The jobs numbers for September came in on Friday and at 336,000 are nothing short of stunningly good news for the President and more importantly, for the people. The unemployment rate continues to stay below 4%.

The fact that this jobs report came out on Jobs Day and National Manufacturing Day when President Biden was already expected to give remarks on the “unprecedented turnaround in America’s manufacturing leadership and our strong jobs market thanks to Bidenomics” is just further icing on the cake.

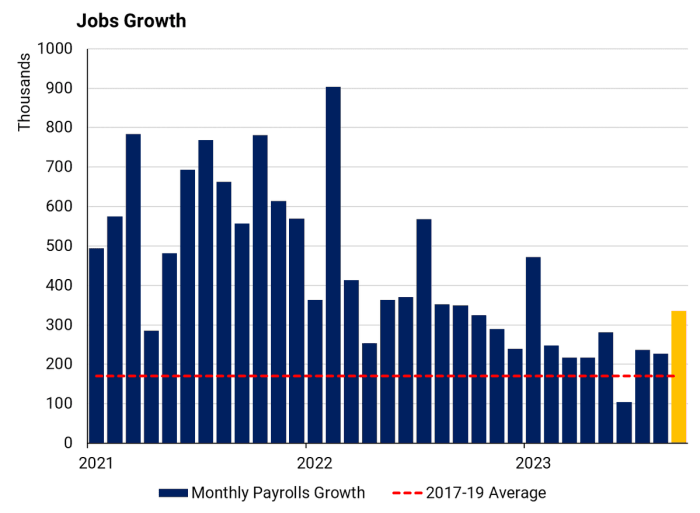

The jobs market under this president has been historic and continues to defy gravity. Check out the average versus the job growth under Biden, as provided by Steve Rattner:

These jobs are not just replacing jobs lost during the pandemic, in fact they had surged well beyond that point as FactCheck noted in July of 2023, when they wrote, “The number of people with jobs has increased dramatically since Biden took office, far surpassing pre-pandemic levels.”

This sounds pretty good, right? More jobs is great for the people!

Oh, wait. Jobs for working people are bad for investors, which is the metric by which the New York Times apparently initially presented this news. Remember, every story told asks the writer and editor to make a choice about the lens through which it will be told. Will the jobs report be seen through the lens of Main Street or Wall Street? People scared they can’t pay their mortgage or rich investors? Big business or the people? On and on it goes.

Magdi Jacobs, who writes for the Editorial Board, caught the weird take (or should I say, elitist take) in the NYT (due to Twitter’s ever-changing status, I’ve provided screengrabs with a link instead of an embed that might disappear):

If it’s accurate that they edited their headline to say “in a sign of unexpected vigor” instead of “in troubling news for the fed,” that’s a good step in the right direction. The Times clearly does some of the best investigative reporting out there, but at the same time has become infamous for catering its news to the wealthy and not budging from that position even as times changed.

The reason this matters is that stock ownership is still a game for the privileged. Gallup reported in May based on a survey in which people self report, “In 2023, the percentages owning stock range from highs of 84% of adults in households earning $100,000 or more and about eight in 10 college graduates and postgraduates to a low of 29% of those in households earning less than $40,000.”

It’s fair to say that the stock market isn’t impacting the ability to pay bills for those people who are not in the top percentiles, though that’s not to suggest a market crash isn’t devastating when it wipes out retirement funds. It’s just that as a lens through which to view the economy, it’s a choice that reflects catering to the privileged.

Yes, the economy is complex and it’s not as simple as happy workers = good news. Investopedia suggests a low rate of unemployment is bad news because it can cause inflation and reduced productivity, the latter point of which sounds a lot like workers get lazy when they aren’t terrified of being replaced — a concept that no one is suggesting be applied to overpaid CEOs. But certainly, inflation is an issue with which the Fed has been grappling. The “US Inflation Rate is at 3.67%, compared to 3.18% last month and 8.26% last year. This is higher than the long term average of 3.28%.”

Still, in terms of choosing how to present how many people are employed and thus able to pay their bills and buy food, a Forbes breakdown from a senior contributor pointed out in 2020, “Most Americans Don’t Have A Real Stake In The Stock Market.”

“But the majority of Americans are not significantly affected by jumps in the stock market.”

The Gallup survey asks people if they are invested in the market. Many people will say yes to that because they have a retirement account, which is not the same thing as the impact the stock market has on the top 10% income of households who Forbes noted “had stock ownership rates above 90%.”

“The latest available government data, via the Federal Reserve from 2016, shows a relatively small share of American families (14%) are directly invested in individual stocks but a majority (52%) have some market investment mostly from owning retirement accounts such as 401(k)s. The Federal Reserve study found that only about one-third of families in the lower half of the income scale had stock holdings. In the next 40% of the income scale, about 70% of households held stocks, while households in the top 10% of the income scale had stock ownership rates above 90%.”

It’s not a surprise that Biden’s poll numbers aren’t great when the media rather consistently treats good news for Main Street as bad news, while continuing to normalize the Republican Party as its dysfunction and anti-democracy push grab hold of the majority of the party.

The bottom line is the jobs report is really good news for working people. It means people have employment. It’s absolutely bonkers that this country has for so long only viewed employment numbers through the lens of how it impacts the wealthiest among us. In August, Biden made history by releasing a report from the Treasury Department on the part that labor unions play in the American economy.

As President Biden in his remarks on the latest jobs report and Manufacturing Day, “We’re creating good jobs in communities all across the country, including in places that have been left behind for the last, in some cases, 20 years because the factories they used to work at for years and years shut down, leaving them with no options, no jobs in that community all over the Midwest and all over the Northeast that under Bidenomics you won’t have to leave home now to get a good job.”

Video of Biden:

The working class makes up the majority of Americans. How the economy works for Main Street should be prioritized in news coverage that is designed to protect democracy for everyone. After all, happy workers are harder to radicalize and make for a more robust democracy. And everyone deserves the security that comes with a decent job.