(Bloomberg) — Bond investors face the crucial decision of just how much risk to take in Treasuries with 10-year yields at the highest in more than a decade and the Federal Reserve signaling it’s almost done raising rates.

Most Read from Bloomberg

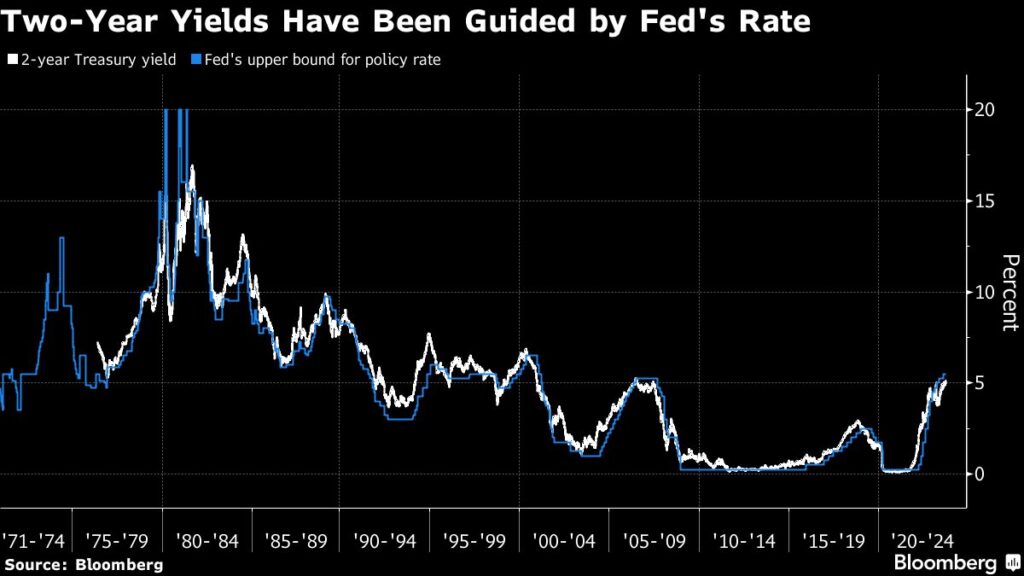

While individuals are piling into cash, for many portfolio managers the debate now is about how far to go in the other direction. Two-year yields above 5% haven’t been this lofty since 2006, while 10-year yields eclipsed 4.5% on Friday for the first time since 2007.

For Ed Al-Hussainy at Columbia Threadneedle, the sweet spot now is in the shorter-dated notes, which would likely perform well in the event the Fed pivots to rate cuts within a couple years. That maturity also avoids the added risk of longer tenors, which have delivered the most pain to bond investors in 2023 as yields surged broadly amid a resilient economy and swelling Treasury issuance.

“Unless you think the Fed’s going to be on hold for two years,” yields above 5% “present pretty good value,” said Al-Hussainy, a global rates strategist. “The longer end is where you get hurt the most.”

To extend further out, he said, “you have to have a stronger view that the labor market is going to crack.” That scenario might lead investors to bet on a recession, spurring a Treasuries rally and fueling outsize gains in longer maturities, a function of their greater sensitivity to changes in interest rates.

With the job market proving robust, that looks unlikely to happen this year, Al-Hussainy said.

“You can be very patient before stretching your neck out to get duration in the Treasury market,” he said.

Tough Week

Yields rose across the curve this week after the Fed kept rates unchanged, while penciling in one more hike this year and indicating it anticipates keeping borrowing costs elevated well into 2024 to tame inflation. It’s an outlook that means even short maturities may not be out of the woods.

What Bloomberg Strategists Say…

“The resounding selloff in front-end Treasuries we have seen in this cycle isn’t done yet, with yields likely to reach the highest in more than two decades should the Federal Reserve follow the path of its latest dot plot.”

– Ven Ram, Markets Live strategist

For the full note, click here

Treasuries are down 1.2% this year through Thursday, and are on track for an unprecedented third straight annual loss, Bloomberg index data show. Intermediate maturities are roughly flat on the year, while longer-dated debt has lost 6.6%.

ING Financial Markets LLC this week said it sees the risk of a further selloff that drives 10-year yields to 5%.

For now, the front end appears to have the most appeal. Since the end of July, US government bond mutual funds and ETFs targeting maturities of four years and less have seen around $10.3 billion of inflows, according to EPFR Global data through Sept. 20. Middle maturities have attracted $3.25 billion, and funds covering beyond six years have lured $5.5 billion.

Bulls’ Case

For some bond bulls, longer maturities are still the place to be, despite the risk of additional losses. This camp has argued all year that rising borrowing costs are bound to derail growth.

Jack McIntyre at Brandywine Global Investment Management said he expects the 4.5% area should hold for the 10-year, given recent weakness in equities and rising oil prices.

“Meaningfully lower equity valuations would go a long way to tightening financial conditions for asset owners, whereas higher energy prices are tightening financial conditions for lower income earners,” said the senior portfolio manager.

He’s overweight duration in emerging markets and Treasuries and is watching for evidence that the economy and inflation pressures will cool further.

It may all be a question of time horizon. For those with lengthier investment mandates, longer-dated Treasuries are at levels that mean “your starting point for future returns is pretty attractive,” said Michael Cudzil, a portfolio manager at Pacific Investment Management Co.

US fiscal deficits and the Fed’s move to shrink its balance sheet complicate that long-term view. It’s a backdrop that’s prompted investors to demand a higher risk premium on longer-dated debt, helping steepen the curve from historically inverted levels.

“We are in this environment where it’s hard to envision we are going to go back to the level of long-term rates we had in the last decade,” said Jay Barry, head of US government-bond strategy at JPMorgan Chase & Co.

The upshot, he said, is “a steeper yield curve with long-term rates that just remain elevated even if the market finally gets comfortable with the Fed going on hold.”

What to Watch

-

Economic data:

-

Sept. 25: Chicago Fed national activity index; Dallas Fed manufacturing activity

-

Sept. 26: Philadelphia Fed non-manufacturing activity; Bloomberg Sept. US economic survey; FHFA house price index; S&P Corelogic US home price index; new home sales; Conference Board consumer confidence; Richmond Fed manufacturing index/business conditions; Dallas Fed services activity

-

Sept. 27: MBA mortgage applications; durable goods/capital goods orders

-

Sept. 28: GDP; initial jobless claims; Kansas City Fed manufacturing activity; pending home sales

-

Sept. 29: Advance goods trade balance; personal income/spending; PCE deflator; MNI Chicago PMI; U. of Michigan sentiment; Kansas City Fed services activity

-

-

Fed calendar:

-

Sept. 25: Minneapolis Fed President Neel Kashkari

-

Sept. 26: Fed Governor Michelle Bowman

-

Sept. 28: Chicago Fed President Austan Goolsbee; Fed Governor Lisa Cook; Chair Jerome Powell town hall with educators; Richmond Fed President Tom Barkin

-

Sept. 29: New York Fed President John Williams

-

-

Auction calendar:

-

Sept. 25: 13-, 26-week bills

-

Sept. 26: 42-day cash management bills; 2-year notes

-

Sept. 27: 17-week bills; 2-year floating rate notes; 5-year notes

-

Sept. 28: 4-, 8-week bills; 7-year notes

-

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.