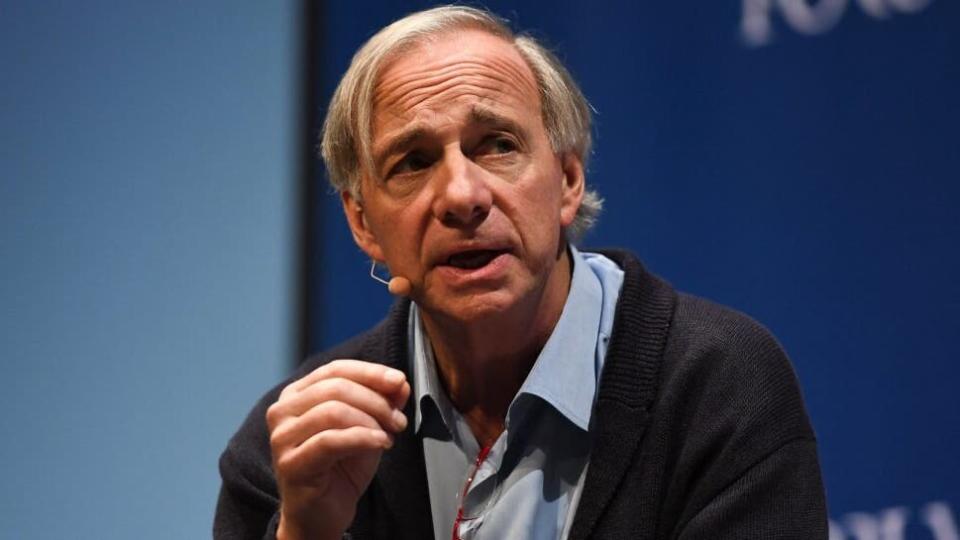

In 2020, billionaire investor Ray Dalio famously claimed that “cash is trash.” He later elaborated that cash is not safe because “it will be taxed by inflation.” But as time passed, Dalio’s view on cash has made a U-turn.

“Temporarily, right now, cash I think is good … and the interest rates are fine. I don’t think it will be sustained that way,” he said at the Milken Institute Asia Summit in Singapore last week.

In the U.S., the Federal Reserve has implemented significant interest rate hikes to cool inflation. The federal funds rate is now at its highest level since 2001. For investors, some high-yield savings accounts are now paying over 5% annual percentage yields (APYs).

Don’t Miss:

Dalio also told the audience what he doesn’t want to own at the moment.

“I don’t want to own debt, you know, bonds and those kinds of things,” he said.

When asked about his approach to deploying capital, Dalio said that he would want to be “in the right places” geographically. He also emphasized the importance of diversification and paying attention to disruptions.

As the founder of Bridgewater Associates, the world’s largest hedge fund, Dalio knows about deploying capital. Here’s a look at some notable investment themes in Bridgewater’s portfolio.

Emerging Market Equities

Dalio’s investment horizon extends beyond U.S. borders.

According to Bridgewater’s latest Form 13F filing with the Securities and Exchange Commission (SEC), Dalio’s fund held 17,932,948 shares of the exchange-traded fund (ETF) iShares Core MSCI Emerging Markets ETF (NYSE:IEMG) at the end of the second quarter. With the position valued at $883.92 million at the time, IEMG was the second largest publicly traded holding in Bridgewater’s portfolio.

IEMG holds more than 2,700 stocks and provides exposure to a broad range of emerging market companies. Its top three holdings are Taiwan Semiconductor Manufacturing Co. Ltd., Tencent Holdings Ltd. and Samsung Electronics Co. Ltd.

Bridgewater also owned 7,848,503 shares of Vanguard FTSE Emerging Markets ETF (NYSE:VWO) at the end of June, a stake valued at $319.28 million.

VWO is another ETF that gives investors access to emerging markets like China, India, Brazil and South Africa. It holds more than 5,000 stocks.

In a MarketWatch interview published last October, Dalio said that opportunities will “come in different regions” over the next five years.

“As we look at the world, we have to recognize that there are bright spots and there are less bright spots, and places like emerging Asia, places such as Singapore and Vietnam and Indonesia and places like that are bright spots,” he said. “India, I think, is going to be a brighter spot.”

Consumer Staples

In an era where artificial intelligence and cutting-edge technologies dominate the headlines, consumer staples may not seem like an exciting business on the surface.

But Dalio still likes the segment.

Bridgewater’s third-largest publicly traded holding at the end of June was Procter & Gamble Co. (NYSE:PG), a company deeply entrenched in the consumer staples business. With well-known brands like Tide, Bounty, Gillette and Pampers, the company offers a range of products that households buy regularly, allowing it to generate consistent revenue through thick and thin.

Beverages are another part of the consumer staples category. And rather than choosing between Pepsi and Coke, Dalio is going with both.

Bridgewater’s Form 13F filing revealed that the firm held 2,566,566 shares of PepsiCo Inc. (NASDAQ:PEP) and 8,214,890 shares of Coca-Cola Co. (NYSE:KO) as of June 30, valued at $475.38 million and $494.7 million, respectively.

It’s easy to see why both companies can be resilient: Even in a recession, a can of Coke or Pepsi is still affordable to most people.

Another reason many investors are attracted to consumer staples companies is their ability to pay reliable dividends.

In May, PepsiCo announced its 51st consecutive annual dividend increase. Coca-Cola’s board approved the company’s 61st consecutive payout increase in February. Meanwhile, Procter & Gamble has paid a higher dividend to shareholders for 67 years straight.

Read next:

Photo: Web Summit on Flickr

Don’t miss real-time alerts on your stocks – join Benzinga Pro for free! Try the tool that will help you invest smarter, faster, and better.

This article No More ‘Cash Is Trash’: Billionaire Ray Dalio Says Cash Is Good But Only Temporarily — Here’s How He’s Positioning His Portfolio originally appeared on Benzinga.com

.

© 2023 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.