(Bloomberg) — The highest long-term Treasury yields in years are headed for a major hearing next week as investors place their bids for two risky auctions — right before the Federal Reserve’s potentially game-changing annual gathering at Jackson Hole.

Most Read from Bloomberg

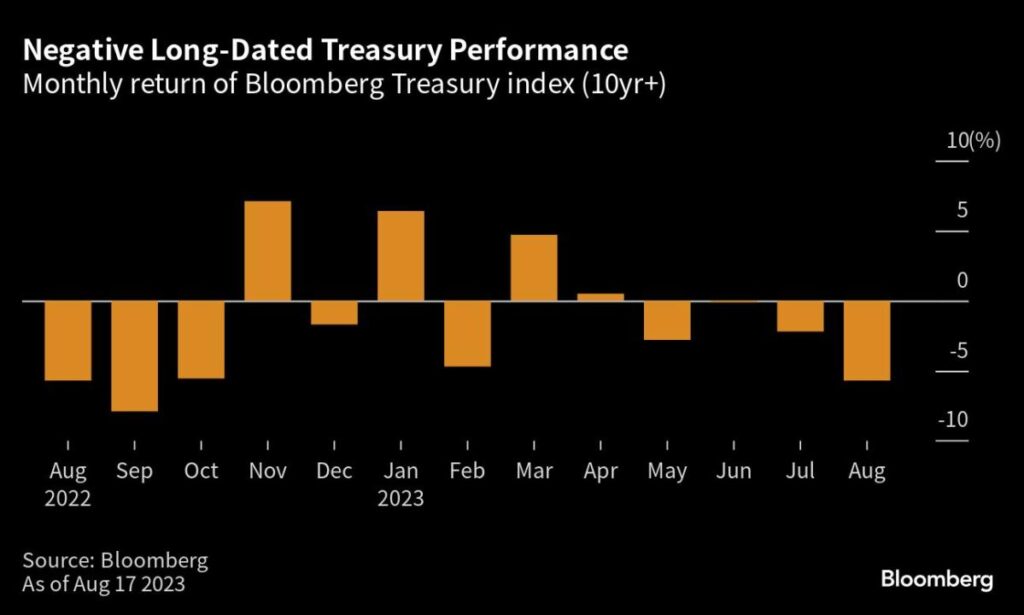

A relentless Treasury-market selloff this month wiped out what was left of year-to-date gains that at one point exceeded 4%. Next week, the US Treasury will sell 20-year bonds and 30-year inflation-protected bonds, demand for which is notoriously unpredictable. If investors shy away, even higher yields will be needed to lure them back.

For most of the past two years, Treasury yields were led higher by short-dated tenors in anticipation of Fed interest-rate increases that have totaled more than five percentage points. Over the past month, though, long-maturity yields have taken the baton as focus has shifted to the labor market’s refusal to buckle, a still-elevated inflation rate, and an expanding supply of new Treasuries sold to close a growing federal budget deficit.

“No one wants to step in front of the issuance freight train, especially in the long end at the moment,” said George Catrambone, head of fixed income, DWS Americas. “There aren’t great reasons to front-run a hawkish Fed, additional supply and very resilient US economic data prints.”

The pain is registering acutely for bondholders, with a Bloomberg index comprised of Treasuries maturing in 10 years and more slumping 5.7% so far in August, on course for its worst month since September.

Read More: BofA’s Warning of a ‘5% World’ Sinks In as Bond Yields Surge (1)

The coming week’s auctions are particularly worrisome because 20-year bonds and 30-year TIPS have smaller investor bases than other Treasury products, so demand will be closely followed for any hint the current rout is nearing an end, or perhaps has further room to run.

To be sure, some people have a soft spot for the 20-year, in part because it has long stood out as being the highest-yielding Treasury benchmark and traded above those on both 10- and 30-year bonds.

Read More: Wall Street Falls Hard for Once-Unloved 20-Year Treasury Bonds

A key consideration around the 30-year TIPS sale is whether pension funds and insurance companies bite at a 2%-plus yield not seen since 2011. Some on Wall Street believe this group of investors, long absent from these auctions, may start returning.

Once the dust settles from the debt sales, the last full week of August — in addition to being a popular holiday week with few major economic releases — also features the Fed’s annual confab in Jackson Hole, which occasionally has been used to reshape market expectations for monetary policy.

A hawkish tone from Chair Jerome Powell Friday will likely test a bond market that still retains faith in rate cuts arriving next year. It’s a belief that explains why many fund managers favor owning the five-to-10-year area of the market, according to positioning surveys.

But a tug of war is playing out in the long end, where a surge in so-called real yields, insulated from the effects of inflation, represent the risk-free rate of return investors demand.

Investors want a higher premium for owning long-dated debt amid uncertainties over data that could prompt another Fed rate hike later this year and keep policy well above 5% in 2024. There’s also supply concerns as the Treasury boost sales to fund the fiscal deficit while the Fed withdraws from the market to shrink its balance sheet.

“The question of how much term premium needs to be priced is the big one,” Matthew Raskin, head of US rates strategy at Deutsche Bank, wrote in an email. “Some of the term structure models Fed staff use still have historically low longer-dated term premia, which seems … wrong.”

Read More: When Fed Cuts Rates, It May Still Be Tightening Via QT Program

For Meghan Swiber, director of US rates strategy at Bank of America, the focus is on whether a resilient economy means the Fed’s current long-run policy rate estimate of 2.5% should be adjusted higher.

“At Jackson Hole, there is really going to be two points of focus,” she said. First, “how much if at all they need to adjust the Fed funds rate higher,” and the second is “where do they think these longer run rates ultimately have to be, which the back end of the curve is really struggling with.”

What to Watch

-

Economic calendar:

-

Aug. 22: Philadelphia Fed non-manufacturing, existing home sales; Richmond Fed manufacturing and business conditions

-

Aug. 23: MBA Mortgage Applications; S&P Global US manufacturing, services and composite PMIs; new home sales

-

Aug. 24: Jobless claims; Chicago Fed activity index; durable goods orders; Kansas City Fed manufacturing index

-

Aug. 25: U. of Michigan sentiment survey and inflation expectations survey; Kansas City Fed services activity

-

-

Fed calendar

-

Aug. 22: Richmond Fed President Tom Barkin, Chicago Fed President Austan Goolsbee; Fed Governor Michelle Bowman

-

Aug. 24: Philadelphia Fed President Patrick Harker

-

Aug. 25: Fed’s Harker on Bloomberg TV, Harker interview with Yahoo Finance Live, Fed Chair Jerome Powell speaks at Jackson Hole

-

-

Auction calendar:

-

Aug. 21: 13- and 26-week bills

-

Aug. 22: 42-day cash management bills

-

Aug. 23: 17-week bills; two-year floating rate notes; 20-year bonds

-

Aug. 24: 4- and 8-week bills; 30-year TIPS

-

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.