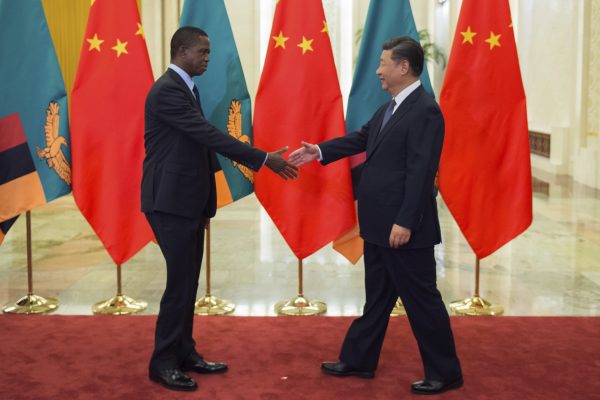

Over the past few weeks, China has reiterated its call multilateral development banks (MDBs) to play a larger role in debt relief on the African continent and beyond. For instance, China’s foreign ministry spokesperson Mao Ning called on MDBs to provide debt relief to Zambia, where they account for 19 percent of external debt.

These calls have been interpreted with much skepticism by a number of experts, especially in the run up to a closed, 20-member “sovereign debt roundtable” including six borrowing countries, three of whom are African (Ethiopia, Ghana, and Zambia). The first session was held virtually last Friday, and the second session will be held in person on the margins of the G-20 meeting in India.

The topic is fraught. Some coverage has implied China is using this position as a deliberate excuse to itself avoid a push from the United States and IMF to provide debt relief. A recent Financial Times article even misquoted the Zambian’s finance minister’s views on the issue. (The Zambian government hurriedly issued a very clear correction).

However, China’s view on MDB participation is not new, nor is it just a Chinese view. It is an African view, too – and for good reason.

In the early days of COVID-19 in 2020, the G-20-initiated the Debt Service Suspension Initiative (DSSI), to support low-income countries in weathering the storm of additional health and economic costs necessary in order to combat the pandemic. While agreeing to take part, the Chinese government did mention that to be most effective, debt servicing to MDBs should be suspended, along with debt servicing to bilateral and private lenders. Thereafter, in August of last year, a Tsinghua University report reiterated the challenges faced by African countries from private debt repayments.

But others outside of China equally held the view that actors beyond bilateral creditors needed to act. In 2020, on behalf of the African Union, South Africa’s President Cyril Ramaphosa called on MDBs to join the DSSI while warning of the effects of the COVID-19 pandemic on African debt levels. Letters from Ethiopia’s Prime Minister Abiy Ahmed, written in April 2020 – well before the country found itself having to apply for restructuring through another G-20 program – called on bilateral and private creditors not only to suspend debt but to relieve it in the interests of COVID-19 recovery. He also specifically mentioned that Africa “welcomes all debt-alleviating initiatives coming from multilateral financial institutions, notably the World bank and IMF.”

These calls, whether from China or African countries, have significant logic.

Approximately one-third of African debt is owed to multilateral creditors, with the World Bank and the African Development Bank currently being the largest multilateral financiers. Low-income African countries such as Ethiopia (at least, countries that are not already in arrears to the World Bank or IMF) have been able to draw highly concessional loans from various MDB funds. For instance, loans for low-income countries from the IMF’s Extended Credit Facility have a zero interest rate and a grace period of 5.5 years, but mature in 10 years.

Other African middle-income countries, however, such as Ghana, Egypt, and Angola, must draw loans from other MDB funds offered at more commercial levels of interest, although sometimes with longer maturities or grace periods. For instance, Ghana’s current assigned interest rate for World Bank loans is around 5 to 5.5 percent.

In 2020, total debt service for all low- and middle-income countries was $437 billion, of which 27 percent was for debt owed to Chinese stakeholders (e.g. China Exim Bank), and 33 percent for debt to multilateral lenders. The rest was for debt owed to governments and the private sector from OECD countries (including “Eurobond” payments). On current trends, by 2028, MDBs are forecast to become the largest group of creditors for the group of “most vulnerable” or “V20” countries.

Meanwhile, our firm, Development Reimagined, calculated that African governments spent a total of $130 billion on COVID-19 response measures in 2020 and 2021 to protect and support millions of citizens, thereby averting significant poverty increases. This was equivalent to just 2.5 percent of GDP, and therefore significantly lower than volumes spent by the rest of the world. For example, it is estimated that Asian countries spent 7 percent of their GDP on similar efforts, and the G-7 over 13 percent of GDP). Nevertheless, debt service suspension or relief by all creditors – bilateral, multilateral, and private sector – over the same period and applied to both low- and middle-income countries would have made a significant difference to the continent’s prospects for economic growth and poverty reduction.

So, given these calls and expenses that African and other low- and middle-income regions have had to suffer, what is the case for excluding MDBs from discussions around debt suspension, relief or restructuring, thereby treating them as “preferred creditors”?

Three arguments are typically put forward. First, that MDB loans are highly concessional – with the implication that they are cheaper than Chinese loans, for instance, and thus more “worthy” of repayment. Second, that MDBs need an “AAA” credit rating to issue such cheap loans, and engaging in debt relief could endanger the rating and therefore deliver an “own goal” for low- and middle-income countries that will need cheap loans in future. Third, that MDB relief is compensated for by the MDBs effectively and consistently disbursing fresh, cheap loans.

All three arguments are questionable.

First, as explained above, MDB concessionality rates differ widely depending on a country’s income. This means it is challenging to make general comparisons across lenders. It must be calculated on a country-by-country basis, considering counterfactuals. For instance, some African countries that have sought loans from China’s Exim Bank have achieved interest rates of under 2 percent, with maturities of over 20 years, and over 7-year grace periods.

This means it is misleading at best and outright mistaken at worst to assume that China poses a greater debt burden than MDBs in all instances. In 2020, 55 percent of Nigeria’s debt service payments were to Eurobond holders, followed by the World Bank and African Development Bank (AfDB) Group.

An analysis of 157 countries comparing World Bank to Chinese lending in the 2000-2014 period found that while Chinese lending terms were less concessional than those for World Bank projects, Chinese loan terms were more concessional than private sector terms. The authors also found that loans from Chinese institutions tended to be larger than those from the World Bank (the average loan sizes were $307 million and $148 million, respectively), while 30 countries were able to get loans from China but not the World Bank, which may explain the difference in costs.

Put simply the argument that MDB loans are “cheap,” and thus should not be forgiven, holds little water.

The second argument related to capital ratings is equally shaky – both based on history and recent analysis. The fact is, like China, MDBs have provided debt relief before. In the late 2000s, the World Bank, the IMF, and the AfDB relieved $26.7 billion in debt globally. To put this into perspective, Paris Club creditors spent around $27.7 billion. Overall, between 1970 and 2021, the World Bank relieved at least $38.4 billion in debt on the African continent, followed by AfDB with $9.4 billion and the IMF with $5.8 billion, with Ghana, Tanzania, Ethiopia, Uganda, and Zambia benefiting from the largest reductions. For some MDBs the forgiveness was itself compensated for from elsewhere in the system. For instance, the IMF compensated the AfDB for foregone reflows over a 50-year period (2004-2054).

Moreover, a recent independent report commissioned by the G-20, and led by Tanzanian consultant Frannie Léautier, who previously worked at very senior levels at the World Bank and AfDB, found that 15 MDBs, 10 of which have AAA ratings, have a significant potential to reduce risk aversion and ease capital requirements, without losing these ratings. To date, the Léautier report has been used by international NGOs to argue for “trillions” of new fresh financing from the MDBs without more pledges of finance from G-7 donors, but the corollary also applies with regards to the potential for less painful debt suspension, relief, or restructuring by the MDBs.

So what about the final argument – that MDBs issued fresh financing over the pandemic years, and this compensated for repayments?

Unfortunately, the data suggests this was not necessarily the case for all African countries. Over the 2020 and 2021 period, for example, we calculate that 48 African governments for which data is available borrowed a gross total of $20 billion from the World Bank. This was a small amount compared to their spending on COVID-19 responses, but of course it was helpful. However, governments also had to make repayments of $1.6 billion to the Bank, and accrued new interest payments of approximately $200 million. This meant that while overall the position was positive for the continent, the countries lost almost 10 percent of their loan inflows.

Furthermore, six countries of variable economic size – Burundi, Chad, Mauritius, Sao Tome and Principe, South Africa, and Sudan – paid more to the World Bank than they received in new loans. So certainly, the World Bank at least could have done more.

In this context, what can the new sovereign debt roundtable achieve for African borrowers? In 2023, although economic growth in the African region is expected to accelerate, domestic revenues are still recovering from COVID-19 and other global shocks, and poverty reduction efforts should take priority. This is why several African governments have rationally encouraged all lenders – including the MDBs – to support debt suspension, relief, and restructuring.

But a significant gap in understanding and advocacy remains regarding African views on MDB engagement. Experience suggests that the longer they find arguments to exclude their lending from discussions, the larger challenges all creditors and borrowers will face.

The time is now for all lenders to really listen and respond to African leaders – not to reject their position out of hand because of the perception that following through might benefit China.