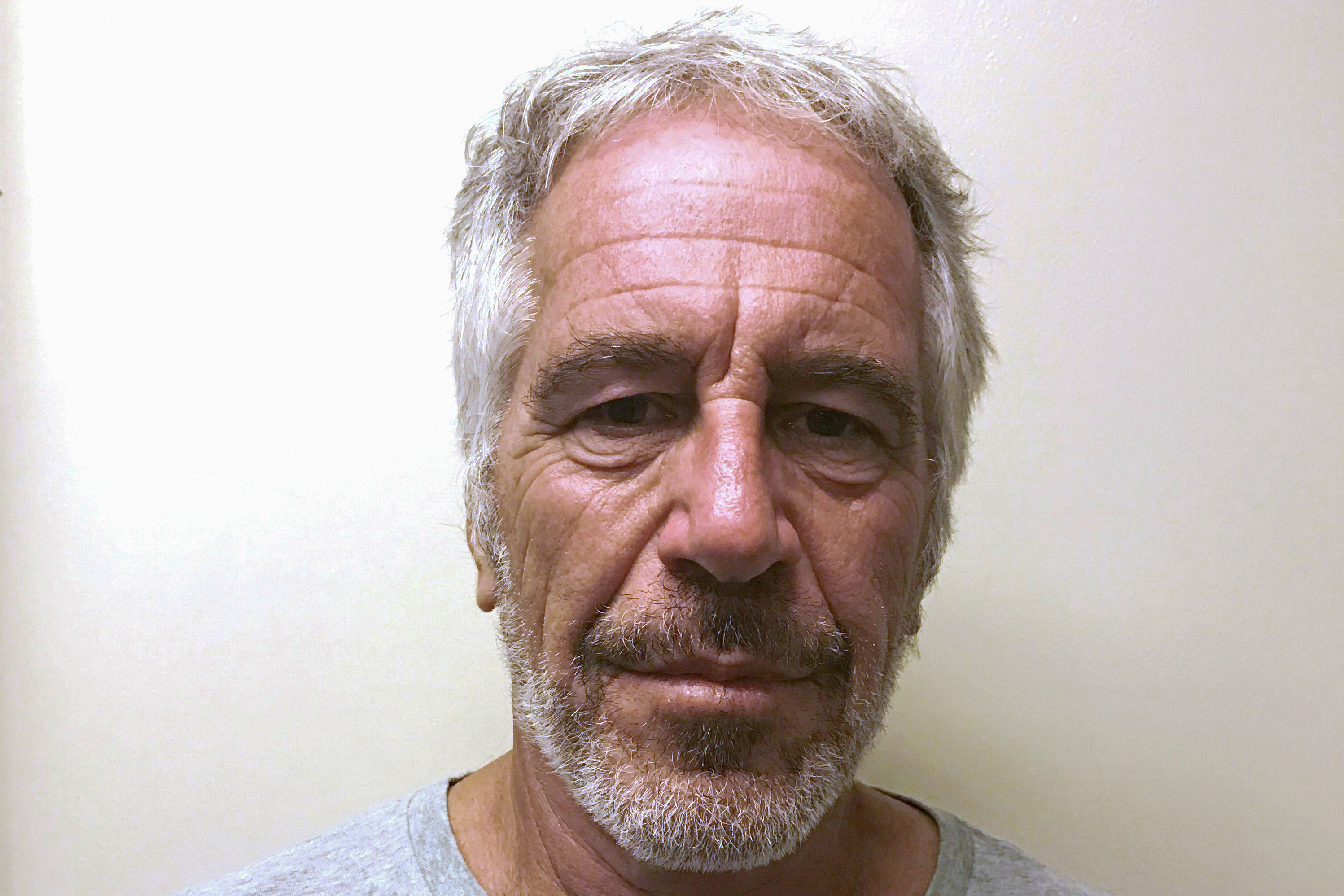

[1/2] U.S. financier Jeffrey Epstein appears in a photograph taken for the New York State Division of Criminal Justice Services’ sex offender registry March 28, 2017 and obtained by Reuters July 10,…

May 17 (Reuters) – Deutsche Bank AG (DBKGn.DE) agreed to pay $75 million to settle a lawsuit by women who say they were abused by the late financier Jeffrey Epstein, and accused the German bank of facilitating his sex trafficking.

The accord resolves a proposed class action in Manhattan federal court, and was confirmed by the accusers’ lawyers late on Wednesday.

Deutsche Bank was accused of missing red flags in Epstein’s accounts that he was engaged in wrongdoing.

Epstein, who pleaded guilty in 2008 to a Florida prostitution charge and registered as a sex offender, was a Deutsche Bank client from 2013 to 2018.

He died in August 2019 in jail while awaiting trial for sex trafficking, in what New York City’s medical examiner called a suicide.

Deutsche Bank’s settlement requires approval by U.S. District Judge Jed Rakoff, who on Thursday scheduled a June 1 preliminary hearing to consider its fairness.

Two similar lawsuits against JPMorgan Chase & Co (JPM.N), where Epstein was a client from 1998 to 2013, remain unresolved.

Deutsche Bank spokesman Dylan Riddle declined to discuss the accord, but the bank has acknowledged error in making Epstein a client.

Riddle also said Deutsche Bank has invested more than 4 billion euros to bolster its controls, processes and training, and hired more people to fight financial crime.

David Boies, one of the accusers’ lawyers, in a statement said Epstein’s abuses required “the collaboration and support of many powerful individuals and institutions. We appreciate Deutsche Bank’s willingness to take responsibility for its role.”

Boies Schiller Flexner and Edwards Pottinger represent Epstein’s accusers.

A trial had been scheduled for Sept. 5.

The Wall Street Journal reported the settlement earlier and said Deutsche Bank did not admit wrongdoing, citing people familiar with the matter.

JPMORGAN IMPACT

It was unclear how the settlement might affect the two similar, larger lawsuits against JPMorgan by Epstein’s accusers and by the U.S. Virgin Islands, where the financier had a home.

Court papers have outlined many details about that bank’s allegedly turning a blind eye to his activities.

JPMorgan spokeswoman Patricia Wexler on Thursday declined to discuss those lawsuits.

She noted that JPMorgan has regretted its association with Epstein and said it did not believe it violated any laws.

The bank is separately suing Jes Staley, a former private banking chief who had been friendly with Epstein, to help cover its losses in the two lawsuits. Staley is also a former Barclays Plc (BARC.L) chief executive.

JPMorgan’s trials are scheduled for Oct. 23. Tesla Inc (TSLA.O) CEO Elon Musk is among those who have been subpoenaed.

The Deutsche Bank case was led by a woman, known as Jane Doe 1, who said Epstein sexually abused her from 2003 to 2018.

A different Jane Doe 1, a former ballet dancer who said Epstein trafficked her from 2006 to 2013, leads the accusers’ case against JPMorgan.

In 2020, New York state’s financial regulator fined Deutsche Bank $150 million over its work with Epstein.

Last September, Deutsche Bank agreed to pay $26.25 million to settle a U.S. shareholder lawsuit over its relationships with risky, ultra-rich clients like Epstein.

The case is Jane Doe 1 v Deutsche Bank AG et al, U.S. District Court, Southern District of New York, No. 22-10018.

Reporting by Rahat Sandhu in Bengaluru; Editing by Jacqueline Wong

: .