-

The stock market is poised to hit new 2023 highs by the end of the year, according to Bank of America.

-

The bank said a leading bond market indicator just flashed a bullish signal for the stock market.

-

“Constructive credit markets entering September support the case for the bullish seasonality scenarios,” BofA said.

The bond market just flashed a signal that suggests the stock market will hit a new 2023 high by the end of the year, according to a Tuesday note from Bank of America.

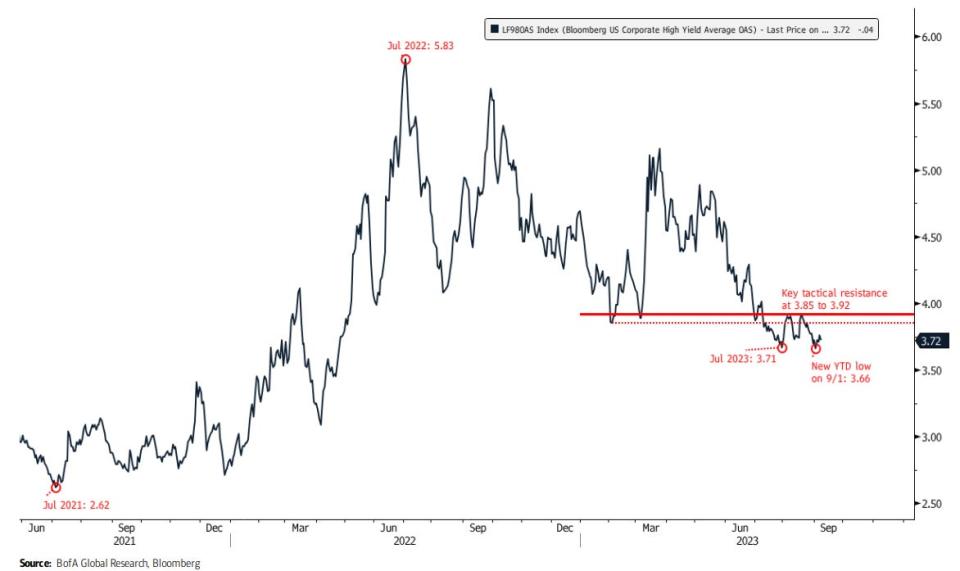

The bank highlighted that the Bloomberg US Corporate High Yield Average option adjusted spread hit a new year-to-date low earlier this month, meaning that bond investors are growing more comfortable buying risky debts.

That’s a leading indicator for the stock market because bond investors are typically the first in the market to panic about some type of macro event that could lead to pain for equities. And when bond investors panic, they demand higher yields for the debts that they buy.

But that’s not happening. Instead, the high-yield OAS is at about 3.7, which is near its lowest level since early 2022.

“We view this as a risk-on bullish leading indicator that favors eventual new year-to-date highs on the S&P 500,” Suttmeier said. “Constructive credit markets entering September support the case for the bullish seasonality scenarios that we have highlighted.”

The S&P 500 hit a year-to-date high of 4,607 on July 27, meaning that the stock market would have to rise by at least 3.1% from its current level to eclipse that.

As to what drives the market higher, Suttmeier also pointed out that a “mountain of money” in the form of $5.62 trillion in money market funds could help fuel a year-end stock rally as investors weigh their risk-free return of just 5% versus the S&P 500’s year-to-date return of nearly 17%.

“Since the S&P 500 can continue [to] thrive after solid returns for [the] first half and through August, it would not surprise us to see investors put cash to work and fuel a rally into year-end,” he said.

Also boding well for the stock market and further potential upside is the fact that defensive sectors like utilities and consumer staples are falling and breaking support levels. Investors often buy these defensive stocks for safety when the broader market is falling, so this is a bullish risk-on signal, according to Suttmeier.

Read the original article on Business Insider