NEW YORK, Aug 23 (Reuters) – A recent spike in U.S. bond yields has come alongside muted expectations for inflation, a sign to some bond fund managers that economic resilience and high bond supply are now playing a larger role than second-guessing the Federal Reserve.

Benchmark 10-year nominal yields on Tuesday hit near 16-year peaks on concerns about U.S. Federal Reserve Chair Jerome Powell sending a hawkish message about keeping rates high at the annual Jackson Hole symposium on Friday.

Bond yields, which move inversely to prices, tend to rise in an inflationary environment because inflation erodes the value of a future bond payout.

But while higher moves in bond yields in the last several months were often driven by investors pricing in higher interest rates as the Fed sought to tame rising inflation, expectations on the pace of price rises have moved lower in recent weeks.

“The narrative has very much changed over the last few months,” said Calvin Norris, Portfolio Manager & US Rates Strategist at Aegon Asset Management.

Investors see evidence that a fresh set of drivers has taken hold, including the Bank of Japan letting yields go higher, which may reduce foreign investors’ appetite for Treasuries, and an increase in supply of U.S. government bonds, with investors demanding more for holding more debt.

While the timing and size of the central bank’s monetary tightening actions have preoccupied bond investors for well over a year, the market may have reached “an inflection point in terms of the primary driver of sentiment,” BMO Capital Markets analysts said in a note last week.

“The source of uncertainty is moving away from the (Fed) and toward the derivative of monetary policy in the economic fallout from policy rates at their highest level since 2001,” they said. “The issues of longer-term growth, term premium, and issuance are accounting for an increasing share of the price action.”

SOFT LANDING

Annual consumer price growth has slowed down from a peak above 9% in June 2022 to around 3%, considerably closer to the Fed’s 2% target after policymakers delivered 525 basis points of rate hikes starting in March 2022.

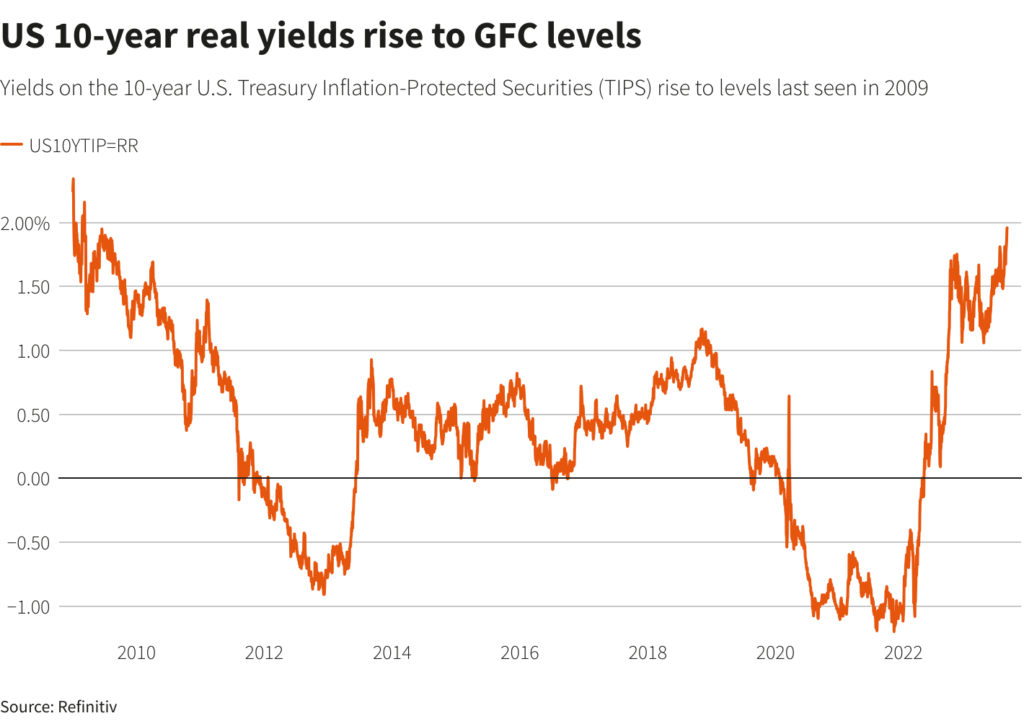

Meanwhile, expectations for inflation over the next decade as measured by the Treasury Inflation-Protected Securities market have remained relatively stable in recent months. The 10-year breakeven inflation, at 2.35%, is about 5 basis points higher since the beginning of the year, while 10-year nominal yields have increased by about 50 basis points.

“We’re pricing in a soft landing, which means we’re seeing things working out in the Fed’s favor, as inflation is coming down and the probability of a recession has been reduced,” said John Madziyire, senior portfolio manager and head of U.S. Treasuries and TIPS at Vanguard Fixed Income Group.

Long-term Treasury yields account for factors such as inflation expectations and term premiums, or what investors demand to be compensated for the risk of holding long-term paper.

“A lot of the move that we’re seeing now has to do with more long term structural questions, be it around growth or around term premiums,” said Anthony Woodside, head of U.S. fixed income strategy at LGIM America.

Yields are also a reflection of expectations around the so-called neutral rate – the level at which interest rates are neither stimulative or restrictive for the economy. A recent string of strong economic data despite higher interest rates has strengthened investor beliefs that interest rates will remain higher for longer, even if inflation is tamed.

“The fact that growth has been so strong and is still very resilient, even at these restrictive rates, means that potentially the neutral rate is now higher,” said Madziyire.

While such longer-term factors have become more prominent recently, the Fed’s more immediate monetary policy actions could land right back in the driver’s seat in case of a reacceleration of inflation or a sharp deterioration in the economy.

Money markets expect the Fed to maintain rates in the current 5.25%-5.5% range until the second quarter next year before starting to ease, but many will be looking for clues about possible additional rate hikes from Powell’s Jackson Hole speech on Friday.

“I still think there’s some risk that the Fed goes further, but the market is not giving that a whole lot of credence right now,” said Aegon’s Norris.

Reporting by Davide Barbuscia; editing by Megan Davies and Anna Driver

: .