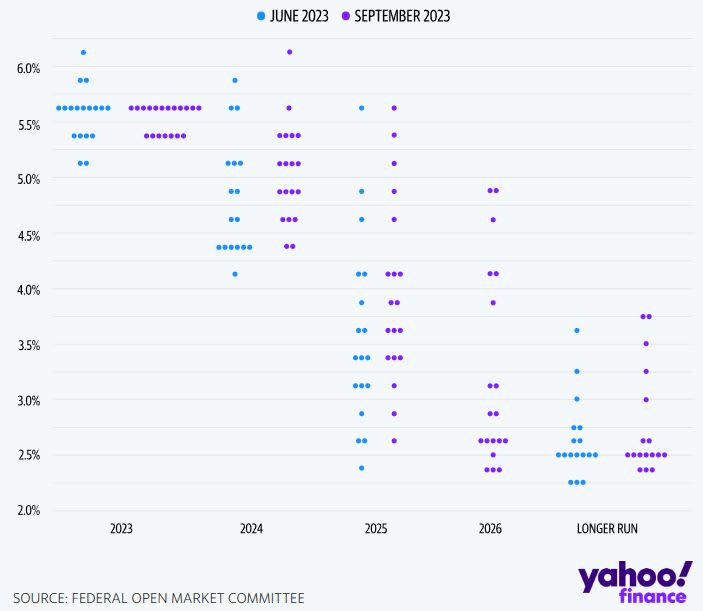

Digital assets tentatively sold off this week in response to the Federal Reserve indicating another rate hike may come this year, despite deciding to keep interest rates steady on Wednesday.

Projections released by the central bank show median rates of 5.6% before year’s end, up from the current range of 5.25% to 5.5%. The suggested hike garnered support from 12 Federal Reserve officials and opposition from 9.

“We want to see convincing evidence really that we have reached the appropriate level, and we’re seeing progress, and we welcome that,” Fed chair Jerome Powell told reporters at a press conference following the decision. “But, you know, we need to see more progress before we’ll be willing to reach that conclusion.”

According to CoinMarketCap, $30B was wiped from the combined capitalization of crypto assets, which now sits at $1.05T following the 3% retracement. BTC has since dropped 2.5%, and ETH is down 3% after both assets regained 1% in the past 24 hours.

Quarterly Options Set To Expire

September’s close will also coincide with the expiry of $3B worth of quarterly BTC options and $1.8B in contracts tracking Ether.

Luuk Strijers, the chief commercial officer at crypto options exchange Deribit, told The Defiant that quarterly contracts are typically “the most significant in terms of volume and value,” estimating institutions represent 85% of activity.

However, Strijers said he does not expect to see “strong market moves in the coming week” based on the current positioning of market participants.

On-chain Activity Drops

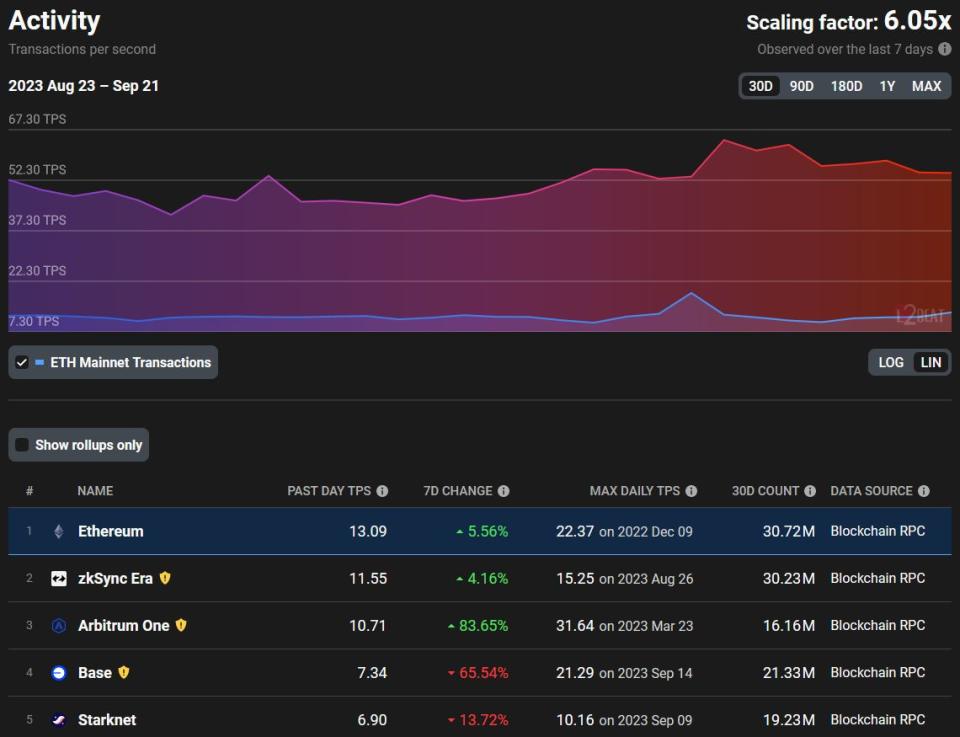

September has been the weakest month for Ethereum’s on-chain activity this year.

According to Ultra Sound Money, more than 13,000 ETH ($21M) was added to Ether’s supply since the month began — meaning Ethereum’s burn mechanism failed to offset new ETH entering supply as rewards for validators amid the slump in activity.

The low activity has been attributed to the prolonged downturn in the NFT market and the buzz surrounding memecoins dying down.

However, the retracement in on-chain also coincides with Layer 2 transaction throughput setting new highs multiple times in recent weeks. Ethereum’s L2 ecosystem processed an average of 64.2 transactions per second (TPS) on Sept. 14, compared to 12.4 TPS on the Ethereum mainnet.