- The Biden administration and the media insist that the economy is doing well, with claims of big job growth and a reduction in inflation.

- Consumers, however, are unenthusiastic about the economy, having poor faith in its future while also being crushed by the effects of long-running high inflation.

- “While future forecasts may look promising with many economists predicting a ‘soft landing,’ that in itself cannot make up for the fact that the average consumer pays significantly more for daily products now than they did in 2021,” Jai Kedia, a research fellow for the Center for Monetary and Financial Alternatives at the Cato Institute, told the Daily Caller News Foundation.

Consumers are right to be dissatisfied with the current state of the economy despite claims of a booming economy from U.S. officials and the media, experts told the Daily Caller News Foundation.

Consumer sentiment, meaning Americans perception of the economy, is expected to improve in December following a mid-month reading of 69.7 index points, which is far from the high under Biden of 88.3 in April 2021 and even further from the 90 to 100 range that was common during the Trump presidency, according to the University of Michigan’s Survey of Consumers. Politicians and the media have insisted that consumers are wrong to be unenthusiastic about the state of the economy, but experts told the DCNF that consumer perceptions are more in line with the true state of the country. (RELATED: Biden’s Student Loan Cancellation Dreams Are A Nightmare For Average Americans, Experts Say)

“It is unfair to outright dismiss consumer sentiment concerns,” Jai Kedia, a research fellow for the Center for Monetary and Financial Alternatives at the Cato Institute, told the DCNF. “Yes, the ‘misery index’ (sum of unemployment and inflation rates) is low, but consumers are backward-looking just as they are forward-looking. Simply saying that inflation is low now, so consumers should be happy, conflates falling inflation with falling prices. Consumers have already suffered through nearly 2 years of rising prices, so it is reasonable that they feel their standard of living has shrunk since the pandemic.”

The unemployment rate has remained historically low since its decline to below 4% under the Trump administration, before spiking and declining again following the initial shock of the COVID-19 pandemic, according to the Federal Reserve Bank of St. Louis. In turn, the misery index has declined in recent months as inflation decelerates, but still remains above pre-pandemic trends.

Inflation peaked under Biden at 9.1% in June 2022 and slowly receded to its current year-over-year rate of 3.1% as of November. Since Biden took office in January 2021, prices have risen 17.2% in total as of November, with goods like shelter and cars seeing the biggest increases.

“The return of significant inflation after four decades of relative price stability has left a lot of Americans financially shell shocked,” Peter Earle, economist at the American Institute for Economic Research, told the DCNF. “Watching prices all throughout the economy rise substantially and feeling one’s purchasing power wither away in less than a year is a process U.S. citizens aren’t familiar with. And although the rate of inflation has come down since surpassing 9% in June 2022, the general price level is still rising at a rate higher than it has in decades. Even though the rapid ascent of prices has slowed, most Americans’ earnings have not kept up, and consequently, they’re struggling to maintain their consumption patterns.”

Wages have failed to keep up with the sky-high inflation seen under Biden, declining 2.1% since the president first took office in January 2021, according to FRED. To make up the difference, consumers have turned to credit cards to finance everyday expenses, resulting in the amount of credit card debt being held by Americans exceeding $1 trillion in 2023 for the first time ever.

Yellen on CNN: “What we are seeing now I think we can describe as a soft landing.” pic.twitter.com/vkSpN14wHX

— Win Smart, CFA (@WinfieldSmart) January 5, 2024

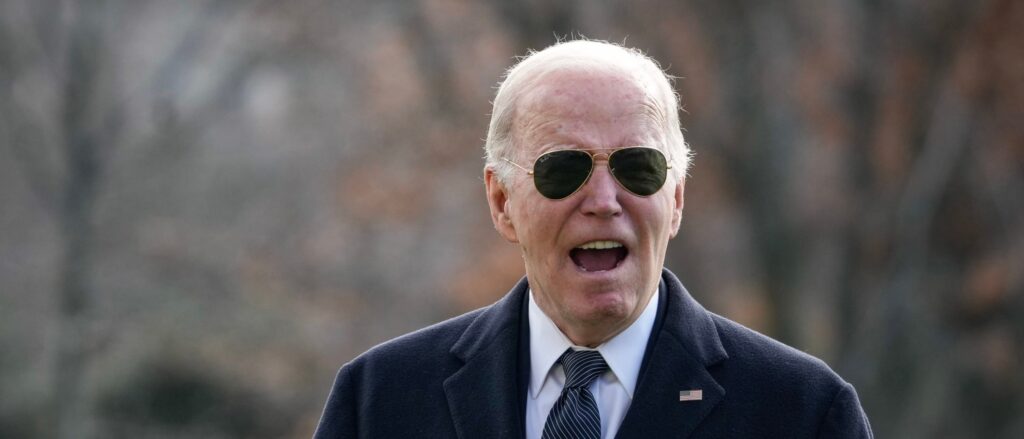

Despite the struggling state of the American consumer, Biden has continued to push the narrative that Americans are doing financially well, saying Friday that “2023 was a great year for American workers” and pointing to data for December showing that the year saw 2.7 million new jobs. The jobs that were created in 2023 were heavily concentrated in just a few industries, including the government, which had its total employment reach an all-time high of 23 million in December.

“Not only is inflation still about 30 percent higher than it was for roughly 40 years, but interest rates have also risen more quickly than they have in many decades,” Earle told the DCNF. “Credit card interest is at an all-time high, mortgage rates haven’t been as high as they are now in well over a decade, down and monthly payments on cars are twice as high as they were five years ago, and the list goes on. The sudden leap in prices and rates has clobbered the personal finances of many US citizens and made them more uncertain than they’ve ever been about the future. Add to that what’s sure to be a contentious US election year and a handful of small regional conflicts, and yes — there’s not a lot of optimism out there.”

The average interest rate for a 30-year mortgage reached a recent peak on October 26, 2023, of 7.79%, the highest point since 2000, having since moderated slightly to 6.62% as of Jan. 4, according to FRED. In the same month, home prices climbed 4.8% year-over-year to the highest point in U.S. history.

Interest rates are feeling upward pressure from the Federal Reserve’s federal funds rate, which has been set to a range of 5.25% and 5.50% since July 2023, the highest point in 22 years, in an effort to bring down inflation. The Fed released its median future projection at the Federal Open Market Meeting in December, with members expecting the rate to be lowered to 4.6% by the end of 2024, possibly providing some relief to debt-ridden Americans.

“The likelihood of a recession has had one clear economic effect: Americans are increasingly reluctant to change jobs,” Earle told the DCNF. “The ‘quits rate’ is down to its lowest level since September 2020, which is a clear sign that uncertainty about the direction of the U.S. economy is being met by hanging on to whatever form of financial certainty one can manage. People are feeling less confident about getting new jobs that pay more than their current ones or about finding a new job, period.”

The number of people voluntarily quitting their jobs continued to sink in December as Americans grow increasingly cautious about a possible economic downturn, according to FRED. The number of people quitting declined to 3,471,000 in November, after receding from its peak of 4,501,000 in November 2021.

“Under President Biden, the economy created 2.7 million jobs last year — more than any year under the previous administration, inflation fell to 2% over the last six months, and wages and wealth are higher than before the pandemic,” Michael Kikukawa, assistant press secretary for the White House, told the DCNF. “We have more work to do to lower costs — building on our work to cut prescription drug and energy costs — but Americans are feeling the impact of the strong economy, with consumer sentiment soaring 14% last month, the largest one-month increase in over a decade.”

Recession predictions among economists and institutions remain mixed, with Deutsche Bank and Société Générale predicting a recession in 2024 while Goldman Sachs and JP Morgan Chase are only predicting a risk of recession in the new year. Treasury Secretary Janet Yellen emphasized the health of the economy Friday, saying that the U.S. had achieved a “soft landing” by avoiding a recession and bringing inflation down, according to Yahoo Finance.

“While future forecasts may look promising with many economists predicting a ‘soft landing,’ that in itself cannot make up for the fact that the average consumer pays significantly more for daily products now than they did in 2021,” Kedia told the DCNF.

All content created by the Daily Caller News Foundation, an independent and nonpartisan newswire service, is available without charge to any legitimate news publisher that can provide a large audience. All republished articles must include our logo, our reporter’s byline and their DCNF affiliation. For any questions about our guidelines or partnering with us, please contact licensing@dailycallernewsfoundation.org.