NEW YORK, Sept 27 (Reuters) – As the Federal Reserve’s hawkish stance boosts Treasury yields and slams stocks, some investors are preparing for more pain ahead.

For most of the year, equity investors brushed off a rise in Treasury yields as a by-product of better-than-expected economic growth, despite worries that yields could eventually weigh on stocks if they rose too high.

Those concerns may be taking on fresh urgency after the Fed last week forecast it would leave rates elevated for longer than many investors were expecting.

Following a 1.5% tumble on Tuesday, the S&P 500 (.SPX) is now down more than 7% from its July highs, stung by sharp declines in shares of some of this year’s biggest winners — including Apple (AAPL.O), Amazon.com (AMZN.O) and Nvidia (NVDA.O). At the same time, yields on the U.S. benchmark 10-year Treasury stand near a 16-year peak at 4.55%.

With policymakers projecting rates will remain around current levels until the end of 2024, some investors say more volatility could be in store. Higher yields on Treasuries – which are sensitive to interest rate expectations and seen as risk free because they are backed by the U.S. government – offer investment competition to stocks while raising the cost of borrowing for corporations and households.

The market “is recalibrating what is the right valuation for equities in a 5% interest rate world,” said Jake Schurmeier, a portfolio manager at Harbor Capital Advisors. “Investors are asking, ‘Why do I need to (take) equity risk when I get more returns than that just by holding a Treasury bill?’”

If history is any indication, higher rates are a less favorable environment for equity investors. An analysis by AQR Capital Management going back to 1990 showed U.S. equities returned an average of 5.4% over cash when rates were above their median level – as they are now – compared with a return of 11.5% when interest rates were below their median.

“Stock markets are just plain expensive,” said Dan Villalon, principal and global co-head of portfolio solutions at AQR Capital Management, who believes rates will be higher over the next five to 10 years than in the previous decade, impacting returns.

AQR’s analysis showed that trend-following hedge funds tend to outperform when rates are elevated, as they hold large cash positions that benefit from higher rates.

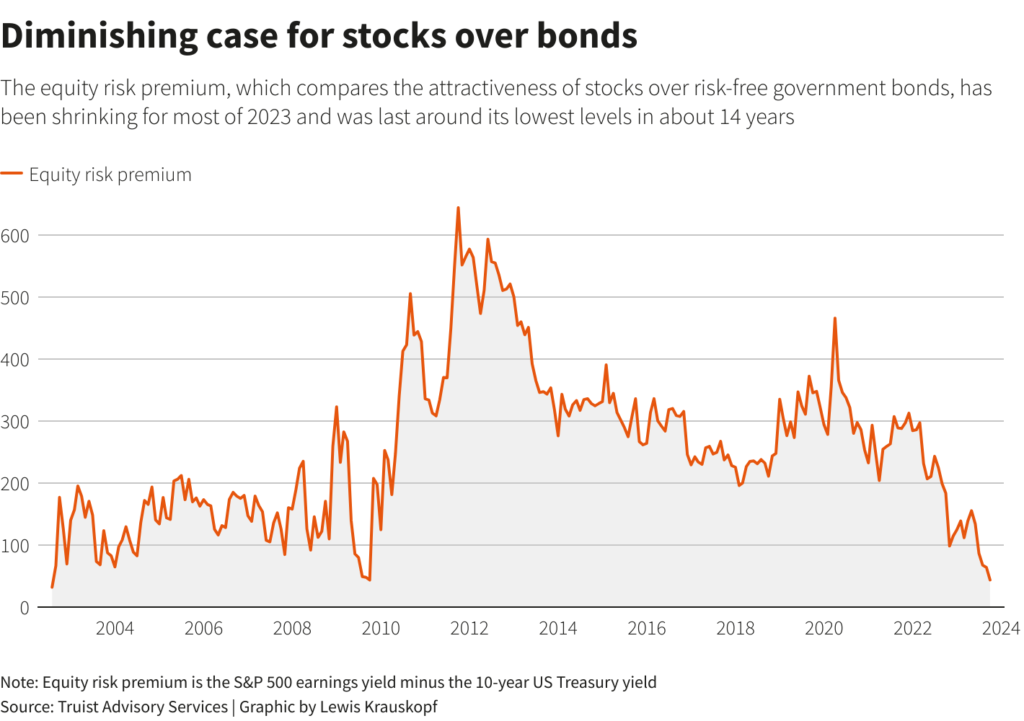

The equity risk premium, which compares the attractiveness of stocks over risk-free government bonds, has been shrinking for most of 2023 and was last around its lowest levels in about 14 years, according to Keith Lerner, co-chief investment officer at Truist Advisory Services.

The current ERP level has historically translated to just a 1.3% average 12-month excess return of the S&P 500 over the 10-year Treasury, according to Lerner.

The 10-year Treasury yield up to 4.5% “changes the narrative for stocks,” said Robert Pavlik, senior portfolio manager at Dakota Wealth Management, who is holding a higher-than-normal cash position.

“Investors are going to be even more worried that we could enter into a recession as the cost of borrowing is increasing and corporate margins will be squeezed,” he said.

Analysts at BofA Global Research argue that equities – specifically, the tech-heavy Nasdaq 100, which has soared 33% in 2023 in part due to excitement over advances in artificial intelligence – have until recently ignored the risk of rising rates.

“Sentiment could be turning, however. The Nasdaq has started to move inversely with real rates again,” the bank’s analysts wrote. “If this continues, the risk is that equities have a long way to go to price-in rate sensitivity again, hence more downside.”

Schurmeier, of Harbor Capital, said he’s been increasing his exposure to long-duration bonds and value stocks in anticipation that a period of high rates will weigh on growth stocks, as occurred in the mid-2000s following the bursting of the tech bubble.

Of course, plenty of investors believe the Fed will cut rates as soon as economic growth starts to wobble. Futures tied to the Fed’s key policy rate show investors pricing in the first rate cut in July 2024.

“We don’t believe that ‘higher for longer’ will prove true,” said Eric Kuby, chief investment officer at North Star Investment Management Corp.

Still, he has been holding off on adding to the firm’s holdings of small-cap consumer stocks, wary there may be more market volatility ahead as investors digest higher rates and other factors, including elevated energy prices.

“Certainly, the combination of the Fed’s jawboning and the spike in oil prices are creating headwinds for equities,” he said.

Reporting by Lewis Krauskopf, David Randall and Carolina Mandl; Editing by Ira Iosebashvili and Leslie Adler

: .