While influencers advocate for healthcare price transparency, adherence lags among hospitals, unsurprisingly, as competing interests and increasing oversight signal shifts for the industry.

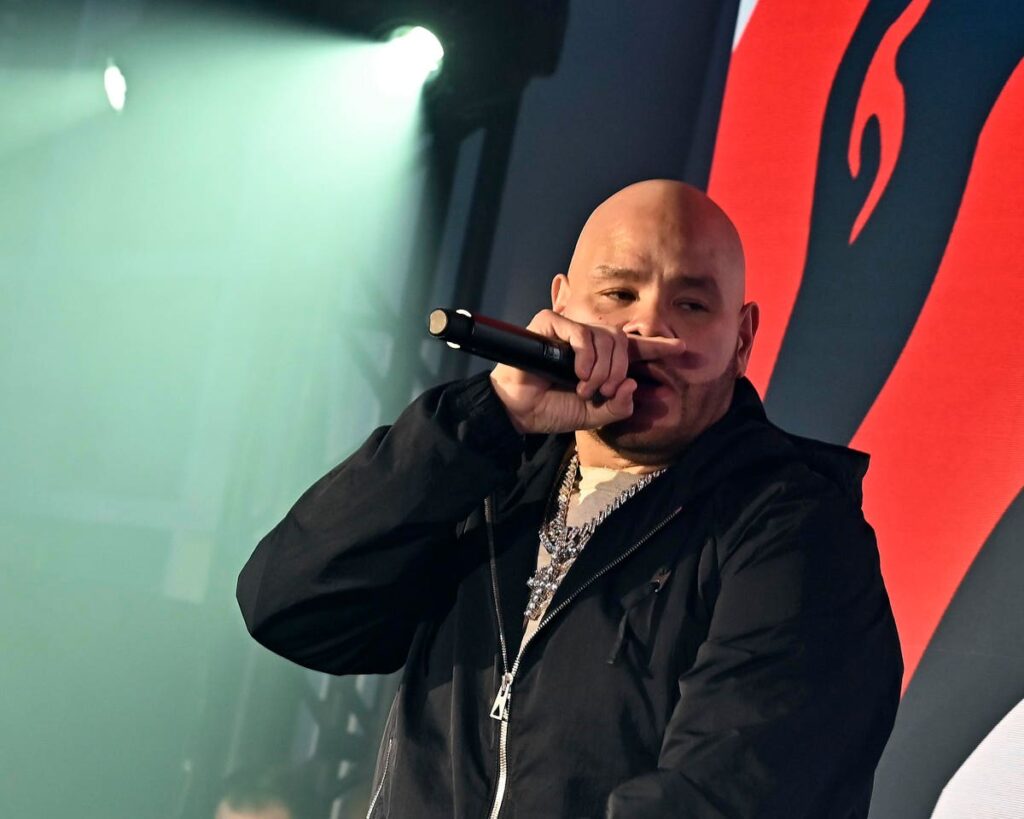

Fat Joe, perhaps most well-known for questioning, “What’s Luv?” in his 2001 summer smash, is embracing a new role nowadays: healthcare price transparency influencer. The rapper was in Washington, D.C., in April, 2023 as part of his ongoing advocacy work, speaking to policymakers and patients about better price transparency compliance and enforcement.

WASHINGTON, DC – APRIL 27: Fat Joe performs during “Power To The Patients” event in support of … [+]

Part of what’s driving Fat Joe’s mission? Wanting to improve health equity and address disparities, with a wealth of data showing just how deep the divide is. Research from Yale and Stanford reveals the rise of recent medical debt lawsuits disproportionately affects Black and lower-income patients, where a 2021 U.S. Census Bureau survey found that Black and Hispanic populations were more likely to hold medical debt than their white and non-Hispanic household counterparts.

Another part of Fat Joe’s mission is wanting to ensure the mandates are effective.

And herein lie the problems.

Under the Centers for Medicare & Medicaid Services (CMS) Hospital Price Transparency final rule, hospitals have been required to post standard pricing information and payer-specific negotiated rates for the most common healthcare services since 2021. But in a healthcare system that incentivizes information asymmetry, the less the public knows about costs of services, the better economically positioned hospitals and health systems are.

Price transparency in healthcare: easy in theory, difficult in practice

To be clear, these organizations should not be vilified for wanting to keep pricing information close to the vest; they’re not bad actors. They’re rational actors in a fee-for-service healthcare system, being asked to cooperate against their economic interests.

The question is, what should the path to compliance look like (for those hospitals that can’t afford to take the financial hit of the fines), and what happens next?

Hospital Price Transparency Compliance At A Slow Crawl

Having to reveal pricing information, while a boon to patients savvy enough to search for and find this information (easier said than done), is a challenging scenario for any hospital or health system. They’ve been brought up in an industry that competes on the clandestine. It’s also why, despite increasing fines for non-compliance, some studies show fewer than 25 percent of U.S. hospitals have complied with the mandate to date. And just how that compliance is taking shape is anything but uniform.

Survey data from PatientRightsAdvocate.org, as detailed in STAT in March 2023, found only 24.5% of 2,000 hospitals surveyed between December 2022, and January 2023, were posting complete pricing information. The likes of HCA Healthcare, Tenet Healthcare, Providence, UPMC, and other large medical centers had compliance rates of 0%. A separate CMS analysis, which looked at a smaller sample size of only 600 hospitals, found that 70 percent, or 420, were in compliance with website posting requirements.

As of April 2023, CMS issued more than 730 warning notices and 269 requests for CAPs, or corrective action plans, to hospitals that have yet to comply with pricing transparency mandates. But despite the hundreds of warnings, CMS has only imposed civil monetary penalties (CMPs) – or, fines – on four hospitals, as of April 2023. Importantly, CMS has raised the fee for noncompliance from more than $100,000 a year to more than $2 million per hospital – a financial burden many organizations won’t be able to bear, competitive advantage be damned.

What’s Behind Non-Compliance

On top of the hefty fines, one of the many reasons for hospitals’ noncompliance is the complexity of healthcare pricing overall. Prices for most people, for most healthcare services, will vary depending on the patient’s insurance coverage, the type of service provided, and the hospital’s negotiated rates with insurers. Some hospitals have argued that the required disclosures could be misleading to patients, as the actual costs of care may be different based on a variety of factors.

In this light, there have also been plenty of challenges in how hospitals present this information and the usability of the patient-focused websites in general. Different data formats, multiple costs being listed for a single procedure or service, and different codes being used to refer to one service are just some of the issues that Mary Katherine Wildeman, a health data journalist for the Associated Press, found when digging into hospital compliance in the state of Connecticut.

Another reason for hospital noncompliance is the lack of enforcement by regulators. Hospitals may not face immediate consequences for failing to comply with the regulations, leading some to prioritize other areas of compliance or investment over pricing transparency.

To become more timely and agile, CMS’ enforcement update notes that it is now leveraging “automation” to improve the speed and accuracy with which they conduct facility reviews. By using automation to group complaints based on file types and hospital systems, CMS says the number of comprehensive reviews conducted each month increased from 30-40 to over 200. Other enhancements in oversight include the enforcement of CAP completion deadlines, imposing CMPs earlier, and streamlining the compliance process overall.

Against Competitive Interests

But the crux of the noncompliance issue lies in the economics of the U.S. healthcare system. Hospitals simply aren’t incentivized enough to turn over their prices, agrees Sophia Tripoli, director of healthcare innovation for the advocacy group Families USA, who also called for lawmakers to codify the rule that’s been in effect since January 2021.

“It’s just about the business model of the sector, which is to keep prices hidden,” said Tripoli. “There is not a strong enough financial incentive or requirement to disclose prices,” she said, adding that hospitals should be prohibited from posting prices as a percentage of Medicare and gross charges.

Hal Andrews, CEO of data analytics firm Trilliant Health, agrees. “One of the longstanding issues that we’ve had in healthcare is that people thought competition was impolite, rude, was something not to be discussed,” said Andrews in a recent Trilliant Q&A. This thinking is especially ironic, noted Andrews, “because the people who are most focused on competition historically are the sisters of the Catholic healthcare systems for whom competition was essential.” It was the sisters who said, “no margin, no mission,” because they understood the business of healthcare in the U.S.

It’s important to note that transparency mandates extend to health plans as well. On January 1, 2023, the next phase of the Transparency in Coverage mandate and No Surprises Act legislation for health insurance plans went into effect, which requires most commercial insurers and group payers to provide out-of-pocket cost estimates for 500 items and services to health plan members. Similar to hospital mandates, health plans must make their price and rate information available, in a consumer-friendly format.

Price Transparency Driving Value-Based Care And Competition

For those hospitals and health systems charting the course to compliance – and those weighing the economic benefits with the costs – there are several steps to make the process as smooth as possible. One is to invest in technology and infrastructure that can accurately calculate and display pricing information. Hospitals and health systems should also be working with payers to ensure that patients receive accurate and timely information about their insurance coverage and out-of-pocket costs. Additionally, providers can educate patients about the benefits of pricing transparency and how it can help them make more informed decisions about their healthcare.

By providing patients with more information about the cost and quality of healthcare services, the hope is that patients will be empowered to make more informed decisions about their care. This could, in turn, drive hospitals to offer higher quality and more cost-effective care in order to attract and retain patients. Pricing transparency is also intended to support the shift towards value-based care by encouraging providers to focus on delivering higher-value services that meet patient needs at a reasonable cost. And for those more standard services, like an X-ray, where variability is minimal, the hope is patients will have the information available to make more cost-conscious decisions.

Again, that is the hope. The reality is that “consumer-friendly” formats of pricing datasets are as variable as each individual’s insurance coverage and financial circumstances. Negotiated rates hospitals post will rarely, if ever, be what most patients see on their bills, given the varying negotiated rates for each health plan, for each service, at each hospital location. This variability also includes plan deductibles, which put patients on the hook for costs up to a certain amount per their specific plan.

This complexity doesn’t mean that pricing transparency for hospitals and health plans isn’t a worthwhile endeavor. It simply means that, in a fee-for-service industry that’s trying to drive down costs and empower consumers, transparency mandates should be making hospital and health plan leaders reconsider how competitively advantaged they really are and what steps they need to take to be better.

What’s Next?

CMS is continuing to engage interested parties, including patients, consumer advocates, researchers and other experts, as well as hospitals, to obtain their feedback on the most useful and meaningful ways to display hospital standard charge information and exploring how to further drive standardized reporting of price transparency information.

Will this feedback, increased oversight and automation ultimately deliver more penalties and corrective action? One could hope that’s the case, though given the fundamentally competing interests of healthcare payers and providers, it remains to be seen.