April 25 (Reuters) – Biogen Inc (BIIB.O) said on Tuesday it will pause or discontinue at least four studies of experimental drugs to focus on more potentially lucrative options including its second Alzheimer’s treatment, Leqembi, in the latest attempt by the new CEO to trim costs.

“We made good progress on the previous program that it amounts $1 billion of cost savings,” Chief Executive Christopher Viehbacker said on a conference call to discuss the company’s first-quarter earnings, adding that Tuesday’s announcement was part of a new cost-saving effort.

The U.S. biotech company said it will terminate two studies of an experimental neurological drug, and will also put on hold or scrap at least two more studies.

The company said it will provide more details on its cost-cutting efforts when it reports second-quarter results, but added that it expects the program to modestly trim 2023 expenses and have a more meaningful impact in 2024.

Biogen also reaffirmed its full-year adjusted profit forecast of $15 to $16 per share. Its shares were down more than 3%.

“For Biogen, the narrative has been less on how much they can save their declining business and it’s more on where the future prospects of the company are coming from,” said William Blair analyst Myles Minter.

Biogen is preparing to increase marketing efforts for Leqembi as it awaits full U.S. approval in July after the drug initially received an accelerated approval, and for its experimental depression treatment zuranolone facing an FDA decision in August.

Biogen recorded $18.9 million in expenses related to Leqembi’s launch as negative revenue. “There was revenue during the quarter. It was minimal,” said Chief Financial Officer Michael McDonnell.

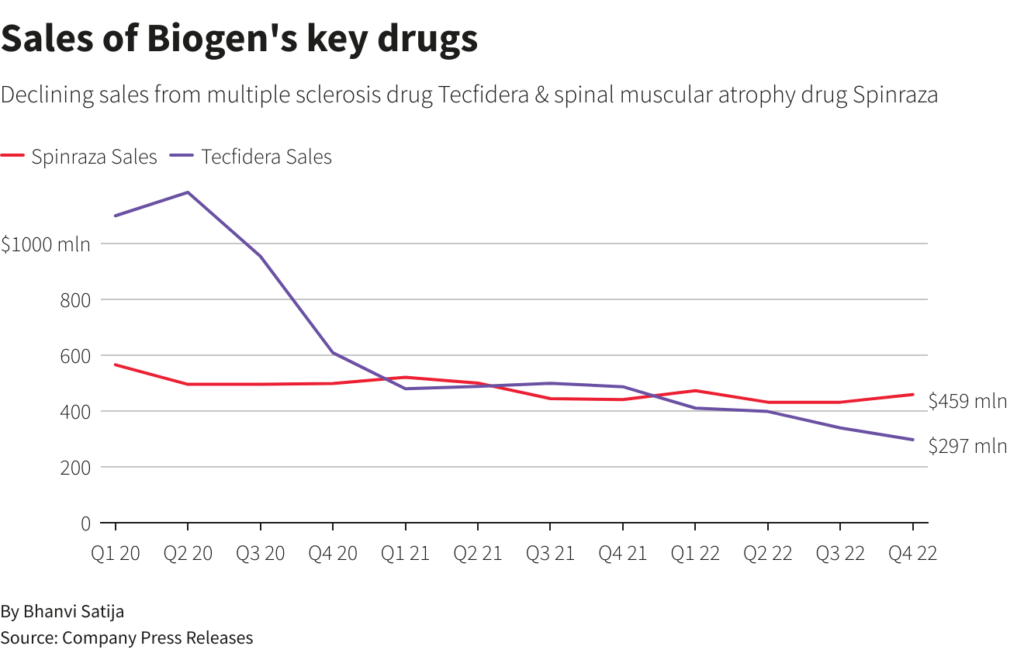

The company expects overall sales to decline by mid-single digit percentages in 2023 as top-selling drugs Tecfidera for multiple sclerosis and Spinraza for spinal muscular atrophy face fierce competition from rivals and generic versions.

“In the next couple of years, that’s where we’re in this – the tide going out on MS and the tide coming in on new products,” Viehbacker said, adding that the company would consider smaller acquisitions that would be “revenue-generating in the near term.”

One new product was approved by the U.S. Food and Drug Administration on Tuesday. The agency gave the green light to Qalsody for an inherited form of amyotrophic lateral sclerosis (ALS) under its accelerated approval pathway that allows for speedy access to treatments that target serious and life-threatening conditions with few other options.

Biogen beat first-quarter profit estimates by 12 cents a share, according to Refinitiv data.

Reporting by Bhanvi Satija and Sriparna Roy in Bengaluru

: .