By Casey Harper (The Center Square)

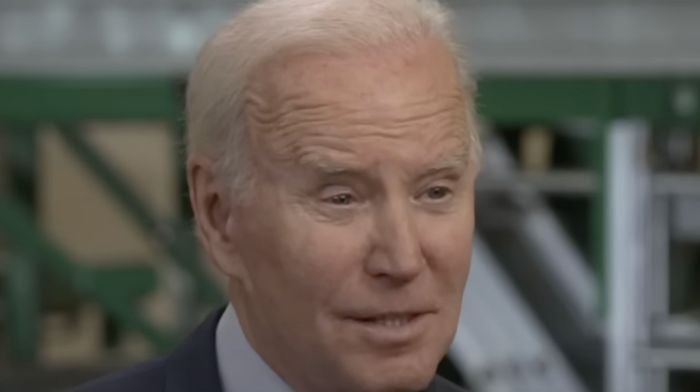

President Joe Biden is taking criticism after the IRS said it will go after service industry tips in a new effort to increase collection.

The IRS issued new guidance this week for a “voluntary tip reporting program” for service industry employers.

The plan allows for the “monitoring of employer compliance based on actual annual tip revenue and charge tip data from an employer’s point-of-sale system, and allowance for adjustments in tipping practices from year to year.”

The IRS incentivizes employers to allow this monitoring by saying “employers receive protection from liability” and that it makes them less likely to receive a “compliance review” from the IRS.

“Participating employers demonstrate compliance with the program requirements by submitting an annual report after the close of the calendar year, which reduces the need for compliance reviews by the IRS,” the IRS said.

Republicans blasted Biden over the new plan.

“Stop the presses. No need to raise the debt limit,” said Rep. Thomas Massie, R-Ky. “Biden is going after those billionaire waitresses’ tips,” he added, apparently referencing Biden’s call for a billionaires tax.

Related: Biden Claims Public Isn’t Interested In Investigation of His Son Hunter, the Public Says Otherwise

The effort comes the same week Biden emphasized in his State of the Union address that no one making less than $400,000 will pay more in taxes.

In the speech, Biden also called for the “wealthiest and biggest corporations to begin to pay their fair share,” and proposed quadrupling the tax on corporate stock buybacks from 1% to 4%, a proposal critics say would cost countless jobs.

“Look, I’m a capitalist, but pay your fair share,” Biden said. “The idea that in 2020, 55 of the largest corporations in America, the Fortune 500, made $40 billion in profits and paid zero in federal taxes … folks, it’s simply not fair.”

Biden also touted the 15% minimum tax on book income passed in the Inflation Reduction Act in his speech.

A more aggressive IRS is not new. Biden has made clear since taking office that it is a key part of his agenda. The president pushed for greater IRS enforcement to fund some of his spending as an alternative to raising taxes. The main thrust of that plan came through the previous Democrat-led Congress funding 87,000 new IRS agents to audit Americans and thus increase revenue.

“Joe Biden’s radical war on the working class just expanded to tipped workers, further proof that working-class Americans who make less than $75,000 will bear the brunt of over 710,000 new IRS audits under the newly supercharged IRS,” said Ways and Means Committee Chairman Rep. Jason Smith, R-Mo. “While the president talked a big game about going after billionaires in his partisan State of the Union address, it’s clear that the White House is doubling down on crazy and prioritizing going after hardworking middle-class employees.”

Related: Americans’ Personal Finances Worst Since The Great Recession

House Republicans voted to defund Biden’s extra IRS agents earlier this year, but that bill will almost certainly not become law on Biden’s watch.

“When Biden says the IRS is going after millionaires and billionaires, apparently he means the ones that are waitresses living off of tips,” said Rep. Lauren Boebert, R-Colo.

Syndicated with permission from The Center Square.