SHANGHAI/BEIJING Sept 14 (Reuters) – Beijing on Thursday blasted the launch of a probe by the European Commission into China’s electric vehicle (EV) subsidies as protectionist and warned it would damage economic relations, a concern shared by Germany’s car industry.

European Commission President Ursula von der Leyen announced the investigation on Wednesday, accusing China of flooding global markets with electric cars at artificially low prices due to huge state subsidies.

The probe, which could result in punitive tariffs, has prompted analyst warnings of retaliatory action from Beijing and complaints from Chinese industry executives who say the sector’s competitive advantage is not due to subsidies.

“(The investigation) is a naked protectionist act that will seriously disrupt and distort the global automotive industry and supply chain, including the EU, and will have a negative impact on China-EU economic and trade relations,” China’s Ministry of Commerce said in a statement.

“China will pay close attention to the EU’s protectionist tendencies and follow-up actions, and firmly safeguard the legitimate rights and interests of Chinese companies,” it added.

Eurasian Group analysts warned that should Brussels ultimately levy duties against subsidised Chinese EVs, Beijing would likely impose countermeasures to hurt European industries.

The European Union’s imposition of tariffs will depend on the degree of unity within the bloc.

France has called for such an investigation for months, part of a years-long campaign by President Emmanuel Macron for the EU to get tougher on trade and insist on a level playing field.

Other EU countries also see China as more of a rival than a partner and agree the bloc should be more assertive.

A decade ago Germany, wary of retaliation, opposed tariffs on Chinese solar panel imports, paving the way for a compromise with Beijing.

By contrast, German Economy Minister Robert Habeck said on Wednesday he welcomed the EU’s latest action.

Germany’s car industry, conscious that a trade war could hit its business in China, was more circumspect.

Mercedes Benz (MBGn.DE) said protectionist measures were counterproductive and Bosch, the world’s largest automotive supplier, said a race for punitive tariffs and trade barriers would only have losers.

“Chinese distortions of competition are a particular problem that Europe should tackle, but if possible not with excessive subsidies or new punitive tariffs at the end of a lengthy process,” said Volker Treier, head of trade at the German Chamber of Commerce and Industry (DIHK)

Some analysts said the probe should not pose a big risk for Chinese EV makers because they could turn to other growing markets like Southeast Asia.

The manufacturers have been accelerating export efforts as slowing consumer demand in China exacerbates production overcapacity.

[1/5]The sports car NIO EP9 is presented at the NIO House, the showroom of the Chinese premium smart electric vehicle manufacture NIO Inc. in Berlin, Germany August 17, 2023. REUTERS/Annegret Hilse Acquire Licensing Rights

Hong Kong-listed shares of Chinese EV makers pared initial losses, with market leader BYD closing down 1.2%. Smaller rivals Geely Auto (0175.HK) and Nio (9866.HK) fell 0.5% and 0.9%, respectively. Xpeng (9868.HK) reversed losses to rise 0.4%.

Shanghai-listed shares of state-owned car giant SAIC (600104.SS), whose MG brand is the best-selling China-made brand in Europe, closed down 0.3%.

Nio and Geely declined to comment on the EU probe, while BYD, Xpeng and SAIC did not respond to requests for comment.

Shares in European carmakers were also among the biggest fallers on the euro zone stock index (.STOXXE50). BMW (BMWG.DE), Volkswagen (VOWG_p.DE), Mercedes (MBGn.DE) and Stellantis (STLAM.MI) were down by between 0.7% and 1.7% at 1425 GMT.

In its first response to the probe, Stellantis said it welcomed “fair competition which drives innovation and performance across our industry globally for the benefit of citizens and our customers”.

STRAINED RELATIONS

The anti-subsidy probe, initiated unusually by the European Commission and not from any industry complaint, comes amid broader diplomatic strains between the EU and China.

Relations have become tense due to Beijing’s ties with Moscow after Russian forces swept into Ukraine, and the EU’s push to rely less on the world’s second-largest economy.

The EV probe will set the tone for talks ahead of the annual China-EU Summit, due to take place before year-end, with the EU pushing for a rebalancing of trade. EU trade chief Valdis Dombrovskis will travel to China later this month.

GROWING MARKET SHARE

EU officials believe Chinese EVs are undercutting the prices of local models by about 20% in the European market, piling pressure on European automakers to produce lower-cost EVs.

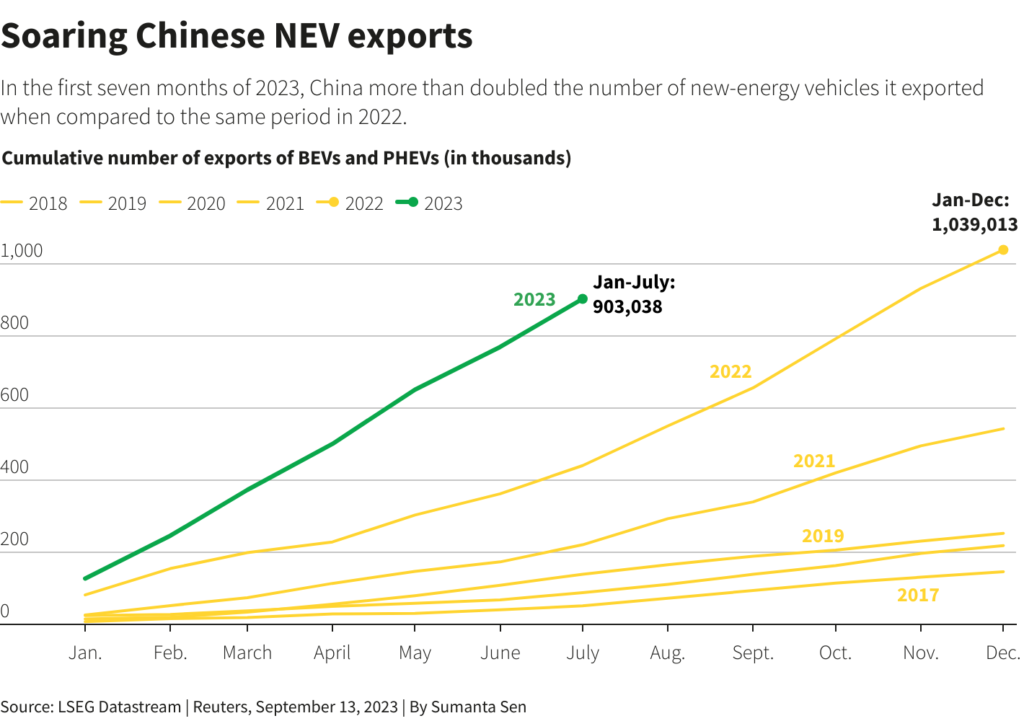

The Commission said China’s share of EVs sold in Europe had risen to 8% and could reach 15% in 2025.

Underscoring challenges facing established European automakers, Volkswagen (VOWG_p.DE) is looking at cutting staff at its all-electric plant in eastern Germany, the dpa news agency reported on Wednesday.

In 2022, 35% of all exported electric cars originated from China, according to U.S. think-tank the Center for Strategic and Internal Studies (CSIS), with most destined for Europe. The single largest exporter from China is U.S. giant Tesla (TSLA.O).

Reporting by Donny Kwok in Hong Kong, Brenda Goh in Shanghai, Ryan Woo in Beijing, Victoria Waldersee in Frankfurt and Philip Blenkinsop in Brussels

Writing by Anne Marie Roantree

Editing by Jamie Freed, Sharon Singleton and Mark Potter

: .