March 20 (Reuters) – Shares of U.S. lender First Republic tumbled nearly 50% on Monday on fears it will need a second rescue to stay afloat, bucking a broader rally in bank shares driven by UBS Group’s state-backed takeover of Credit Suisse.

Less than a week after large U.S. banks pumped $30 billion in deposits into the midsized U.S. lender, investors dumped First Republic on worries that infusion of capital would not be enough. Ratings agency S&P Global also downgraded it deeper into junk status on Sunday, citing liquidity risks.

JPMorgan Chase & Co (JPM.N) CEO Jamie Dimon is leading talks with other big banks on new efforts to stabilize First Republic with a possible investment into the lender, the Wall Street Journal reported, citing people familiar with the matter.

JPMorgan and First Republic declined to comment on the report. A spokesperson for First Republic pointed to an earlier statement where the bank said it was “well-positioned to manage short-term deposit activity”.

The tumult at First Republic, whose shares ended down 47.1%, overshadowed an otherwise positive day for banking stocks globally, led by relief that UBS Group AG’s (UBSG.S) takeover of 167-year-old Credit Suisse Group AG (CSGN.S) would avert a wider banking crisis.

“There (is) more good news than bad news on the banking front,” said Art Hogan, chief market strategist at B. Riley Wealth. “First and foremost, the Credit Suisse, UBS merger certainly takes a lot of stress out of the global banking system.”

The 3 billion Swiss franc ($3.2 billion) deal for the troubled Swiss bank – which was once worth more than $90 billion – was engineered by Swiss regulators and announced on Sunday.

European bank shares (.SX7P) rebounded from recent losses, while on Wall Street the S&P 500 banks (.SPXBK) index recovered 0.6%.

Regional U.S. lenders also rose. PacWest Bancorp (PACW.O) jumped almost 11% after saying deposit outflows had stabilized and its available cash exceeded total uninsured deposits.

Bonds issued by major European banks fell after some Credit Suisse bondholders were wiped out in the deal. But UBS shares closed up 1.3%, bouncing from a 16% slump triggered by concerns about the long-term benefits of the deal and the outlook for Switzerland, once considered a paragon of sound banking.

A deal on Sunday for a unit of New York Community Bancorp (NYCB.N) to buy deposits and loans from the failed Signature Bank (SBNY.O) also boosted sentiment in U.S. banks. New York Community Bancorp shares surged 32%.

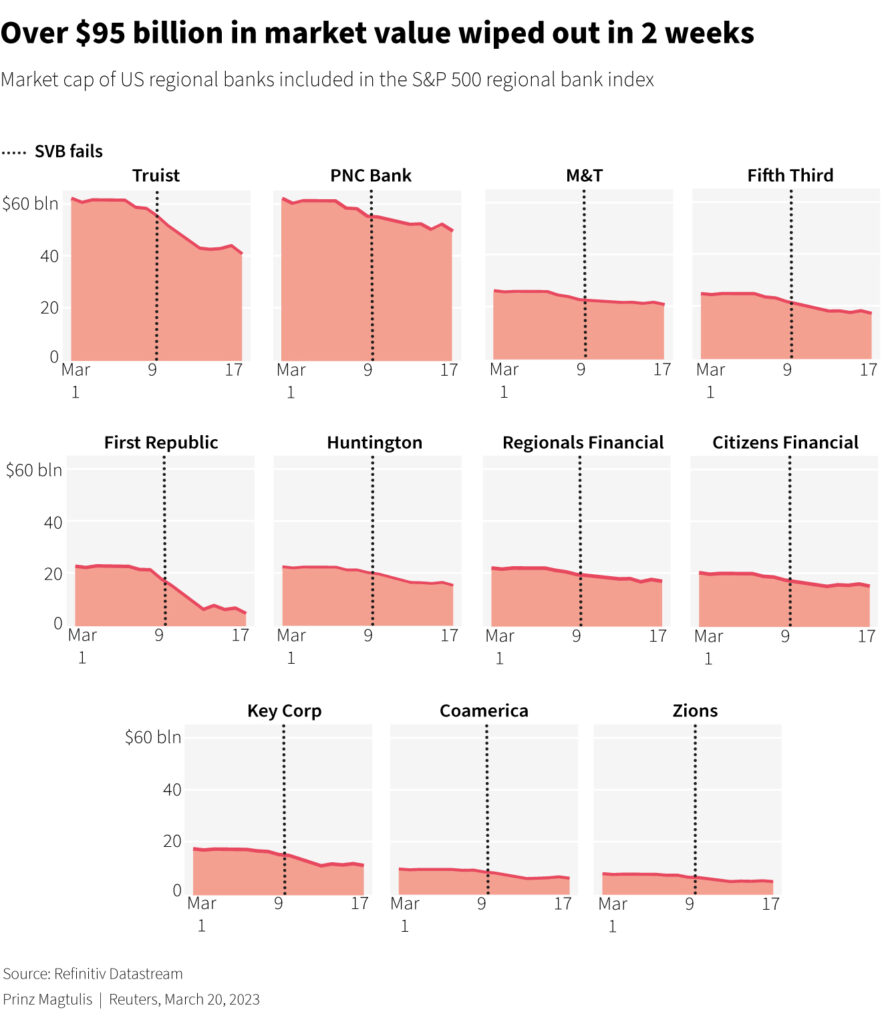

The turmoil that gripped banks over the past week was triggered by the collapse of U.S. midsized lenders Silicon Valley Bank and Signature Bank, quickly ensnaring Credit Suisse as investors fretted about other ticking bombs in the banking system.

The Federal Deposit Insurance Corporation has decided to break up Silicon Valley Bank and hold two separate auctions for its traditional deposits unit and its private bank after failing to find a buyer for the failed lender last week.

With worries around Credit Suisse easing, attention is now turning to the U.S. Federal Reserve, whose relentless rate hikes to quash inflation were seen as a trigger for the turmoil.

Traders have now increased their bets that the central bank will pause its hiking cycle on Wednesday to try to ensure financial stability, but on the whole remain split over whether the Fed will raise its benchmark policy rate.

[1/2] Buildings of Swiss banks UBS and Credit Suisse are seen on the Paradeplatz in Zurich, Switzerland March 20, 2023. REUTERS/Denis Balibouse

COORDINATED ACTION

Policymakers from Washington to Europe have repeatedly stressed that the current turmoil is different from the global financial crisis 15 years ago, pointing to banks being better capitalised and funds more easily available.

Still, top central banks promised at the weekend to provide dollar liquidity to stabilise the financial system to prevent the banking jitters from snowballing into a bigger crisis.

In a global response not seen since the height of the pandemic, the Fed said it had joined central banks in Canada, Britain, Japan, the euro zone and Switzerland in a co-ordinated action to enhance market liquidity.

Investor focus in Europe shifted to the massive blow some Credit Suisse bondholders will take, prompting euro zone and UK banking supervisors to try to stop a rout in the market for convertible bank bonds.

The regulators said owners of this type of debt would only suffer losses after shareholders have been wiped out – unlike at Credit Suisse, whose main regulators are in Switzerland.

The eleventh-hour Swiss rescue is backed by a massive government guarantee, helping prevent what would have been one of the largest banking collapses since the fall of Lehman Brothers in 2008.

However, the Swiss regulator decided Credit Suisse’s additional tier-1 (AT1) bonds with a notional value of $17 billion will be valued at zero, angering some holders of the debt who thought they would be better protected than shareholders.

AT1 bonds – a $275 billion sector also known as “contingent convertibles” or “CoCo” bonds – can be converted into equity or written off if a bank’s capital level falls below a certain threshold.

The deal will make UBS Switzerland’s only global bank. It will also make the Swiss economy more dependent on a single lender.

S&P said its outlook on UBS was revised to negative over execution risk but affirmed its ratings.

Switzerland’s two biggest political parties sharply criticised the takeover, saying huge state support – which could add up to $280 billion – created enormous risks for the country.

“What has happened is terrible for the credibility of Switzerland,” said Roger Nordmann, leader of the Social Democrats in the Swiss parliament.

“It’s a warning shot for Switzerland about having banks which are just too big.”

($1 = 0.9280 Swiss francs)

Reporting by Medha Singh, Shubham Batra, Amruta Khandekar and Ankika Biswas in Bengaluru; John Revill in Zurich, Stefania Spezzati, Oliver Hirt and John O’Donnell in London, and Noel Randewich in Oakland, California; Additional reporting by Reuters bureaus

Writing by Sam Holmes, Toby Chopra and Deepa Babington

Editing by Nick Zieminski and Matthew Lewis

: .