President Joe Biden claimed Friday that American banks were “in pretty good shape” and that depositors’ funds were “secure” despite the collapses of two major regional banks in March and growing concerns of a widespread banking crisis.

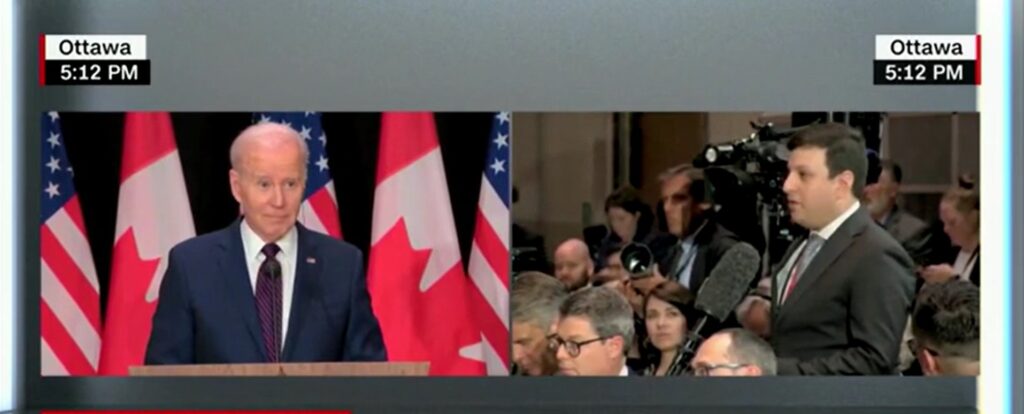

“Look, I think we’ve done a pretty damn good job,” Biden said during a joint press conference with Canadian Prime Minister Justin Trudeau when asked about frustration on Wall Street over uncertainty about whether the Biden administration had “contained” the banking crisis. “People’s savings are secure, and even those beyond the $250,000, the FDIC has guaranteed them, and American taxpayers are not going to have to pay a penny. The banks are in pretty good shape.” (RELATED: ‘We’ve Got Some Cleanup To Do’: Former FDIC Chair Says There Will ‘Probably’ Be More Bank Failures)

Biden also noted that this wasn’t the first time Wall Street had been in “consternation.”

Federal regulators shut down Silicon Valley Bank (SVB) March 10 after its stock price collapsed and customers began a bank run following the financial institution’s disclosure of a $1.8 billion loss on asset sales due to high interest rates, CNBC reported. Depositors who had accounts at SVB and Signature Bank, which was shut down by regulators March 12, will be able to fully recover their funds, the FDIC announced in conjunction with the Treasury Department and the Federal Reserve.

WATCH:

Treasury Secretary Janet Yellen told lawmakers Wednesday that the Biden administration was not offering “blanket insurance” for bank deposits.

The banks collapsed due to increasing inflation, according to some observers, like businessman Andrew Yang, who noted that Silicon Valley Bank had invested heavily in Treasury bonds while interest rates were low. As the Federal Reserve hiked interest rates, the bank lost money leading to financial advisors suggesting businesses withdraw their funds, according to Bloomberg.

The turmoil that riled American banks has also spread to European financial institutions.

Credit Suisse shares collapsed March 14, when the bank reported “material weakness” in its financial reporting, leading to an eventual purchase for $2 billion by banking giant UBS. Shares of Deutsche Bank dropped by 14.5% Friday as that bank faced concerns of defaulting on its bonds.

“What’s going on in Europe isn’t a direct consequence of what’s happening in the United States,” Biden said. “I don’t see anything on the horizon that’s about to explode.”

All content created by the Daily Caller News Foundation, an independent and nonpartisan newswire service, is available without charge to any legitimate news publisher that can provide a large audience. All republished articles must include our logo, our reporter’s byline and their DCNF affiliation. For any questions about our guidelines or partnering with us, please contact licensing@dailycallernewsfoundation.org.