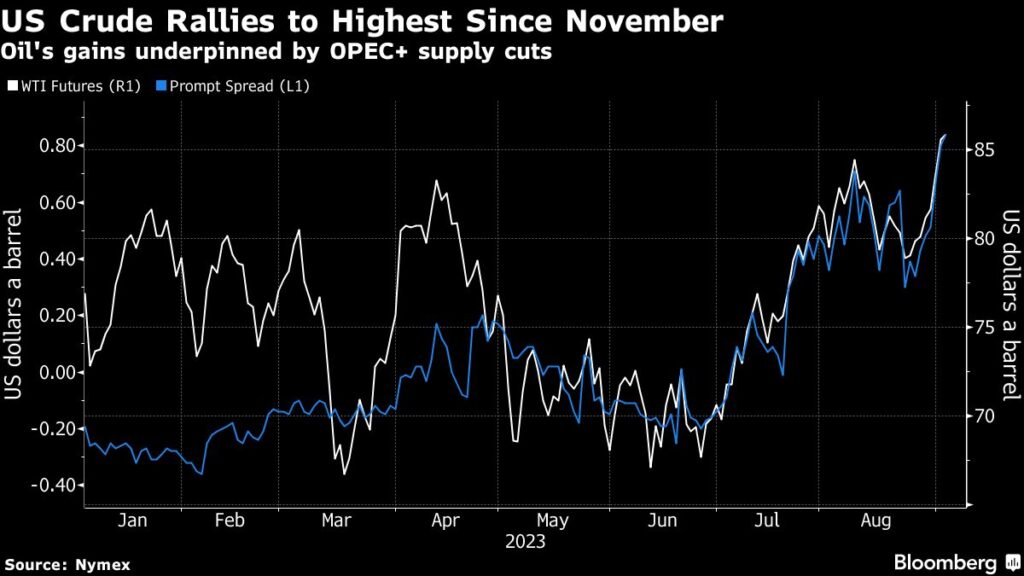

(Bloomberg) — Oil steadied after hitting the highest level since November on expectations that supply cuts by OPEC+ leaders will tighten the market.

Most Read from Bloomberg

West Texas Intermediate was little changed above $85 a barrel after an initial surge as the week’s trading kicked off. Underlying metrics, including WTI’s prompt spread, have widened markedly in recent days, suggesting tighter conditions after benchmark US futures jumped by more than 7% last week.

Russia has announced that it will extend export curbs, with more details of the reductions to be released in the coming days. Saudi Arabia — which along with Moscow sets the tone at the OPEC+ alliance — is widely expected by traders to follow suit by pushing its voluntary curbs into October.

Oil’s fortunes have improved this quarter following a lackluster first half as the supply reductions show signs of rebalancing the market, with US stockpiles slumping. Additional support for crude has come from speculation that the US Federal Reserve may be close to finishing its hiking campaign, as well as signs China’s efforts to bolster growth could be starting to gain traction.

“Supply is really tight if Saudi and allies don’t reverse their output cuts plan,” said Zhou Mi, an analyst at the Chaos Research Institute in Shanghai, adding that oil prices are now likely to move toward $90 a barrel. In addition, “demand is now looking very optimistic,” Zhou said.

Read also: Asia Oil Latest: Iran Won’t See Jump in Flows If Sanctions Eased

The OPEC+ cuts have been successful, Vitol Group Chief Executive Officer Russell Hardy said at a conference in Singapore on Monday. In addition, even if Iranian sanctions were eased, there’s not necessarily going to be a huge bump in its exports, he said at the APPEC by S&P Global Commodity Insights event.

The market’s underlying metrics point to expectations for tighter conditions. Among them, the spread between WTI’s two closest contracts has ballooned to 84 cents a barrel in backwardation. That’s a bullish pricing pattern, and is up from 43 cents a barrel one week ago.

To get Bloomberg’s Energy Daily newsletter direct into your inbox, click here.

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.