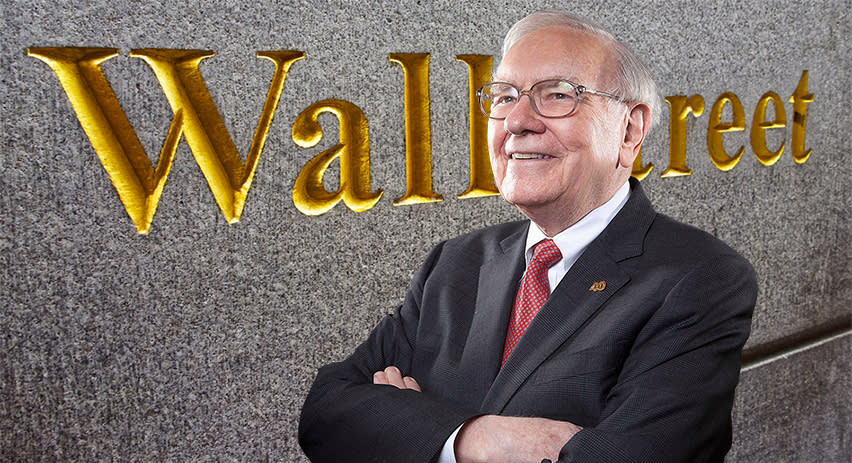

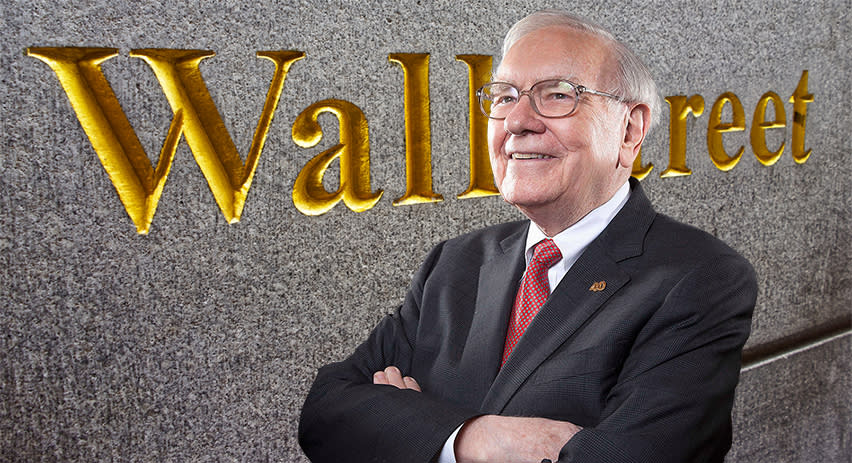

Wall Street legend Warren Buffett has always been a proponent of value investing. The Oracle of Omaha’s decades of almost unparalleled success have been built on recognizing when a stock is priced significantly below its inherent worth and then betting big on it. Touting the merits of patience and the long-term effect of compounding returns, Buffett is a master of his profession.

However, even the most successful investors’ portfolios include stocks that go through down periods. It’s probably safe to say that during those times, Buffett, who is known for his sage advice to “be greedy when others are fearful,” might be making plans to increase his holdings if he is convinced a certain stock will eventually recover.

With this in mind, we used TipRanks’ database to pinpoint a pair of equities sitting in Buffett’s portfolio that have been underperforming this year. These are not low stakes; true to form, he has multi-billion-dollar holdings in both, and has been a shareholder of each for over 5 years. Let’s see what Wall Street’s stock experts make of them right now.

Kraft Heinz (KHC)

First on the underperforming Buffett list is a stalwart of the consumer goods sector, Kraft Heinz; one of the largest food and beverage companies in North America and owner of such popular brands as Philadelphia cream cheese, Jell-O, and Velveeta.

While food and drink are essential, Kraft’s stock has definitely underperformed in recent months – KHC is down by 15% year-to-date. That hasn’t phased Buffett, or caused him to reduce his holdings in the stock. The billionaire investing legend has been a shareowner in KHC since 2015, and his firm currently holds 325,634,818 shares worth $10.89 billion. The scale of the holding makes Berkshire the largest owner in Kraft Heinz.

Kraft Heinz can boast of owning 8 brands capable of generating $1 billion-plus annually, and has a global reputation as a trusted provider of the foods and drinks that people love to eat. The company generated approximately $26 billion in total revenue last year, and saw both revenue and earnings show year-over-year increases in the latest financial report, from 2Q23.

That said, while Kraft’s Q2 top line came to $6.72 billion, growing 2.55% y/y it missed the forecast by $81.9 million, with the company noting a sharp 7% drop in volume. At the bottom line, the company’s EPS of 79 cents compared favorably to the 70-cent figure from the year-ago quarter and came in 3 cents per share better than expected.

Buffett has always liked dividend stocks, prioritizing high-yielding dividend payers to generate a strong passive income from his holdings. KHC is set to pay out a common share dividend of 40 cents per share on September 29. The dividend annualizes to $1.60 per share and gives a yield of 4.74%. Kraft’s dividend has been held at its current level since 2019.

Turning to the Street’s analysts, we find Deutsche Bank’s Stephen Powers taking a bullish position on Kraft Hienz. Powers notes headwinds in the industry, but sees the company as fundamentally strong.

“While we acknowledge and understand recent negative sentiment around packaged food stocks owing to (i) skepticism around demand/ volume recovery, (ii) potential retailer pushback on pricing, and (iii) the risks of trade down or intensifying competitive dynamics, we remain constructive on KHC’s improved fundamentals (i.e., structurally stronger portfolio, clearer growth/ corporate strategy, expansion opportunities in Foodservice and Emerging Markets, healthier levels of reinvestment spending vs. pre-pandemic, enhanced capabilities across the company, better management execution, etc.) and supportive valuations. Hence, we remain Buy rated,” Powers stated.

That Buy rating is backed by a $47 price target that points toward 40% share appreciation in the coming year. (To watch Powers’ track record, click here)

Overall, KHC stock gets a Moderate Buy rating from the Street’s analyst consensus, based on 15 recent reviews that break down to 5 Buys and 10 Holds. The shares are trading for $33.45 and their $40.47 average price target implies ~21% upside potential in the next 12 months. (See KHC stock forecast)

Bank of America Corporation (BAC)

The second stock on our list, Bank of America, is a major name in the global banking industry, and with $3.12 trillion in total assets, is one of the world’s largest bank firms.

That said, BAC shares are down some 11% this year, even as the S&P 500 has posted a net gain of 16%. The share price decline hasn’t kept Berkshire Hathaway from maintaining an extensive holding in BAC; the firm has ~1.033 billion shares in the bank, making up 8.5% of the Berkshire portfolio. The Buffet stake in BAC is valued at more than $29 billion, and Berkshire Hathaway is Bank of America’s largest single shareholder, owning nearly 13% of the outstanding shares.

Bank of America has a wide-ranging business, in both consumer and commercial accounts, small- and mid-market business banking, and large-scale institutional banking. The bank’s total revenue grew by 11% y/y, according to the 2Q23 financial release, to reach $25.2 billion, coming in $258.8 million over the estimates. This supported a net income of $7.4 billion, up 19% y/y, with an EPS of 88 cents that beat the forecast by 4 cents per share. Bank of America finished Q2 with $373.5 million in total cash and liquid assets, compared to just $198 million at the end of 2Q22.

This bank company is known for its strong capital return policy and in Q2, the bank returned $2.3 billion to its stockholders through share repurchases and dividends. The stock’s dividend was last declared on July 19, for a September 29 payout at 24 cents per common share, marking a 9% increase from the previous quarter. The dividend annualizes to 96 cents per share and yields 3.3%.

While Bank of America’s strong dividend history must be attractive to Buffett, based on his own long-stated preferences, Well Fargo analyst Mike Mayo takes a different tack. He’s impressed by BAC’s size, seeing the bank’s gigantism as an overall positive, an asset that cannot be denied.

“In our view, Bank of America is among the best positioned large-cap banks as it relates to deposits (esp. consumer), cost management, credit quality, and reputation as a leader in stakeholder capitalism. In addition, BAC is a leader in tech among banks, which should help it further grow its leading deposit share toward its goal of one-fourth in the U.S. and aid in its effort to show superior operating leverage. Indeed, its tech benefits should help BAC show about the best 2023 spread of revenue vs. expense growth, leading to higher incremental Consumer Bank profit margins. Overall, BAC is a Goliath at a time when Goliath is winning,” Mayo opined.

Mayo goes on to give the stock an Overweight (i.e. Buy) rating, and his $40 price target indicates confidence in a 39% gain on the one-year horizon. (To watch Mayo’s track record, click here)

Overall, BAC boasts a Moderate Buy consensus rating based on 16 recent analyst reviews, including 8 Buys, 6 Holds, and 2 Sells. The $28.84 trading price and $35.13 average price target combine to suggest ~22% one-year upside potential. (See BAC stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.