Fox Business host Charles Payne on Wednesday asserted the economy had many “red flags” ahead of the Federal Reserve announcing it will lower its federal funds rate target range by 0.50%.

The Fed’s move follows inflation dropping to 2.5% last month and weaker-than-expected job growth in July and August. Payne, on “Making Money with Charles Payne,” noted three negative economic indicators heading into the Fed’s decision to cut rates. (RELATED: One Of Kamala Harris’ Tax Proposals Could Be ‘An Economic Doomsday Device,’ Experts Say)

WATCH:

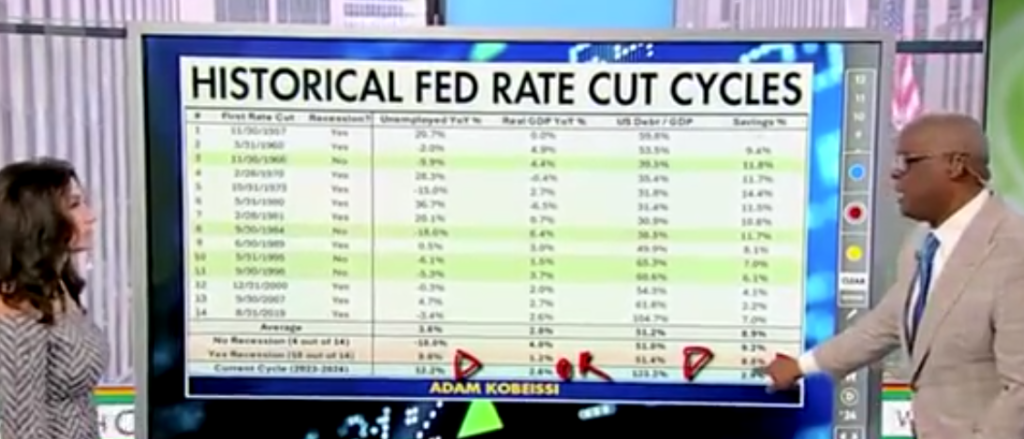

“Let’s talk about historically now. Okay, our first rate cut, going back 14 recessions … Unemployment rate in the past year, typically going into an unemployment rate with the recession, right, up 9% without a recession, down 10% … The unemployment rate is rising so much faster than normal before first rate cut,” Payne said. “Real GDP, this is actually pretty good.”

Payne was standing in front of and referencing a chart by The Kobeissi Letter, which publishes commentary pertaining to the global capital markets.

This is incredible:

The current savings rate for US adults is below levels seen in any other rate cut cycle in HISTORY.

The current savings rate of 2.9% less than ONE THIRD of the historical average of 8.9% seen in previous rate cut cycles, according to Reventure.

Furthermore,… pic.twitter.com/bhDDKdbXbn

— The Kobeissi Letter (@KobeissiLetter) September 18, 2024

“I’m going to call that a red flag,” Payne said, drawing a red flag by the year-over-year unemployment rate of 12.2%. The Fox Business host said the real GDP year-over-year of 2.6% is “okay.”

“But look at this, the U.S. debt up 123%. Obviously, a red flag,” he added. “Savings rate has plummeted, 2.9%, normally it’s at 8.8% … We had a lot of red flags here.”

The rate cut marks the first shift in Federal Reserve policy since July 2023, after the Federal Open Market Committee (FOMC) kept rates at a 23-year high of 5.25% to 5.50% for eight consecutive meetings. The cut comes after a downward revision of over 800,000 jobs for the period between April 2023 and March 2024.

The U.S. is also presently facing its highest credit card delinquency rate in over a decade, with nearly 10% of credit card balances becoming past due in the past year, according to the Federal Reserve Bank of New York.

All content created by the Daily Caller News Foundation, an independent and nonpartisan newswire service, is available without charge to any legitimate news publisher that can provide a large audience. All republished articles must include our logo, our reporter’s byline and their DCNF affiliation. For any questions about our guidelines or partnering with us, please contact licensing@dailycallernewsfoundation.org.