(Bloomberg) — Investors who stuck with bonds from countries that defaulted or are on the brink are betting the double-digit returns they’ve posted over the past month are just the start of a rally.

Most Read from Bloomberg

JPMorgan Asset Management’s Pierre-Yves Bareau, who oversees $50 billion in emerging-market debt, says he’s never seen so much value unlocked from distressed and defaulted government notes this late in a Federal Reserve interest-rate hiking cycle. Similarly, UBS Asset Management’s Shamaila Khan says there are more opportunities now than she has seen in her two decade-long career.

“We are not in a regular cycle,” Bareau said, referring to the Fed’s tightening campaign. “The restructuring talks that we’re seeing in front of our eyes now are a bit more favorable than what the market had been pricing in.”

The gains come as the nations reach milestones that, in some cases, were years in the making. Zambia, which defaulted in 2020, struck an agreement in June with bilateral creditors led by China to restructure $6.3 billion of debt. A week later, Pakistan announced a $3 billion deal with the International Monetary Fund, while Sri Lanka said it would revamp nearly $20 billion of local bills and bonds.

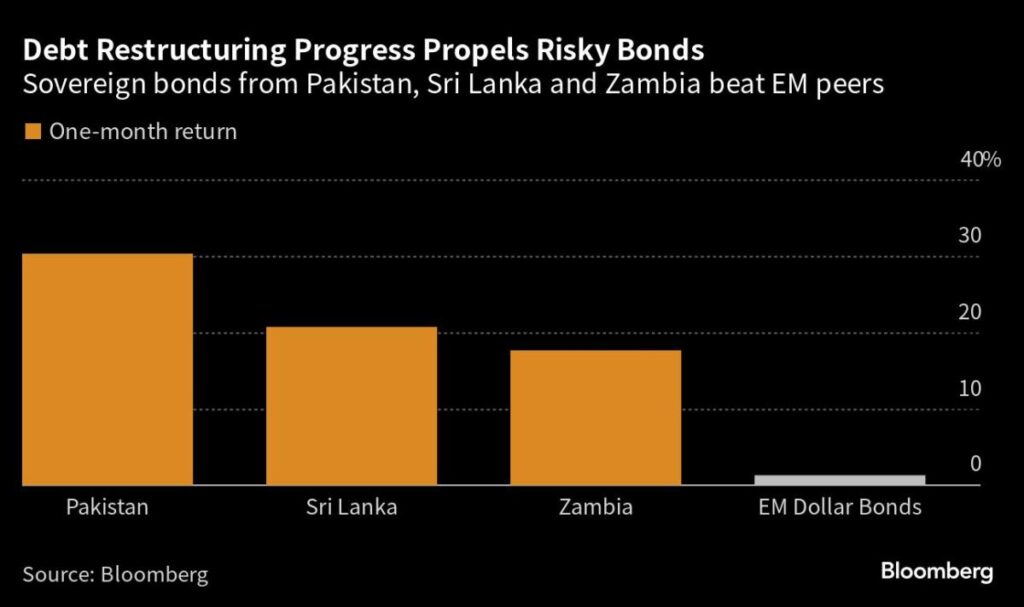

Dollar bonds from those three countries have returned 25% over the past month, compared to 1.3% in total returns for an index of developing-nation government debt. They had handed investors losses of more than 45% from the start of the pandemic through the end of May, according to data compiled by Bloomberg.

That rebound is being closely monitored by emerging-market investors after the pandemic, soaring inflation and the most aggressive US monetary tightening in a generation pushed vulnerable countries into debt distress and default. Challenges have multiplied for governments locked out of international bond markets, especially those that have been trapped in default by complex, drawn-out debt restructuring processes.

Early indications of more orthodox policies and productive debt talks, however, have already spurred outperformance across junk-rated government bonds. Argentina’s debt is up ahead of a presidential election that stands to usher in market-friendly leadership, and notes from Egypt have risen as authorities devalue the currency at the IMF’s request.

Common Framework

Now, Zambia’s debt restructuring breakthrough is being hailed as a bellwether of even more upside in defaulted and other high-risk debt.

The southern African nation defaulted in 2020, a victim of the pandemic economic slowdown that dampened demand for copper, its main export. Nearly three years of negotiations ensued, complicated by demands from its largest single creditor, China.

That’s why investors cheered as Zambia became the first to reach a deal under the so-called Common Framework, a G-20 initiative that seeks to give lenders equal treatment in a restructuring.

Read more: Shift in China’s Debt Relief Stance Catalyst for EM: The Brink

It has the potential to serve as a blueprint for other defaulted countries, according to Pankaj Bukalsaria, director of investment banking at Acuity Knowledge Partners.

“It’s a significant turning point,” he said. “This deal has opened up the possibility and practicality of negotiating similar agreements with creditors, even in cases of large debts and challenging economic situations.”

After the deal was announced, Zambian notes due in 2024 rose to around 58 cents from hitting a low of around 40 cents last year.

Pakistan then saw its bonds rally to the highest level in nearly a year following announcement of a bailout from the IMF. The deal for $3 billion in loans will both help the country stave off default and transition to a new administration later this year.

What Bloomberg Intelligence says:

“Emerging market credit spreads could tighten on broader burden-sharing under the Common Framework, property sector stimulus in China, policy reform in Turkey and elections in Argentina. External factors are weighing on EM dollar credit, yet spread volatility continues to decline in the face of tighter US financial conditions and rising uncertainty surrounding oil supply-demand dynamics.”

– Damian Sassower, chief EM credit strategist

– Click here to read full report

Money managers are looking at other countries that have similar potential. Ghana and Sri Lanka, for example, could follow in Zambia’s footsteps and strike a Common Framework restructuring, Bareau said.

Still, he warns against a buy-everything approach.

US bond traders are expecting one more Federal Reserve interest-rate hike this month, even after recent labor market data raised concern about the labor market. That’s kept investors cautious about wading too far into high-yielding emerging market debt.

Bareau, for example, said he’s avoiding bonds from Ecuador, where there’s a high level of uncertainty around the upcoming presidential election.

“Rather than to do a credit-index trade, we feel it’s more idiosyncratic,” he said. “There’s definitely a positive window to engage in some of those names where we are seeing some catalyst at play.”

Read more: Emerging-Market ‘Orthodoxy’ Pivots Find Skeptics on Wall Street

UBS’ Khan said investors should look at Argentina and junk-rated debt of countries like Egypt and Nigeria, where authorities are pivoting to more market-friendly policies.

“Our preference has been the countries that have really avoided default and we think can continue to avoid default going forward,” she said.

What to Watch

-

Bloomberg Economics expects Chinese CPI inflation to hover marginally above zero, underscoring the need for more monetary stimulus. The world’s No. 2 economy will also post trade data and offer a credit report.

-

Singapore is set to release advance second-quarter GDP data, offering a glimpse into regional trends.

-

Investors will watch June inflation prints for Colombia and Brazil as they weigh the path ahead for monetary policy in Latin America. A reading of Argentina’s data is also in focus as the nation continues its battle with triple-digit inflation.

-

Hungary’s inflation data will be in focus as the forint’s recent losing streak fuels doubt that the central bank can keep cutting rates

-

Central banks in South Korea and Peru will hold policy-rate meetings

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.