The Biden-Harris administration has “grossly” understated inflation, hiding the economic pain that price hikes have caused Americans, according to a new study from the Brownstone Institute.

The Bureau of Labor Statistics’ (BLS) consumer price index (CPI) — one of the most popular gauges of inflation — has failed to accurately account for rising homeownership costs, economic harms from government regulations and the cost to consumers of indirect purchases like health insurance, the study found. Using an alternative inflation metric that accounts for these CPI deficiencies, the study’s authors found cumulative inflation since 2019 has been undercounted by nearly half and economic growth has been overstated by approximately 15%, with the metrics indicating that the U.S economy has been mired in recession since 2022. (RELATED: ‘Recession May Have Already Begun’: Biden Admin Admits It Overestimated Employment By Nearly 1 Million Jobs)

“These conclusions are in stark contrast to the establishment narrative that the US economy is enjoying robust growth that for some reason the public is incapable of perceiving,” the study’s authors, E.J. Antoni —a research fellow at the Heritage Foundation’s Grover M. Hermann Center for the Federal Budget — and Peter St. Onge — the Heritage Foundation’s Mark A. Kolokotrones Fellow in Economic Freedom — wrote. “Indeed, our results are consistent with the perceptions of the American public, of whom a majority believe we are in recession.”

In this study we quantify some of the biases in inflation statistics to get closer to a true understanding of economic growth since 2019.

~@RealEJAntoni & @profstonge

Recession Since 2022: US Economic Income and Output Have Fallen Overall for Four Yearshttps://t.co/jj09or5VDB— Brownstone Institute (@brownstoneinst) October 9, 2024

Roughly 70% of respondents say cost of living is their biggest economic concern, according to a poll conducted by market research and analytics company Harris in May. However, on paper, the economy is not experiencing an extended period of decline, with the economy growing at an upwardly revised rate of 3% in the second quarter of 2024, well above the 1.6% growth rate seen in the first quarter.

Antoni and Onge attribute this disconnect largely to a “bias related to housing,” arguing CPI’s proxy for homeownership costs — “owners’ equivalent rent of residences” (OER) — understates inflation because it is calculated based on rent expense, which has inflated more slowly than the cost of homeownership in the last four years. The result is CPI “grossly underestimat[ing] housing cost inflation,” as OER makes up roughly 26% of CPI.

Another CPI deficiency stems from trouble quantifying the impacts of government regulations, according to the Brownstone study. When a regulation drives up the price of a product, but the government claims the regulation has improved its quality and thus made it more valuable, the price increase is not registered, and could result in a price decline.

CPI also fails to account for price changes when consumers are charged for a good indirectly, the study claims. In the case of health insurance, for example, costs are imputed from the profits of health insurers, meaning if profits decline due to an increase in operating costs for the insurer, CPI will count the shift as a decline in costs for consumers, even if the premium the consumers pay and the coverage they receive is identical to before.

These “egregious biases” cause CPI to massively undercount the price increases weighing on the wallets of everyday Americans, according to the study. They also cause “real GDP” growth — economic growth adjusted for inflation — to be overstated as the downward adjustment for inflation is not large enough.

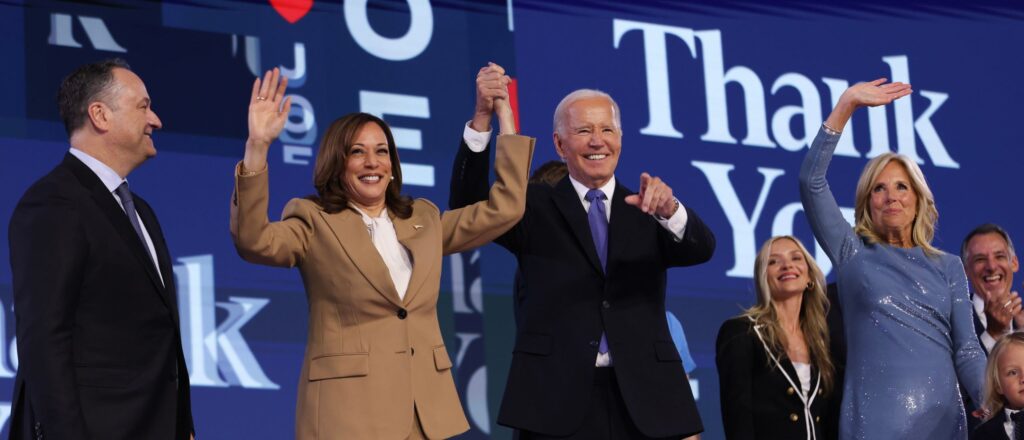

The White House has taken a victory lap on inflation and economic growth in recent months, as year-over-year CPI has drawn closer to the Federal Reserve’s 2% target, and President Joe Biden claimed that he “cured the economy” in August.

However, when adjusted for the CPI metric’s deficiencies, adjusted real GDP fell 2.5% between the first quarter of 2019 and the second quarter of 2024, with the economy experiencing essentially no growth in the two years from the second quarter of 2022 through the second quarter of 2024, the study showed.

The White House did not immediately respond to a request for comment.

All content created by the Daily Caller News Foundation, an independent and nonpartisan newswire service, is available without charge to any legitimate news publisher that can provide a large audience. All republished articles must include our logo, our reporter’s byline and their DCNF affiliation. For any questions about our guidelines or partnering with us, please contact licensing@dailycallernewsfoundation.org.