getting the thumbs up on Wall Street right now.

Sagimet Biosciences (SGMT)

The first Goldman pick we’ll look at is Sagimet Biosciences, a clinical-stage biotech firm, working on novel therapeutics called fatty acid synthase (FASN) inhibitors. These are intended as treatments for diseases such as non-alcoholic steatohepatitis (NASH), acne and different cancers. Sagimet has only been a public entity for a little over a month, having held its IPO in mid-July.

Sagimet has one drug candidate, denifanstat – an oral, once-daily pill in development for the treatment of nonalcoholic steatohepatitis (NASH). In collaboration with its Chinese partner Ascletis, the drug is also being developed as a potential treatment for acne and cancer.

But it’s the NASH opportunity that is most under the microscope right now. There are currently no approved medications to treat the condition, and it is estimated that by 2030 it could represent a global market worth roughly $108 billion. In fact, the US National Institutes of Health reckons that, in the US, as many as 24% have NAFLD (non-alcoholic fatty liver disease), NASH’s precursor, with around 1.5% to 6.5% inflicted with NASH.

Sagimet recently presented planned interim data from the FASCINATE-2 Phase 2b clinical study for denifanstat that demonstrated it was well-tolerated and met the liver fat response endpoint. Biopsy results are anticipated to be released in 1Q24.

Goldman Sachs analyst Andrea Tan has high hopes for the drug. She writes, “With 26-week interim Ph2b FASCINATE-2 data confirming denifanstat’s robust benefit on decreasing liver fat content, inflammation, and fibrosis per biomarkers coupled with emerging evidence on the correlation between liver fat reduction per MRI-PDFF and NASH resolution per histology, we are positive into the upcoming biopsy data in 1Q24, the totality of which should support advancement to a pivotal program.”

“While we acknowledge the competitive landscape, denifanstat’s differentiated mechanism of action, alongside a predictive biomarker panel, could support a best-in-class profile and capture a blockbuster opportunity in F2/F3 NASH patients (GSe peak global sales of $3.7bn in 2037),” Tan went on to add.

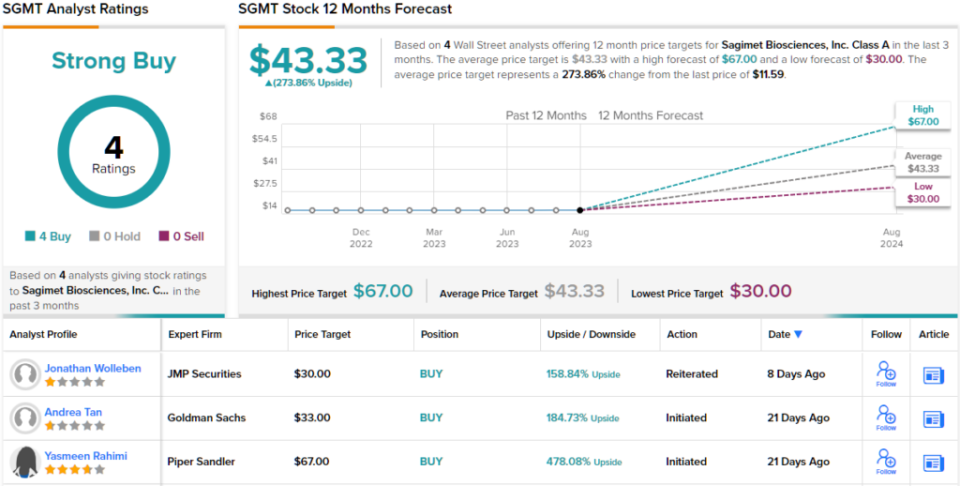

Conveying her confidence, along with a Buy rating, Tan gives SGMT a $33 price target, suggesting ~185% upside potential over the next 12 months. (To watch Tan’s track record, click here)

In its short time on the markets, SGMT has received 4 analyst reviews, and all are positive, making the consensus view here a Strong Buy. The average target is even more bullish than Tan will allow; at $43.33, the figure makes room for 12-month returns of ~274%. (See SGMT stock forecast)

Xenon Pharmaceuticals (XENE)

The next Goldman pick we’re looking at is Xenon Pharmaceuticals, a biotech company focused on treatments for patients suffering from neurological disorders. Specifically, the company is concentrating on areas where there is a high unmet need.

Leading the pipeline development, the company is working on several research programs for XEN1101, a differentiated Kv7 potassium channel opener. It is being developed as a therapy for epilepsy and other neurological conditions, including major depressive disorder (MDD).

Milestones inform the investment path for biotechs as they act as catalysts for stock movement. And here, Xenon has a big one coming up.

With patients now fully enrolled in the XEN1101 Phase 2 X-NOVA study of MDD, the company anticipates having a top-line data readout around late November/mid-December. Prior to that, the company will hold a webinar next month in which it will discuss the MDD program and landscape.

Elsewhere in the pipeline, the company is also progressing its XEN1101 Phase 3 epilepsy program, which includes two identical Phase 3 clinical trials (X-TOLE2 and X-TOLE3), and the Phase 3 (ACKT) study of XEN1101 in primary generalized tonic-clonic seizures (PGTCS).

These studies inform Goldman Sachs analyst Paul Choi’s positive thesis for Xenon, who notes investors particular focus on the MDD opportunity.

“Our recent investor conversation suggests significant interest in the upcoming X-NOVA MDD study, which could represent another important leg of growth for XEN1101, in our view,” Choi said. “Further, given the potential read through from the prior positive ezogabine data, the Kv7 agonism mechanism of action that was evaluated in a proof-of-concept randomized placebo controlled clinical trial (n=45), along with the pre-clinical data profile of XEN1101, which we think could support the hypothesis that XEN1101 may have a reasonable chance of succeeding in MDD… Additionally, XENE plans to share additional data from X-TOLE OLE study on XEN1101’s impacts on quality of life and long-term use at two upcoming medical meetings.”

“Overall, we think these important clinical catalysts in the second half 2023 could potentially validate the company’s leading position in neurology and we look next to the KOL discussion on MDD in mid-September,” the analyst summed up.

What does this all mean for investors? Choi rates XENE shares as a Buy, backed by a $60 price target, implying the stock stands to gain ~56% over the one-year timeframe. (To watch Choi’s track record, click here)

Overall, 5 other analysts have recently waded in with XENE reviews and all are positive, providing the stock with a Strong Buy consensus rating. At $55.17, the average target makes room for growth of 43% in the months ahead. (See XENE stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.