(Bloomberg) — The cap on government spending in Washington’s deal to raise the federal debt limit adds a fresh headwind to a US economy already burdened by the highest interest rates in decades and reduced access to credit.

Most Read from Bloomberg

The tentative deal crafted by President Joe Biden and House Speaker Kevin McCarthy over the weekend — assuming it’s passed by Congress in coming days — avoids the worst-case scenario of a payments default triggering financial collapse. But it also could, even if at the margin, add to risks of a downturn in the world’s largest economy.

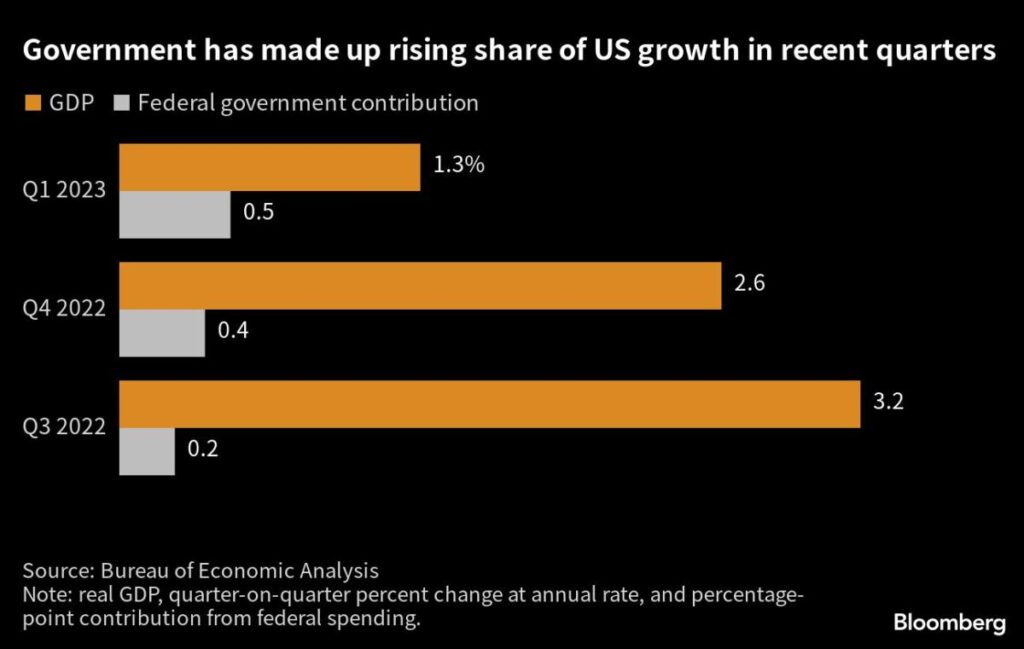

Federal spending in recent quarters has helped support US growth in the face of headwinds including a slump in residential construction, and the debt-limit deal is likely to at least damp that impetus. Two weeks before the debt-limit deal, economists had calculated the chance of a recession in the coming year at 65%, a Bloomberg survey showed.

For Federal Reserve policy makers, the spending cap is a fresh consideration to account for as they update their own projections for growth and the benchmark interest rate, which are due for release June 14. Futures traders as of late last week were pricing in no change in rates for the mid-June policy meeting, with one final 25 basis-point hike seen in July.

“This will make fiscal policy slightly more restrictive at the same time that monetary policy is restrictive and likely to get more so,” said Diane Swonk, chief economist at KPMG LLP. “We have both policies moving in reverse and amplifying each other.”

US stock futures advanced, with contracts on the S&P 500 index up 0.3% as of 10:40 a.m. in New York. Treasuries trading was closed for the Memorial Day holiday, but 10-year Treasury futures were up, sending the implied yield down slightly to 4.42%.

The spending limits are expected to be applied starting with the fiscal year beginning Oct. 1, though it’s possible small effects will emerge before then — such as through clawbacks of Covid assistance or the impact of phasing out forbearance toward student debt. Those would be unlikely to show up in GDP accounts, however.

‘Gimmickry’ Factor

Tobin Marcus, Evercore ISI’s senior US policy and politics strategist, also advised that it will be important to assess the degree to which spending limits are “pure gimmickry” as negotiators sought to bridge differences via accounting maneuvers.

Even so, with spending for the coming fiscal year expected to be held around 2023 levels, what restraint the deal does impose would kick in at a moment when the economy might be in contraction. Economists surveyed by Bloomberg previously penciled in a 0.5% annualized drop in gross domestic product for both the third and fourth quarters.

Bloomberg Economics: Cost of Debt Deal May See 570,000 Hit to US Employment

“Fiscal multipliers tend to be higher in a recession, so if we were to enter a downturn, then the reduced fiscal spending could have a larger impact on GDP and employment,” Michael Feroli, chief US economist at JPMorgan Chase & Co., said in an emailed response to questions.

JPMorgan’s base case of the US tipping into a recession in the second half of 2023.

To the extent that the economy does slow, fiscal policy may work in tandem with monetary policy to quell inflation, which a report showed last week remains well above the Fed’s target.

“It’s an important development — it’s been more than a decade since monetary and fiscal policymakers were rowing in the same direction,” said Jack Ablin, chief investment officer at Cresset Capital Management. “Perhaps fiscal restraint will be another ingredient to weigh on inflation.”

Despite some 5 percentage points of Fed rate hikes since March of last year — the centerpiece of the most aggressive monetary-tightening campaign since the early 1980s — the US economy has so far proved resilient.

Unemployment is at its lowest in more than a half century, at 3.4%, thanks to historically high demand for workers. Consumers still have excess savings to use from the pandemic, a San Francisco Fed study showed recently.

Fed officials will have a range of considerations, because aside from the deal’s impact on the economic outlook, it will have some implications for money markets and liquidity.

The Treasury has run down its cash balance to keep making payments since it hit the $31.4 trillion debt limit in January, and once the ceiling is suspended by the coming legislation, it will ramp up sales of Treasury bills in order to rebuild that stockpile to more normal levels.

That wave of newly issued T-bills will effectively drain liquidity from the financial system, although its exact impact could be challenging to assess. Treasury officials may also arrange their issuance to minimize disruptions.

With the Fed removing liquidity on its own, through running off its bond portfolio at a clip of up to $95 billion a month, it’s a dynamic that economists will be closely watching in coming weeks and months.

Read More: Debt-Ceiling Relief May Be Short as Focus Turns to T-Bill Deluge

Longer term, the scope of fiscal restraint that negotiators have crafted is almost certain to do little for the trajectory of federal debt.

The International Monetary Fund last week said that the US would need to tighten its primary budget — that is, excluding debt-interest payments — by some 5 percentage points of GDP “to put public debt on a decisively downward path by the end of this decade.”

Keeping spending at 2023 levels would fall well short of such major restraint.

“The two-year spending caps at the core of the deal are somewhat in the eye of the beholder,” Evercore ISI’s Marcus wrote in a note to clients Sunday. His assessment: “Spending levels should stay roughly flat, posing minimal fiscal headwinds to the economy while also only marginally reducing deficits.”

–With assistance from Josh Wingrove, Jennifer Jacobs and Erik Wasson.

(Updates futures trading in sixth paragraph. A previous version of this story was corrected to show that JPMorgan’s base case is for a recession.)

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.