With the second half of 2023 well underway, it is a good time to assess the current state of the stock market and examine which equities analysts are selecting as their ‘Top Picks’ for the remainder of the year.

The analysts have analyzed each stock, taking into account its past and current performance, trends across various time frames, as well as management’s plans. They consider every aspect before making their recommendations, which offer valuable guidance for constructing a resilient portfolio.

Several of these ‘top picks’ are truly worth the additional notice, and a look at the recent details on three of them, drawn from the TipRanks platform, tells the stories. The stock picks make an interesting bunch, from a variety of segments and featuring a rage of different attributes. Let’s take a closer look.

Franklin Covey (FC)

First up, Franklin Covey, is a leadership training company offering leadership and life coaching services. The company is named for the two bases of its approach: the writings of Benjamin Franklin and the leadership research of Stephen Covey, the author of The 7 Habits of Highly Effective People. Franklin Covey uses what it describes as ‘timeless principles of human effectiveness,’ and works to give every learner ‘the mindset, skillset, and toolset’ necessary to maximize performance for results.

Franklin Covey has undergone a transformation in its methods over the years. It started with publishing and distributing books and printed leadership materials, then expanded to offering in-person leadership classes, training, and seminars. Later, the company introduced online live video courses and eventually transitioned to mainly conducting online courses via live feed through a subscription model. Currently, the company offers courses in more than 160 countries and boasts over 15,000 client engagements annually. Additionally, its ‘The Leader in Me’ schools, which provide classes designed for K-12 students, exceed 5,000 in number and are available in 50 countries.

All of this makes Franklin Covey a giant in the self-help industry. The company saw $262.8 million in total revenue for its fiscal year 2022, and it’s continuing to show a strong performance during its fiscal year 2023.

Franklin Covey recently reported its fiscal Q3 financial results, revealing record quarterly sales. On the top line, the company posted Q3 revenue of $71.44 million, representing an 8% year-over-year increase and surpassing the forecast by $1.81 million. This growth was primarily driven by an 18% increase in the firm’s Education Division revenues. At the bottom line, Franklin Covey achieved an EPS of 32 cents, exceeding expectations by 15 cents per share.

Taken together, all of this explains why Franklin Covey is a Top Pick for Northland’s 5-star analyst Nehal Chokshi. Chokshi lays out his bullish case point by point, writing: “We are elevating FC to a top pick within our coverage given (1) Invoiced value y/y growth ticks up, other leading metrics trending positively too. (2) ~3x upside our 12-month PT represents, (3) what we believe is de minimus downside risk given shares are trading at ~12x EV/FCF despite mid-teens EBITDA growth and high teens FCF margin and (4) FC BoD strongly indicating their belief shares are severely undervalued with an accelerated rate of buyback and increasing % of FCF utilized for share buybacks.”

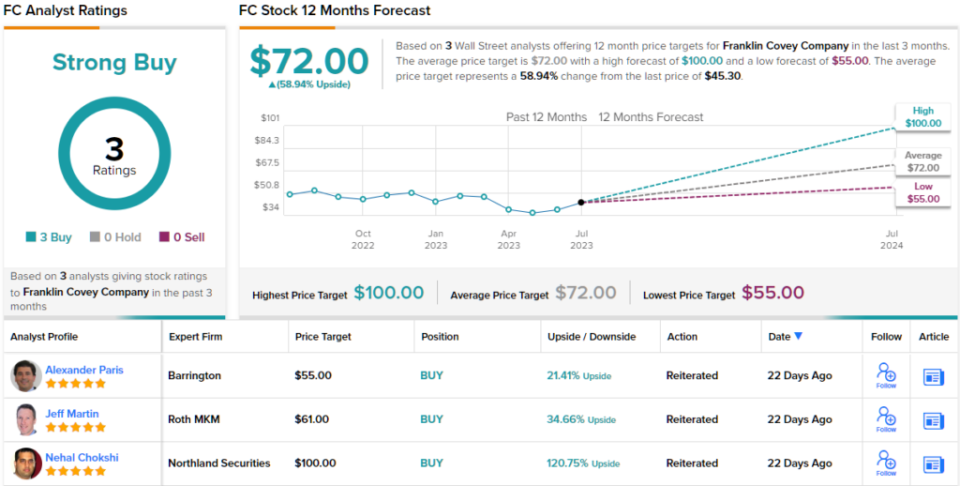

Along with ‘top pick’ status, Chokshi rates FC shares as Outperform (i.e. Buy), with a $100 price target that implies a robust one-year upside potential of ~121%. (To watch Chokshi’s track record, click here)

Like Chokshi, other analysts also take a bullish approach. FC’s Strong Buy consensus rating breaks down into 3 Buys and no Holds or Sells. The stock is selling for $45.30, and its average price target of $72 suggests ~59% gain on the one-year horizon. (See FC stock forecast)

Phreesia, Inc. (PHR)

The second stock on this list of top picks is Phreesia, a software company in the healthcare world. Phreesia offers SaaS application to healthcare organizations, for the automation and maintenance of patient intake – including registration, scheduling, clinical support and follow-up, and payments.

Healthcare is a huge industry, expected to make up $6.8 trillion in US economy just five years from now. This gives Phreesia an enormous field for expansion, and the company is working to fill it with quality services. So far, the results bode well. Some 89% of Phreesia’s clients acknowledge that the company has created visible improvements in their own organizations, while 9 out of 10 clients describe the service as ‘high quality’ and would recommend it to a friend. Phreesia boasts that its services facilitate over 120 million patient healthcare visits per year.

Phreesia ended its fiscal year 2023 this past January 31, and did so with a bang. The company brought in annual revenues for fiscal ’23 of $280.9 million, a 32% year-over-year gain. Phreesia posted this strong gain even as its annual revenue per healthcare services client fell 6% y/y, to $72,599. The company’s average number of healthcare services clients during the year, however, grew by 38% from the prior year, to 2,856.

Getting into fiscal 2024, Phreesia continues to show strong performances. The fiscal Q1 results, released this past May, showed a top line of $83.8 million, for another 32% y/y increase and coming in $2.63 million above expectations. The quarterly average number of healthcare services clients reached 3,309, increasing by 31% y/y. At the bottom line, Phreesia’s Q1 earnings came to negative $0.70 per share. This was a hefty improvement from the 99-cent loss reported in the prior year quarter, and it beat the estimates by 5 cents.

For investors, this adds up to a strong company growing into an expanding niche. Analyst Jessica Tassan, covering the stock for Piper Sandler, is optimistic about the company’s potential. Tassan includes Phreesia on her ‘top pick’ list and expresses confidence in its future prospects.

“We have confidence that PHR can achieve a $500M revenue run-rate exiting FY25; and believe there may be upside to the company’s FY25 profitability targets. While we think the business is undervalued on a standalone basis, we also see strategic value in PHR potentially being a key acquisition target for large, vertically integrated MCOs whose intentions are to build diversified healthcare banking operations with B2B lending and DTC capabilities,” Tassan opined.

“PHR facilitates $1B+ in quarterly patient payment volume, which confers visibility into all practice collections. As such, MCOs can deliver improved revenue cycle tools; structure and time reimbursement to incentivize appropriate care; and offer competitive working capital bridge loans to providers. We believe such initiatives, with PHR’s innate ability to address staffing challenges, could encourage new providers to join the MCO’s network,” Tassan added.

These comments come with an Overweight (i.e. Buy) rating, and Tassan’s price target, set at $43, points toward an upside of ~37% over the next 12 months. (To watch Tassan’s track record, click here)

Turning to the rest of the Street, the bulls have it on this one. With 8 Buys and 1 Hold assigned in the last three months, the word on the Street is that PHR is a Strong Buy. At $39, the average price target implies 24% upside potential. (See PHR stock forecast)

Afya Limited (AFYA)

Last but not least is Afya, another noteworthy stock in the medical sector. Operating primarily in Latin America, with its headquarters based in Brazil, Afya has established itself as a leading force in the region’s medical education landscape. The company’s primary focus lies in providing a comprehensive “end-to-end physician-centric ecosystem” for medical students and physicians in Brazil. From guiding them through the journey of medical school to supporting their residency programs and continuous medical education, Afya collaborates closely with doctors to ensure they remain at the forefront of medical knowledge throughout their practice.

In addition, Afya offers several medical-service-oriented apps that medical professionals and students alike can use, to reach relevant medical content and to find clinical support for medical decisions. The key here, as with Afya’s whole approach, is to put knowledge at the practitioner’s fingertips. The company has seen strong demand for its services, especially post-COVID.

In the recently reported 1Q23, Afya showed a solid 25% year-over-year increase in total revenue, to R709.4 million, or US$147.8 million at current exchange rates. The company’s revenue beat the forecasts by approximately US$7.8 million. Afya’s earnings also came in better than expected. The non-GAAP adjusted EPS was listed at R$1.77, or 36 cents in US currency, and was 4 US cents above the forecast. Afya had a cash position at the end of Q1 of R$722.7 million. The company’s strong results were set on a customer base of ~295,000 monthly active users, physicians and med students using Afya digital services.

Valuation and business model form the basis for JPMorgan’s Marcelo Santos’ choice of Afya for top pick status.

“Afya is the higher education company where we see most upside today, trading roughly in-line with its peers at 5.6x EV/EBITDA (vs. 5.7-6x range), while having a superior business based on medicine which offers much more visibility and an attractive FCF profile. Moreover, we believe the announcement of a new Mais Medicos program is a key overhang, which we expect to be over in August and should remove pressure from the stock… We reiterate Afya as our top pick in education,” Santos wrote.

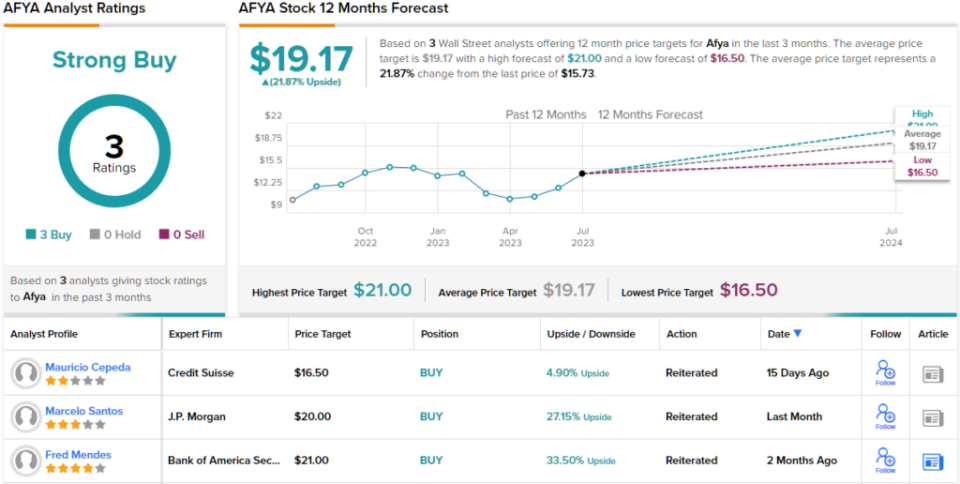

Looking ahead from here, Santos rates AFYA shares as Overweight (i.e. Buy), and gives them a US$20 price target that suggests AFYA will gain 28% on the one-year time frame. (To watch Santos’ track record, click here)

Overall, there are 3 recent analyst reviews on this stock, and all are positive – giving AFYA a unanimous Strong Buy consensus rating. Shares are priced at $15.73 and the $19.17 average target suggests ~22% upside on the one-year timeline. (See AFYA stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.