[1/2] House Speaker Kevin McCarthy (R-CA) sits for debt limit talks with U.S. President Joe Biden in the Oval Office at the White House in Washington, U.S., May 22, 2023. REUTERS/Leah Millis/File Photo

NEW YORK, June 2 (Reuters) – While a U.S. default on its debt has been averted, the possibility of another credit rating downgrade remains, as 11th-hour debt ceiling negotiations have become an almost regular feature in recent U.S. history.

The U.S. Senate on Thursday passed bipartisan legislation backed by President Joe Biden that lifts the government’s $31.4 trillion debt ceiling, following months of bickering between Democrats and Republicans.

“The risk of a downgrade is exacerbated every time Congress flirts with the debt ceiling,” said Calvin Norris, portfolio manager & US rates strategist at Aegon Asset Management, who sees another downgrade as still a risk.

Rating agencies could look at the way the negotiations around the government’s borrowing cap were handled, in addition to fiscal considerations, analysts have said.

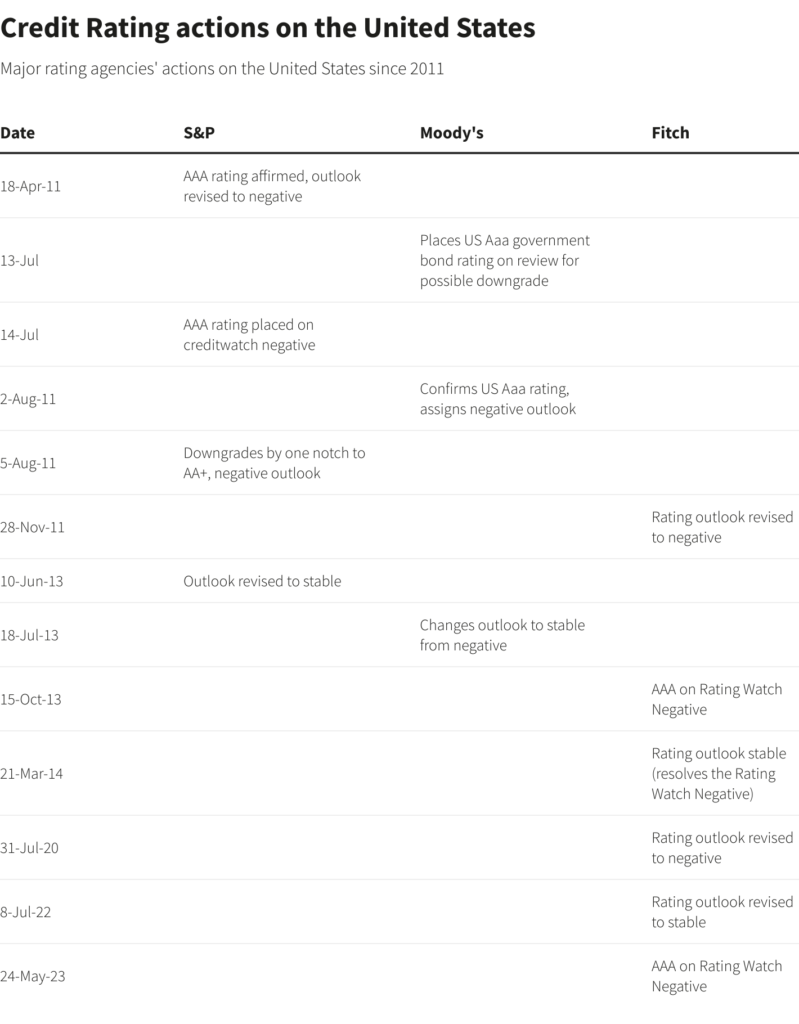

There is a precedent: in the 2011 debt ceiling crisis, rating agency Standard & Poor’s stripped the United States of its coveted AAA rating a few days after Washington narrowly averted a default, citing heightened political polarization and insufficient steps to adjust the nation’s fiscal outlook.

Economic damage from the 2011 and 2013 debt ceiling battles had a chilling impact. Without that political uncertainty, by mid-2015 GDP would have been $180 billion higher and there would have been 1.2 million more jobs, according to a 2021 Moody’s Analytics study.

The U.S. Government Accountability Office said delays in raising the debt limit in 2011 led to an increase in the Treasury’s borrowing costs of about $1.3 billion that year.

CHANGING THE AVERAGE

“A second downgrade would matter, and perhaps more than even the first downgrade,” said Wendy Edelberg, director of The Hamilton Project at the Brookings Institution.

“So much of the guidance that people take from ratings is the average rating across the three major rating agencies … The single downgrade didn’t really have any bite in terms of changing the average,” Edelberg said, referring to investment vehicles which are ratings sensitive.

The three major rating agencies – Fitch, Moody’s, and S&P Global Ratings – rate U.S. sovereign debt AAA, AAA, and AA+, respectively. Fitch and other smaller agencies recently placed their U.S. credit ratings under review.

William Foster, senior vice president at Moody’s Investors Service, said the bipartisan debt deal met the agency’s expectation of a resolution ahead of the so-called X-date.

With the debt limit suspended until January 1, 2025, the main drivers of the U.S. rating returned to be “economic, institutional and fiscal fundamentals,” he said.

Fitch on Friday said its rating will remain on negative watch despite the debt deal, as repeated political standoffs and last-minute debt limit suspensions lower “confidence in governance on fiscal and debt matters.”

S&P Global Ratings referred Reuters to its latest update on U.S. sovereign debt, dated March, which maintained the rating at AA+ with a stable outlook.

CASCADE EFFECT

Investors use credit ratings as one of the metrics to assess the risk profiles of governments and companies. Generally, the lower a borrower’s rating, the higher its financing costs.

A Moody’s Analytics report from May said a downgrade of Treasury debt would set off a cascade of credit implications and downgrades on the debt of many other institutions.

Andy Sparks, head of portfolio management research at MSCI, said another downgrade by a major rating agency could have repercussions on investment portfolios that hold top-rated securities, but the impact on the Treasuries market would likely be marginal. “The reality is it is hard to find substitutes for Treasuries,” he said.

Olivier d’Assier, head of applied research in APAC at Qontigo, said a downgrade could affect the use of Treasuries as collateral, but he considered that a very small probability.

“When the dust settles, the U.S. sovereign bond market will still be the place to go for extra liquidity, simply because there isn’t any other bucket large enough to contain it,” he said.

A downgrade could push some money from Treasury funds into government funds or from government funds into prime money market funds, which have a broader credit exposure, according to money market fund expert Peter Crane, President of Crane Data.

“But I think anyone would take a single A Treasury over AAA commercial paper,” he added.

‘REPEAT GAME’

After the 2011 Standard & Poor’s downgrade, U.S. stocks tumbled and the impact of the rating cut was felt across global stock markets, already in the throes of a financial meltdown in the euro zone. Paradoxically, U.S. Treasuries rose because of a flight to quality from equities.

In the 2013 debt ceiling crisis the legislative standoff did not cause a rating downgrade, although Fitch placed its rating under review. That standoff caused an estimated $38 million and $70 million increase in borrowing costs according to a Government Accountability Office report.

“In some investors’ minds this has become a repeat game … there could be some stigma effects over the longer term, but maybe not as dramatic as we observed in 2011,” said MSCI’s Sparks.

Reporting by Davide Barbuscia; Editing by Megan Davies, Nick Zieminski and David Holmes

: .