-

Most projections for a stock market decline hinge on a weakening US consumer.

-

Bearish investors cite $1 trillion in credit card debt, upcoming student loan payments, and a depletion of excess pandemic savings.

-

But the US consumer has plenty of capacity to spend, and that’s great news for the stock market.

From $1 trillion in credit card debt to the upcoming restart of student loan payments, there are plenty of reasons to be concerned about the financial health of the US consumer.

And those concerns are getting louder and louder as some stock market strategists forecast an imminent end to the bull market, partly due to a weakening consumer who’s expected to slow spending.

But some perspective is needed, especially amid a heightened period of scary headlines that include a record high in credit card debt and the depletion of excess savings that were built up during the pandemic.

In reality, US consumers have plenty of firepower left to spend money, grow the economy, and drive the stock market higher. Here’s why.

1. Low debt-service ratio

While $1 trillion in credit card debt sounds like a lot, what really matters is whether consumers can pay down those debts. And they most definitely can.

Less than 10% of a US households’ disposable income is going towards debt payments, which includes mortgages, auto loans, and credit card liabilities.

That’s below pre-pandemic levels and below the 10%-12% range that was consistent for much of the 2010s, when stocks were remarkably strong.

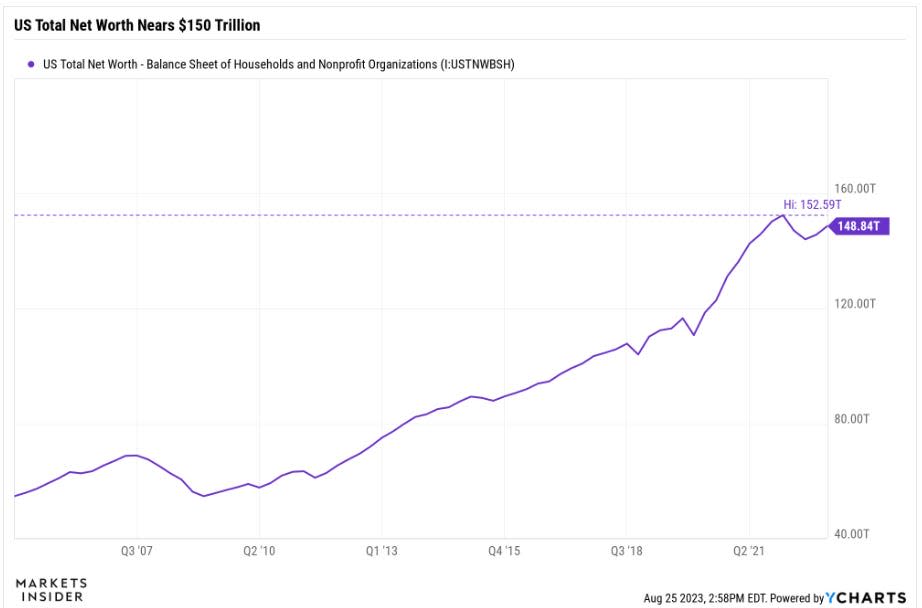

2. Consumer assets dwarf liabilities

While consumer debts are on the rise, so too is the value of consumer assets — and the two are really not comparable.

The collective net worth of US consumers currently sits just below $150 trillion, and total assets are nearly $170 trillion, with much of that in homes and stocks. Meanwhile, consumers have total debts of just under $20 trillion, with the bulk of that represented by mortgages.

And consider this: while credit card debt grew about $100 million from pre-pandemic levels to just over $1 trillion, US consumers’ total net worth increased by about $30 trillion from pre-pandemic levels.

3. Home equity an untapped source of funds

US homeowners have built up nearly $30 trillion in home equity, and they’ve yet to tap into it via home equity lines of credit, as shown in the chart above. Outstanding home equity lines of credit are nowhere near their peak seen during the 2008 recession.

Utilization rates for home equity lines of credit are at 38%, which is well below the pre-pandemic average of 51%.

Home equity lines of credit represent an easy path for homeowners to borrow money against their house, usually at a lower interest rate than personal loans. The vast sums of money that consumers have tied up in their homes represent optionality, allowing them to borrow the money down the road. That’s a lot of firepower that could support further spending and growth for the economy.

4. Average consumer has low mortgage rates locked in

Mortgage rates have surged over the past year to levels that have sparked an affordability crisis for new home buyers, but it’s important to remember the large majority of homeowners locked in their mortgages at historically low rates.

The effective interest rate for outstanding mortgage debt is just 3.60%, slightly above a multi-decade low. So as difficult as it is for new home buyers given the surge in mortgage rates to above 7%, it may not have as chilling of an effect on the economy as some think.

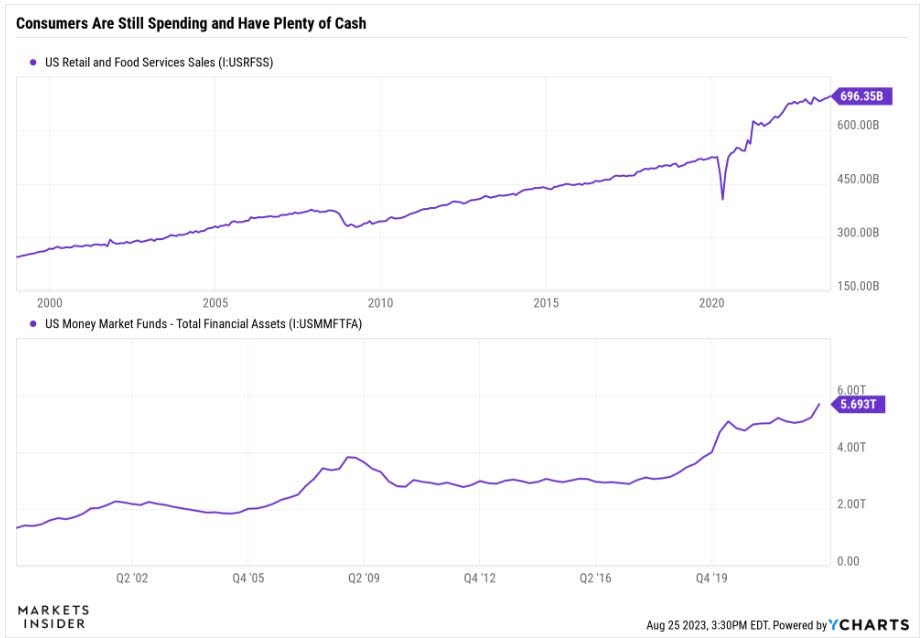

5. Retail spending is solid with plenty of cash-on-hand

All of the hard data shows a consumer that can withstand a few hiccups, like a restart in student payment loans. That’s validated by monthly retail sales data, which has shown resilient growth this year. And as the consumer keeps spending, their pile of cash is still growing.

Money market funds currently have nearly $6 trillion in cash, a record, as investors take advantage of 5% risk-free rates. While some of that cash pile is owned by institutions, consumers command a big chunk too.

Altogether, US consumers are on solid footing with room to continue their spending habits while at the same time servicing their debts. And given that consumption makes up about 70% of GDP, this strength should continue to flow through to the economy and stock market. So don’t count out the consumer just yet.

Read the original article on Business Insider