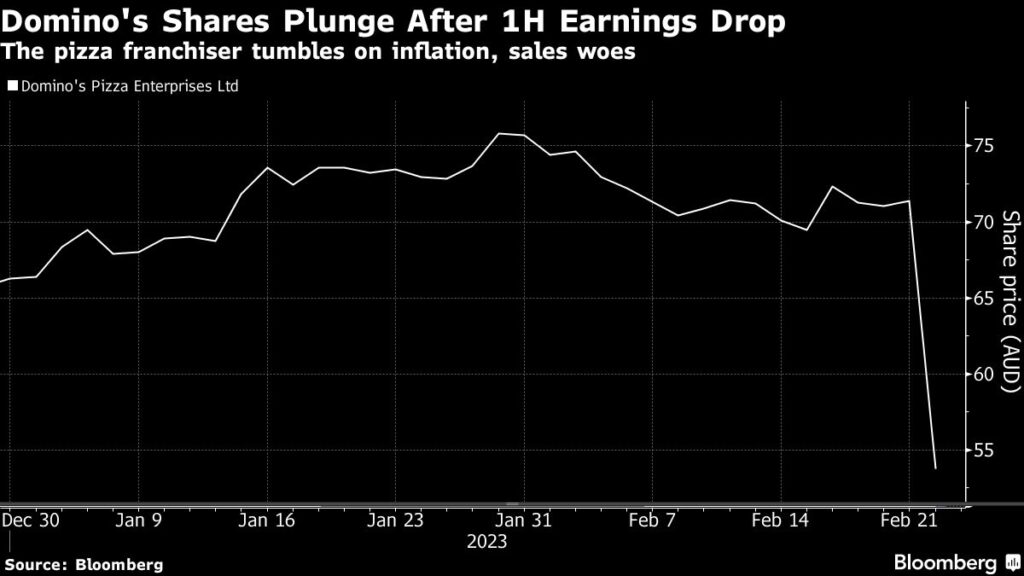

(Bloomberg) — Shares of Domino’s Pizza Enterprises Ltd. plummeted the most on record in Sydney after the pizza chain operator said its first-half earnings fell as customers spurned price increases meant to offset inflationary pressures.

Most Read from Bloomberg

The stock tanked 24% on Wednesday after the Australia-based company said price hikes have hurt customer counts, especially in Europe and Asia. A key measure of the firm’s earnings in the six months to December tumbled 21% from a year ago, according to a company statement.

Domino’s woes reflect the pain rising inflation is inflicting on both consumers and corporations. It’s the latest among a slew of Australian companies flagging inflation concerns during the country’s February earnings season. BHP Group Ltd. on Tuesday said mounting energy and labor costs damped its results, while Commonwealth Bank of Australia earlier this month noted that it has set aside more capital cushions as consumers feel the pinch from higher price pressures.

Read more: Cost-of-Pizza Shock Hits Italy as Surge Far Outstrips Inflation

The Sydney-listed company is Domino’s largest franchisee outside of the US, according to its website. It holds franchise rights to the pizza chain’s brand and network in countries such as Australia, France, Japan, Germany, and Taiwan.

In response to the price increases, some Domino’s customers “reduced their ordering frequency which resulted in December trading being significantly below our expectations,” Chief Executive Officer Don Meij said in the statement.

After initially resisting passing on higher costs to consumers, the company eventually lifted prices. But “given the speed of the change it was difficult to forecast the effect on customer repurchasing rates, especially where customers order less frequently such as Japan or Germany,” Meij added.

(Updates with share move, additional details throughout)

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.