Asda has begun rationing items of fruit and vegetables after a poor harvest in Spain and north Africa left gaps on supermarket shelves.

Britain’s third largest supermarket is limiting customers to a maximum of three items each across tomatoes, peppers, cucumbers, lettuce, salad bags, broccoli, cauliflower, and raspberries.

Poor yields from harvests on the continent and North Africa have hit supplies, which bosses hope will improve in coming days/weeks.

An Asda spokesman said: “Like other supermarkets, we are experiencing sourcing challenges on some products that are grown in southern Spain and north Africa.

“We have introduced a temporary limit of three of each product on a very small number of fruit and vegetable lines, so customers can pick up the products they are looking for.”

Supermarket shelves have been left bare after a weak crop in key markets and the imposition of tighter restrictions on exports by Morocco.

Andrew Opie, director of food and sustainability at the British Retail Consortium, said: “Difficult weather conditions in the south of Europe and northern Africa have disrupted harvest for some fruit and vegetables, including tomatoes.”

Read the latest updates below.

01:40 PM

Asda’s shelves left empty by poor harvests

Shoppers across the country have been posting pictures on social media of empty shelves in the vegetable aisles, caused by the poor harvests in Spain and Morocco.

01:34 PM

Russia sends record amounts of oil to China

Russian exports of discounted crude and fuel oil to China jumped to record levels last month as Vladimir Putin tried to circumvent Western sanctions against Moscow.

Flows of oil from the Kremlin were at their highest level than at any point since the invasion of Ukraine a year ago.

It surpassed a record set in April 2020, according to data intelligence firm Kpler.

China is toe-to-toe with India as the biggest buyer of Russian crude after the war in Ukraine reshaped the pattern of global energy deals.

Moscow has had to offer discounts to entice a shrinking pool of customers, a move welcomed by Asian buyers trying to control inflation.

Russia’s overall crude and fuel oil exports to China reached 1.66m barrels a day last month, according to Kpler data as of February 20.

The uptick in Chinese buying is evidence the country’s economic recovery is picking up after ending its zero-Covid restrictions last year, which should help to lift global oil prices as demand increases.

Last week, Russia announced it would cut production by 500,000 barrels a day from next month amid a cap on prices imposed by the EU and the G7.

01:25 PM

Newcastle and Manchester Building Societies step closer to merger

Newcastle Building Society and under-pressure smaller rival Manchester Building Society have been given approval by the industry watchdog to bypass a member vote over their plans to merge.

Newcastle – the UK’s eighth biggest building society – and Manchester have now agreed the terms of a deal after entering into exclusive talks last August over a tie-up.

But the pair said they had put in a formal request with the Prudential Regulation Authority (PRA) to forgo a member vote in order to speed up the deal, given the “risks and the financial uncertainties facing Manchester”.

The PRA has since granted the request, allowing the two mutuals to join forces by way of a board resolution, without the need to put it before their members “in order to protect the investments of shareholders or depositors”, according to the lenders.

It comes as Manchester is facing strain on its balance sheet, despite having taken action to lower its risks, such as stopping new mortgage lending in 2013.

01:00 PM

US markets expected to fall at opening bell

Wall Street is expected to open lower as disappointing results from Home Depot added to fears that interest rates will remain higher for longer.

The No 1 US home improvement chain dropped 3.8pc in premarket trading after its fourth-quarter comparable sales fell short of estimates on higher supply-chain costs and weak demand due to inflation.

Dow Jones Industrial Average futures were down 0.8p while the S&P 500 is poised to begin the day off 0.8pc. Nasdaq 100 contracts were down 0.9pc.

Recent economic data points to a resilient economy with inflation far from the Fed’s 2pc target, raising bets for two or three more 25 basis point hikes and lower chances of rate cuts at year-end.

12:47 PM

Credit Suisse shares hit record low amid investigation

Credit Suisse shares fell to an intraday record low after a report that the chairman is facing an investigation over comments last year amid huge client withdrawals.

Swiss financial markets regulator Finma is seeking to establish whether the comments from bank representatives including chairman Axel Lehmann were misleading, according to a Reuters report.

In a Bloomberg TV interview in early December, Mr Lehmann had said that outflows had “basically stopped” after it had disclosed the loss of 84bn Swiss francs (£75bn) of client assets in November.

By the end of the quarter, that figure had risen to 110.5bn francs (£98.7bn).

The remarks were made before the close of a crucial $4bn (£3.3bn) capital raise and helped arrest a sharp decline in the share price.

While total quarterly withdrawals exceeded Credit Suisse’s initial disclosure, their exact timing after November is unclear.

The stock slid as much as 9pc to 2.58 francs. The shares have declined about 6.5pc this year.

Finma and Credit Suisse declined to comment on the report.

12:34 PM

Economy still faces ‘uncertainty and volatility’, insists No 10

Uncertainty and volatility remain risks to Britain’s fiscal position, the Prime Minister’s spokesman has said, after data showed the Government ran an unexpected budget surplus in January.

Asked whether the surplus meant the country could expect tax cuts at next month’s budget, the spokesman said it was usual to see a surplus in January. He said:

We shouldn’t place too much emphasis on a single month’s data.

Borrowing remains at record highs and there is significant uncertainty and volatility, both clear risks to the fiscal position.

12:21 PM

Microsoft and Nintendo sign 10-year contract for Call of Duty

Microsoft and Nintendo have formalised their agreement to bring Call of Duty to Nintendo platforms for a decade in a move designed to allay fears about the blockbuster game becoming an Xbox exclusive.

The two companies have “negotiated and signed a binding 10-year legal agreement” that will see Call of Duty released to Nintendo players the same day and with the same features as its Xbox version, Microsoft president Brad Smith tweeted.

The Washington-based company committed to do so in December, contingent upon its proposed $69bn (£57bn) acquisition of Call of Duty maker Activision Blizzard going through.

Microsoft headed into a showdown with European Union competition watchdogs by insisting its takeover will “bring more competition” for gamers but pledging to show willingness to address concerns.

Mr Smith told reporters ahead a closed-door hearing in Brussels: “We’re more than willing, given our strategy, to address the concerns that others have, whether it’s by contracts, like we did with Nintendo this morning, or whether it’s by regulatory undertakings, as we’ve consistently been open to addressing.”

11:59 AM

Holiday Inn owner’s shares slump amid weak China demand

Sales and profits have rebounded at Holiday Inn owner InterContinental Hotels Group (IHG) amid an increase in travel following the easing of pandemic restrictions.

Nevertheless, IHG saw its shares fall as much as 2.9pc amid continued weak demand in China where zero-Covid measures continued to have an impact on operations last year.

Keith Barr, chief executive officer of IHG, said that the group “saw demand return strongly in most of our markets”.

The London-listed group revealed that overall revenues grew by 34pc to $3.9bn (£3.2bn) in 2022, compared with the previous year.

As a result, operating profits increased by 27pc year-on-year to $628m (£523m).

IHG, which runs 6,164 hotels, was lifted by returning demand in Europe, the Middle East and Africa, where sales jumped by 82.2pc.

However, its share have fallen 1.1pc after a slow recovery in the Chinese market, where the business saw a 25pc slump while restrictions remained in place.

11:42 AM

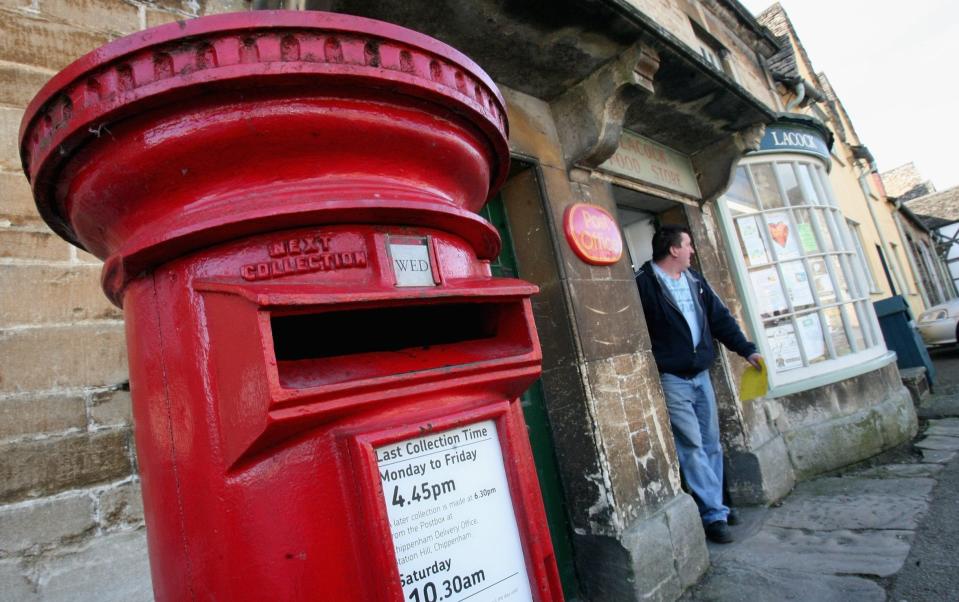

Post Offices can finally send international parcels again

All Royal Mail international services have finally been reinstated at Post Offices following last month’s cyber attack.

The incident on January 11 meant Post Offices were unable to handle international mail or parcels at its 11,500 branches, although domestic services were unaffected.

Post Office managing director of parcels and mails Neill O’Sullivan said:

Postmasters have been the innocent victims of this faceless crime, unable to support businesses and consumers wishing to use their expertise to get parcels sent abroad.

For many small businesses, Post Offices are an integral part of their business set-up and this has been a challenging time for them too.

We have worked day and night in partnership with Royal Mail to reinstate all international services via our branch network.

Post Office will be “providing additional remuneration” to postmasters for handling international items, with a new fixed payment worth 85p per item and 3pc extra commission for international labels sold in branch.

11:32 AM

Brent crude edges higher after earlier swings

Oil has edged higher after plunging earlier as investors weighed the prospect for further US monetary tightening against signs of improving demand from China.

Brent futures retreated below $84 a barrel but are now above the mark again after closing 1.3pc higher on Monday.

Meanwhile, US-produced West Texas Intermediate has risen 1.4pc today above $77 a barrel.

Prices have bounced within a relatively tight range this year, and a measure of volatility remains near the lowest level in 13 months.

Market watchers continue to weigh concerns that more Federal Reserve interest-rate hikes will sap demand, against expectations that China’s reopening will drive an increase in commodity buying.

The world’s largest importer has been buying more oil from Russia and snapping up ships for cargoes from the US as it ramps up imports.

11:26 AM

Carbon permit costs hit €100 per tonne

The price of permits in the European Union’s carbon market has hit €100 (£88) per tonne for the first time, a milestone that reflects the increased costs that factories and power plants must pay when they pollute.

The benchmark EU Allowance (EUA) contract rose to a high of €100.70 per tonne.

EUAs are the main currency used in the EU’s Emissions Trading System (ETS) which forces manufacturers, power companies and airlines to pay for each tonne of carbon dioxide they emit.

It forms part of the bloc’s efforts to meet its climate targets.

11:13 AM

Union’s strike threat after Treasury’s January surplus

A union boss has issued a warning to the Government after the Office for National Statistics said there was a public sector net borrowing surplus of £5.4bn in January.

Public and Commercial Services union general secretary Mark Serwotka said:

The Government says it cannot afford to give our hard-working members a pay rise, but this morning’s news there is a surplus of £5.4bn changes that narrative.

Ministers have no excuse for not putting some money on the table. If they don’t, our strikes will continue to escalate.

11:01 AM

Farming grants of £168m to ‘invest in new technology’

More than £168m in grants are to be made available to farmers this year, farming minister Mark Spencer has announced.

Money will be available to boost food production, pay for equipment and automation, and fund smaller abattoirs.

Speaking at the National Farmers’ Union (NFU) conference in Birmingham, Mr Spencer said the money will come from the farming innovation programme and the farming investment fund.

It will sit alongside the environmental land management schemes (ELMs), which pay farmers for improving biodiversity on their land.

ELMs have taken five years to draw up and are the replacement for the EU common agricultural policy.

Farmers can be paid for planting hedgerows and maintaining wildflower meadows and peatland. Mr Spencer said:

The role farmers play in putting food on our tables as well as looking after our countryside is crucial. We know that sustainable food production depends on a healthy environment, the two go hand in hand.

Helping farms invest in new technology as well as bringing in nature-friendly schemes will support the future of farming.

10:50 AM

Russia to only cut oil output for March, deputy PM says

A 500,000 barrel-per-day cut to Russian oil production announced this month will apply only to March output for now, deputy prime minister Alexander Novak has reportedly said.

It comes as the US deputy Treasury secretary Wally Adeyemo said America and its allies will impose new sanctions this week to crack down on Russia’s efforts to evade the measures and export controls aimed at forcing Moscow to end its war in Ukraine.

The Russian TASS news agency reported that Mr Novak said: “We will watch how the situation on the market develops, and decisions… will be made from this. Now, the decision is for March.”

The cut will be made from January output levels, Mr Novak added.

He has said production stood at 9.8m-9.9m barrels per day last month.

Moscow’s efforts to sell its oil globally have been complicated by an EU ban on purchases of Russian oil products from February 5 and price caps on oil.

Russia’s decision to cut oil production was announced only nine days after oil cartel Opec+ – of which Russia is a member – agreed to leave production cuts agreed last year in place.

10:40 AM

Russia has ‘all financial resources it needs’ says Putin

Vladimir Putin said on Tuesday that Russia has all the financial resources it needs to guarantee its national security and development despite Western economic sanctions.

In a major speech to Russia’s two houses of parliament, he said Russian firms had rebuilt their supply chains and that Moscow was working with other countries to build new payments systems and financial architecture.

Russia’s $2.1trn economy is forecast by the International Monetary Fund to grow 0.3pc this year, far below China and India’s growth rates but a much better result than was forecast when the war began.

Putin said Russia had been oriented on the West since the 1991 fall of the Soviet Union. He quipped that no ordinary Russians shed tears over the loss of yachts and property in the West by rich Russians.

Russia was turning to major Asian powers and Putin called on businesses to invest in the Russian economy.

10:28 AM

Putin claims Western sanctions have not defeated Russia

Vladimir Putin has said that Western countries had imposed sanctions on Russia to make its people “suffer” but that it had not succeeded in defeating it on the economic front.

In a major speech ahead of the first anniversary of his country’s invasion of Ukraine, Putin said: “They want to make the people suffer… but their calculation did not materialise.

“The Russian economy and the management turned out to be much stronger than they thought.”

Speaking of the areas of Ukraine which have declared independence in sham referenda, Putin said: “We have already begun and will continue to build up a large-scale programme for the socio-economic recovery and development of these new subjects of the Federation (territory annexed from Ukraine).

“We are talking about reviving enterprises and jobs in the ports of the Sea of Azov, which has again become an inland sea of Russia, and building new modern roads, as we did in Crimea.”

10:15 AM

‘We doubt it will last’ says economists as UK private firms rebound

The pound has rallied and the FTSE 100 rebounded from steep falls after stronger than expected data on growth in public sector companies.

But there is nothing like an economist’s projection to bring you back down to earth.

Capital Economics UK economist Ashley Webb said the sharp rebound in the flash UK composite PMI in February “suggests the economy continued to remain resilient to the dual drags from high inflation and high interest rates”.

However, he doubts this will last “as the drag from higher interest rates intensifies, triggering a recession this year”. He said:

Overall, the PMIs suggests that the resilience in economic activity from last year continued at the start of this year.

But given our view that the Bank of England will raise interest rates further, from 4pc now to a peak of 4.5pc, we still expect the economy to slip into recession before long.

09:58 AM

PMI data ‘nothing to celebrate,’ says Lloyds economist

Rhys Herbert, senior economist at Lloyds Bank, said:

The economy seems to have performed better than the PMI data implied over the autumn and winter months.

Many expected the UK to be in recession by now, with the PMI now showing the end of a consistent trend of contraction over seven months.

However, official figures suggest that so far least we’ve narrowly avoided recession.

Even that economic picture is nothing to celebrate, particularly as there is little reason to expect a drastic improvement anytime soon.

However, the ongoing slowdown in inflation may be enough of catalyst for growth to continue to keep us out of recession territory.

09:55 AM

Pound rallies amid private sector recovery

The pound has bounced after the stronger than expected data showing growth in the UK’s private sector recovered to an eight-month high, confounding analyst expectations.

The S&P Global/CIPS flash UK purchasing managers’ index soared from 48.5 in January to 53 in February, according to the survey, which is based on preliminary data.

It is the first time in six months that the index has shown growth – anything above 50 is considered to be growth in the sector.

The pound has risen 0.6pc following the release of the data to be worth more than $1.21.

09:43 AM

Economic output unexpectedly grows in UK, data show

The UK economy performed better than expected this month according to a closely-watched gauge of market activity.

The S&P Global flash purchasing managers’ index PMI rose to 53 from 48.5 in January, its highest reading since June last year.

A reading above 50 indicates growth in activity, while below means there has been a contraction.

New orders rose to 53.1, after coming in at 49 in January.

Services rose to 53.3, well ahead of forecasts of a contraction at 49.2. Manufacturing also surpassed expectations, measuring at 49.2, better than the 47.5 estimated by analysts.

09:16 AM

Eurozone recovery gathers pace, figures show

Europe’s economic recovery accelerated this month, a key economic gauge if output has indicated.

The S&P Global flash PMI for the eurozone reached a nine-month high of 52.3 in February, up from 50.3 in January.

Services PMI rose to 53, up from 51 in January. A figure above 50 indicates growth.

However, manufacturing suffered a steeper than expected hit, falling to 48.5, worse than estimates of 49.3.

09:01 AM

HSBC drags down FTSE 100

The exporter-heavy FTSE 100 has fallen 0.7pc, dragged lower by HSBC after the London-headquartered bank dampened investors’ expectations of a sustained income bonanza from rising interest rates worldwide.

HSBC dropped 1.5pc despite a surge in its quarterly profit as Europe’s biggest bank said it expects net interest income to be at least $36bn (£30bn) in 2023, falling short of forecasts of $37bn.

The decline in HSBC shares dragged the banking index down nearly 1pc.

Shares of Holiday Inn-owner InterContinental Hotels Group fell as much as 2.2pc even as it reported a higher full-year profit.

Investor focus will also be on initial estimates for the S&P Purchasing Managers’ Index (PMI) due at 9.30am, which are expected to show a modest improvement in British economic activity in February from the previous month.

The domestically focussed FTSE 250 midcap index was also down 0.6pc.

08:50 AM

Tighter Budget ‘probably still on its way’, say economists

Record tax revenues from workers and capital gains taxes may have helped to offset massive spending on energy bill support and soaring debt interest payments, but do not expect a Budget bonanza from Jeremy Hunt.

Total receipts were £107.8bn, well above the £103.1bn the OBR forecast, as self-assessed income tax receipts of £21.9bn recorded their highest January figure since records began in April 1999.

However, Capital Economics deputy chief UK economist Ruth Gregory said:

With the OBR poised to slash its medium-term GDP growth forecasts, any hopes he might be able to give away a significant amount of money, while sticking to his previous debt-reduction plans, may be disappointed.

Less costly energy price subsidies and stronger income tax receipts were the main sources of January’s borrowing undershoot.

As such, the figures paint a far more upbeat picture of the economy than the recent survey data.

Overall, it’s likely that the Chancellor will have some wiggle-room in the Budget to fund near-term tax cuts and/or spending rises.

But probable downgrades to the OBR’s assumptions about the economy’s potential to grow could yet reduce the Chancellor’s £9.2bn (0.3% of GDP) headroom against his fiscal mandate for 2027/28 and limit his ability to significantly scale back the planned fiscal squeeze.

08:36 AM

‘Impact of climate change really hit home’, says NFU president

Here is some more of Minette Batters’ speech which she is due to deliver at the launch of the NFU annual conference later:

Labour shortages and soaring energy prices are hitting the poultry industry, already reeling from avian influenza, as well as horticultural businesses and pig farms.

Meanwhile, other sectors are facing an uncertain future as direct payments are phased out against a backdrop of huge cost inflation, with agricultural inputs having risen almost 50pc since 2019.

And the impact of this? UK egg production has fallen to its lowest level in nine years. In 2022, UK egg packers packed almost a billion fewer eggs than they did in 2019.

This was also the year that the potential impact of climate change really hit home. The extraordinary temperatures we experienced in July topped the previous record by almost a degree and a half.

While many parts of the country have experienced huge amounts of rainfall recently, impacting farming operations over autumn and winter, some counties still remain in official drought status.

Despite all this, NFU members and the farmers and growers of Britain continued to bring in the harvest, to produce the nation’s food and to keep the country fed through tough times.

08:31 AM

Inheritance tax receipts on target for annual record

The Government is on target to break its annual inheritance tax record as receipts for January 2023 totalled £578m, up from £443m in the same month a year ago.

It takes the total inheritance tax take for the 2022-23 financial year so far to £5.9bn, £853m higher than through the same period last year.

It means the Treasury is only £178m short of its record £6.1bn inheritance tax receipts for the prior year, with two months to go.

Stephen Lowe, group communications director at retirement specialist Just Group, said:

The Chancellor has struck a seam of gold with recent inheritance tax receipts as he looks set to receive another record haul this financial year – and with more to come.

Receipts are likely to race past official predictions for the next few years.

The combination of frozen thresholds and property prices that have soared over the years mean that receipts could continue to grow over the coming years.

While it’s good news for the Treasury there will be many people for whom an inheritance tax bill will be a nasty shock.

08:18 AM

Improved economic outlook easing pressure on Government, says PwC

The Treasury’s net borrowing was in surplus by £5.4bn in January, which was £5bn higher than the Office for Budget Responsibility (OBR) expected.

Jake Finney, economist at PwC UK, said the latest public sector finances data from the Office for National Statistics showed the “improved economic outlook” is easing pressure on the Government. He said:

Tax receipts picked up in January, as workers and companies settled their tax bills. However, this was partially offset by large spending on energy bills support and one-off payments to the EU relating to historic custom duties.

Debt interest payments reached £6.7bn in January, the highest January figure since monthly records began 26 years ago.

This reflects the fiscal consequences of higher RPI inflation and higher interest rates. Higher debt servicing costs as a share of total revenues will leave the public finances more exposed to future economic shocks.

In the coming months, falls to natural gas futures prices should start to gradually bring down the cost of the Energy Price Guarantee scheme. However, we expect this will be partially offset by reduced tax receipts due to lower than expected inflation.

08:14 AM

Clock ticking to secure Britain’s food supply, warn farmers

Surging prices mean “the clock is ticking” for Britain’s food supplies, farmers have warned.

The National Farmers’ Union (NFU) will launch its annual conference later with a message from president Minette Batters saying “volatility, uncertainty and instability are the greatest risks to farm businesses in England and Wales today”.

She will also raise concerns about “labour shortages and soaring energy prices” hitting farmers, pointing out that UK egg production has fallen to its lowest level in nine years.

Ms Batters will tell the conference’s 1,500 delegates: “More often than not – it has been incredibly hard getting government to back up its rhetoric with concrete actions.

“The time is nearly up for government to demonstrate its commitment to food and farming in our great country, not just by saying they support us, but by showing us they do.

“I won’t let the opposition off the hook either, I believe the rural vote will be crucial in the next election.”

Here is some more of what Ms Batters will say as she launches the organisation’s annual conference today:

There are three key lessons we can take from this extraordinary year.

As the global population continues to rise, and parts of the planet become less suited to producing the food we eat, we have an opportunity, and a duty, to get the best out of our maritime climate.

Secondly, in the face of climate change, we should be unwavering in our commitment to achieving net zero and contributing to our energy security through on-farm renewables generation.

And thirdly, we should never take our food security for granted.

But the fact remains, volatility, uncertainty and instability are the greatest risks to farm businesses in England and Wales today.

Critically, those consequences will be felt far beyond farming, they will be felt across the natural environment, and in struggling households across the country.

08:11 AM

Markets fall as Government surplus narrows

The markets do not appear to be reassured by the record tax income for the Government in January.

The Treasury managed a surplus of £5.4bn, ahead of expectations of a deficit, but still well below the surplus of £12.5bn in the same month a year earlier.

The FTSE 100 was down 0.2pc to 7,995.62 points in early trading while the FTSE 250 has dropped 0.2pc to 20,067.88.

07:35 AM

Record tax revenues save Chancellor from bigger headache

Record tax revenues from workers and capital gains taxes helped to offset massive spending on energy bill support and soaring debt interest payments, official figures show.

Economics editor Szu Ping Chan has the latest:

In the final set of public borrowing figures before Jeremy Hunt delivers his Spring Budget, the Office for National Statistics (ONS) said the government received £5.4bn more in taxes in January than it spent on public services.

This is much higher than the £8bn deficit forecast by economists and £5bn larger than forecast by the Office for Budget Responsibility (OBR), the government’s tax and spending watchdog.

January is traditionally a month where the Treasury receives more than it spends as businesses and workers, including the self-employed pay their tax bills.

The ONS said self-assessed income tax receipts were £21.9bn in January. This is the highest monthly figure since records began in 1999 and a third higher than receipts received a year ago.

Capital gains taxes, which are paid on the profits of disposed assets such as buy-to-let properties if they have increased in value, stood at £13.2bn, another record high.

07:30 AM

Hunt: ‘We’re rightly spending billions’

Chancellor of the Exchequer, Jeremy Hunt, said:

We are rightly spending billions now to support households and businesses with the impacts of rising prices – but with debt at the highest level since the 1960s, it is vital we stick to our plan to reduce debt over the medium-term.

Getting debt down will require some tough choices, but it is crucial to reduce the amount spent on debt interest so we can protect our public services.

07:27 AM

HSBC profits slip after Covid impact

Banking giant HSBC has announced a dip in 2022 pre-tax profits last year, calling the ongoing impact of Covid-19 the main factor in its financial performance.

The Asia-focused lender said it made $17.5bn (£14.6bn) before tax, down more than seven percent on-year, while reported revenue increased four percent to $51.7bn (£43.1bn).

In a statement to the Hong Kong stock exchange, HSBC detailed the tough global economic climate international banks are facing.

It cited renewed virus outbreaks in Hong Kong and mainland China as denting last year’s economic growth.

It added that global uncertainty sparked by Russia’s invasion of Ukraine, elevated inflation and rising interest rates contributed to a difficult financial environment that it expects will spill into 2023’s earnings and even eclipse the toll of the pandemic.

“We are already seeing… a cost of living crisis affecting many of our customers and colleagues,” Mark Tucker, the group’s chairman said in a statement.

However, after-tax profits rose $2bn to $16.7bn (£13.9bn), while fourth-quarter pre-tax profit nearly doubled from $2.5bn to $5.2bn (£4.3bn).

07:20 AM

Record tax revenues offset Government energy support spending, says ONS

Record tax revenues from workers and capital gains taxes helped to offset massive spending on energy bill support and soaring debt interest payments, official figures show, writes economics editor Szu Ping Chan.

In the final set of public borrowing figures before Jeremy Hunt delivers his Spring Budget, the Office for National Statistics (ONS) said the government received £5.4bn more in taxes in January than it spent on public services.

This is much higher than a £8bn deficit forecast by economists and £5bn larger than forecast by the Office for Budget Responsibility (OBR), the government’s fiscal watchdog.

07:17 AM

Budget surplus narrows as debt interest costs surge

The budget surplus narrowed sharply in the biggest tax month of the year for the Government as rising debt costs hit the public finances.

January normally delivers a large surplus for the Treasury as income tax payments are due.

However, the £5.4bn that the Government received – taking in more in tax revenue than it spent – was well below the £12.5bn surplus recorded in January last year.

Debt interest was £6.7bn, according to the data from the Office for National Statistics, which was the highest January figure since monthly records began in April 1997.

07:07 AM

Good morning

Public sector borrowing figures have given the Chancellor a boost as he prepares to deliver his Budget next month.

The Government managed a surplus of £5.4bn in January, well ahead of economists’ expectations of a £7.9bn deficit.

However, the surplus was £7.1bn smaller than at the same time a year ago.

5 things to start your day

1) Bank of England pours cold water on ‘Big Bang 2.0’ | Post-Brexit overhaul of rules for the insurance industry were too complex to introduce in one go, says senior policymaker

2) £800 plunge in energy bills to hand Hunt £11bn Budget boost | Drop comes as gas prices fall to their lowest level in 18 months

3) Four-day week makes companies more profitable, study claims | Cambridge study finds adopting the new working pattern increases revenue by more than a third

4) Jaguar Land Rover launches hiring spree in latest push to develop driverless cars | Company seeking to vacuum up laid-off tech workers

5) China is mounting an economic assault on Gen Z – and it will end in disaster | The ramifications of this apparel giant’s massive land grab are likely to be far-reaching

What happened overnight

Asian shares were mostly lower in quiet trading after US markets were closed for Presidents Day.

Shares dropped in Tokyo, Sydney and Hong Kong but rose slightly in Seoul and Shanghai.

Analysts say worries about weakening demand persist in Asia, as companies cope with rising energy and raw material costs and consumers hold back on spending.

In Japan, a preliminary manufacturing indicator, the flash purchasing manager’s index, fell to 47.4 in February from 48.9 the month before. That was the weakest reading in more than two years.

Stocks in Tokyo closed lower, with the benchmark Nikkei 225 index losing 0.2pc to 27,473.10, while the broader Topix index fell 0.1pc to 1,997.46.

The latest data from Australia, called the Judo Bank PMI, showed private sector activity remained in contraction for the fifth straight month.

Australia’s S&P/ASX 200 slipped 0.2pc to 7,336.30. South Korea’s Kospi gained nearly 0.2pc to 2,458.72. Hong Kong’s Hang Seng dipped 1.6pc to 20,561.77, while the Shanghai Composite gained 0.1pc to 3,294.37.

In the currency markets, the dollar was flat, after a three week rally. Treasury futures, which did trade Monday, fell slightly.