(Bloomberg) — Policymakers on each side of the Atlantic are likely to take comfort this week from a slowdown taking hold in key underlying measures of consumer-price growth.

Most Read from Bloomberg

In the US, the annual core metric that strips out food and energy from the Federal Reserve’s preferred inflation measure may have fallen below 4% in August for the first time in nearly two years.

Meanwhile the euro region’s own annual gauge of underlying price growth is expected to have slowed to 4.8% in September — a 12-month low.

Such coinciding evidence would reassure officials from the Fed and the European Central Bank after a week when each signaled monetary tightening may be done or at least paused for now, shifting focus to keeping interest rates durably high to fully squash inflation.

They do have reason for caution however, with the prospect that crude oil heading toward $100 barrel could yet fuel further price growth.

Some recent increases in energy costs are already having an effect. The overall personal consumption expenditures price index that the Fed favors is expected to pick up on a monthly basis to one of the strongest readings this year when that report is released on Friday.

Headline euro zone inflation, which will be released the same day, is still likely to have weakened drastically however — reaching 4.5%, a two-year low.

What Bloomberg Economics Says:

“The Fed’s optimism isn’t likely to be dented by data in the coming week. Even as income and spending rose at a decent clip, August PCE inflation likely continued at a pace close to the Fed’s 2% target for a third straight month. That said, we do expect to see further signs of labor-market weakening in the consumer confidence report.”

—Anna Wong, Stuart Paul and Eliza Winger. For full analysis, click here

Elsewhere, appearances by the Fed and ECB chiefs, along with rate decisions from Hungary to Mexico, will keep investors busy.

Click here for what happened last week and below is our wrap of what is coming up in the global economy.

US and Canada

In the US, the PCE report may be the last government figures that policymakers see for some time ahead of a likely shutdown that would start Oct. 1. When the government was closed in 2013, figures like the employment report and others were delayed.

Other data this week include those on new-home sales, consumer sentiment and durable goods orders. The Census Bureau will publish its third estimate of second-quarter growth as well as benchmark revisions.

Fed Chair Jerome Powell will host a town hall with educators, while his colleagues Neel Kashkari, Austan Goolsbee, Thomas Barkin and John Williams are scheduled to speak at separate events.

In Canada, gross domestic product data for July will be released after preliminary data earlier suggested the economy was flat that month, supporting the central bank’s decision to hold rates steady at 5%.

Payroll and job vacancy data is expected to show the labor market continues to ease although wage growth remains strong.

Asia

The Bank of Japan’s Governor Kazuo Ueda and his deputy Shinichi Uchida will both be speaking on Monday following the central bank’s latest policy decision Friday.

This week the world’s third largest economy will also be reporting on a host of data on Friday, including Tokyo inflation, retail sales, industrial production and labor market related figures.

In a week when the European Commission’s Vice President Valdis Dombrovskis will be visiting China, investors will also be closely watching the country’s PMI data starting Friday to parse the latest state of China’s economic slowdown.

Australia reports on its latest inflation figures Wednesday and retail sales data Thursday — both will feed into the Reserve Bank of Australia’s policy decision the following week.

Meanwhile Thailand’s central bank is expected to continue to raise rates on Wednesday, after which the country is expected to show slightly better trade results Friday.

Elsewhere, Singapore has inflation data due Monday that is likely to show a further slowdown, while Hong Kong reports on trade Tuesday.

Europe, Middle East, Africa

ECB President Christine Lagarde will testify in the European Parliament on Monday, in a session likely to touch on last week’s close-run decision to raise rates again.

Other colleagues scheduled to speak in coming days include Bank of France Governor Francois Villeroy de Galhau and ECB Chief Economist Philip Lane.

While national inflation numbers from around the region will draw attention before the release of the euro-zone report, another data highlight will be Germany’s latest Ifo business confidence reading.

Europe’s biggest economy may be contracting at present, and the index — due Monday — will show whether there’s any sign of optimism of growth improving.

In the UK meanwhile, which last week surprised investors by keeping rates on hold instead of an increase, final GDP data for the second quarter will be released on Friday.

Turning east, Hungary’s central bank is poised to cut its key rate by a full percentage point for a fifth month on Tuesday. The next day, Czech officials may stay on hold.

In Russia, macroeconomic data is published Wednesday including industrial production figures that will likely show a strong rebound as Putin’s war economy intensifies defense output to support his invasion of Ukraine.

The next day, the Bank of Russia’s Governor Elvira Nabiullina, Kremlin economic aide Maxim Oreshkin and Finance Minister Anton Siluanov are scheduled to speak at the Moscow Financial Forum.

Looking south, an unexpected slowdown in August annual inflation and expectations that food-price base effects will drive disinflation in the fourth quarter will probably see the Bank of Ghana keep its key rate unchanged on Monday.

On Tuesday, Morocco’s central bank makes its first rate decision since a devastating earthquake. Despite inflation running at 5%, above the base rate of 3%, the bank may choose against hiking.

Saudi Arabia’s foreign reserves fell to the lowest level since 2009 in July. Investors will on Thursday be closely watching the numbers for August to see if the trend’s continued or if the government has opted to prop up the reserves.

Latin America

In Brazil this week, the central bank on Tuesday posts the minutes of its Sept. 20 rate decision to cut the key rate to 12.75%. On Thursday, the quarterly inflation report will update key scenarios, forecasts through year-end and into 2024.

Also out of Brazil, the mid-September inflation reading will likely jump close to 5% as last August’s -0.73% print falls out of the data series. Analysts expect August unemployment to come in near an eight-year low amid near-record employment levels — all of which have yet to stoke wage pressures.

In Argentina, the July GDP-proxy reading will likely post a fourth straight negative print as South America’s second-biggest economy slides into recession.

A host of indicators including industrial production and retail sales out of Chile for August should remain negative though may offer signs of what’s seen as a region-beating rebound in 2024.

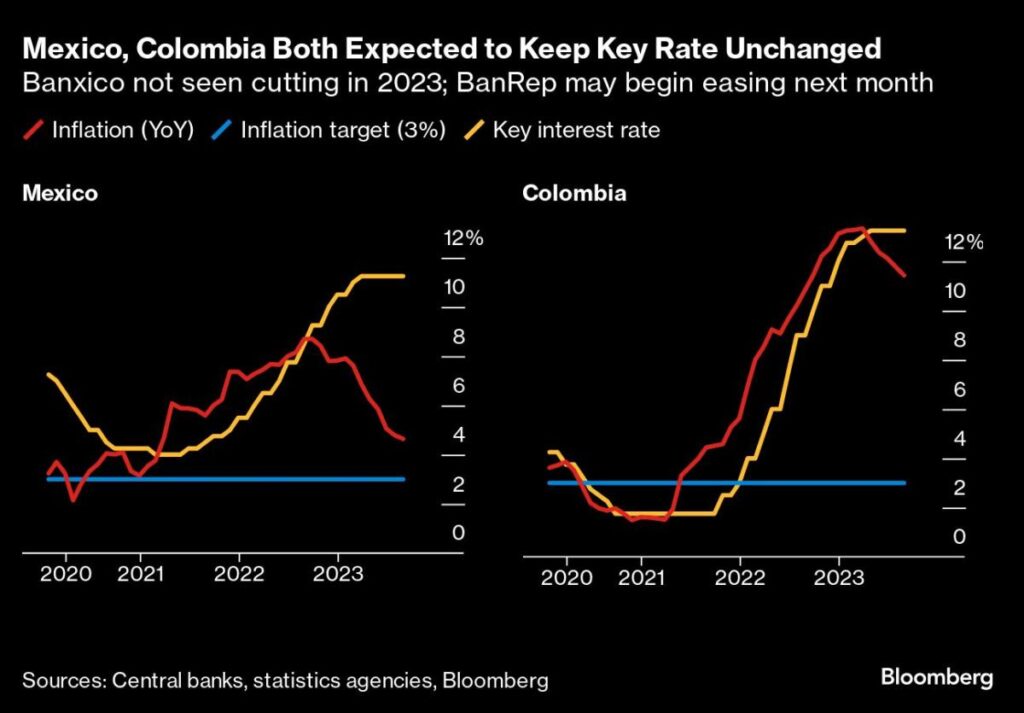

Winding up the week, Banco de Mexico and Colombia’s Banco de la Republica are all but certain to keep their key rates unchanged.

Neither is quite ready to begin unwinding record hiking cycles, though Colombia Finance Minister Ricardo Bonilla says he’ll argue for a cut. Local economists see a reduction from 13.25% next month while Banxico’s expected to hold at 11.25% into 2024.

–With assistance from Tony Halpin, Monique Vanek, Robert Jameson, Paul Wallace, Paul Jackson, Laura Dhillon Kane and Milda Seputyte.

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.