Twitter Sleuth “Unusual Whales” launched investment funds to mimic stock trades by Congressional lawmakers and their families.

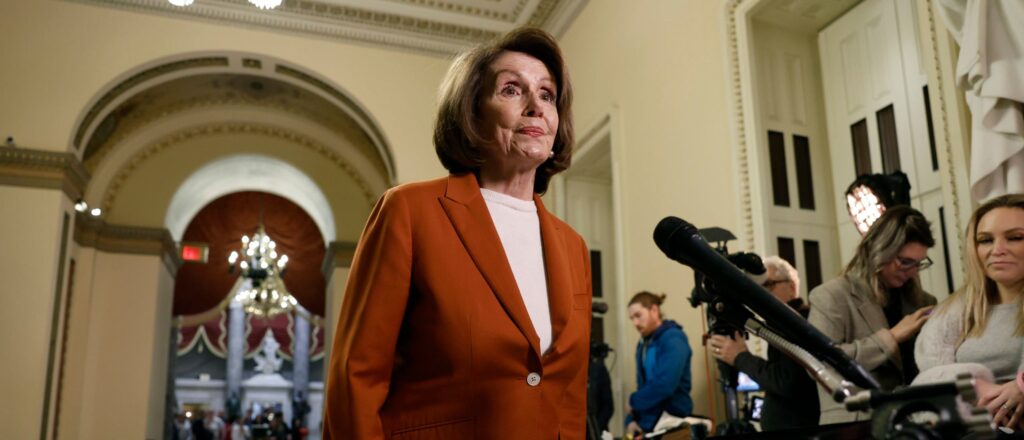

Unusual Whales created Exchange Traded Funds (ETFs) to track Democratic and Republican trading. The Democratic fund is named $NANC in an homage to former House Speaker Nancy Pelosi, a Democratic Rep. from San Francisco. Its early holdings are dominated by big tech stocks such as Microsoft, Google parent Alphabet and Amazon.

BREAKING: Today you’ll be able to trade the portfolios of politicians.

The Unusual Whales Subversive Democratic, $NANC, & Republican, $KRUZ, ETFs are live today.

The ETFs follow the disclosed trades of Congressional members & their families.

See more: https://t.co/CyG5ayenoZ

— unusual_whales (@unusual_whales) February 7, 2023

Pelosi’s wealth has increased by $140 million since 2008 primarily due to her husband’s stock trades, the Washington Free Beacon reported. Her financial portfolio performed exceptionally well during the 2008 financial crisis and the economic downturn caused by covid measures, the outlet found.

Unusual Whales’ ETF for tracking Republican trades is named $KRUZ, a reference to GOP Texas Sen. Ted Cruz. The fund holds stocks in a variety of industries such as oil and gas, tobacco and tech. (RELATED: Dan Crenshaw Invests In Big Tech Stocks Ahead Of New Congress)

Lawmakers are required by the STOCK Act of 2012 to disclose outside investments over $1,000 and they must follow laws preventing insider trading. Lawmakers have 45 days to disclose trades and afterwards the ETFs will mimic congressional stock trades, potentially leading to losses on volatile investments. Members of Congress had returns of 17.5% higher than the market in 2022, Financial Times reported.

Unusual Whales created the funds in partnership with Subversive ETFs, an asset management firm. Both ETFs carry a 0.75% management fee, according to a Securities and Exchange Commission (SEC) filing.