(Bloomberg) — Christine Lagarde is cementing her credentials as the biggest hawk among major central bankers despite the mounting banking stress, handing financial markets a reason to buy the euro and sell German bonds.

Most Read from Bloomberg

The president of the European Central Bank last week declared getting euro-area inflation back on target is “non-negotiable” and won’t involve “trade-offs,” days after she boosted interest rates by 50 basis points.

By contrast, Federal Reserve Chair Jerome Powell executed a smaller increase and said US rate setters had considered a pause, while Governor Andrew Bailey’s Bank of England delivered a 25 basis point hike and said inflation was likely to slow “sharply.”

The widening divergence in monetary policy sits at the heart of two trades favored by currency and bond investors.

For Citigroup Inc., Societe Generale SA and Deutsche Bank AG, Lagarde’s inflation drive provides a tailwind for the euro that could lift it to $1.10 in the coming months. Inflation printing hot this week may encourage the view that the ECB will still be hiking well after the Fed, adding to the euro’s gains.

Meanwhile, Kim Hutchinson, a rates portfolio manager at JPMorgan Asset Management, is “fearful” of holding German government debt compared with US Treasuries.

“The ECB probably gave us the most hawkish message among the central banks,” she said. “Lagarde still sounds very confident they’re going to deliver more if their baseline persists.”

Swap Gap Narrows

Rates on short-maturity European swaps are catching up with their US equivalents, narrowing the gap to as little as 70 basis points earlier in March. That level was last seen when the euro was above $1.21 in 2021, SocGen strategists said.

“We would expect to increase our long position to the euro over the next one to two months based on a more positive trend and bond yield differentials to the US declining,” said Van Luu, global head of currencies at Russell Investments. “The Fed is likely to stop the tightening cycle and then pivot before the ECB by a few months.”

As of Friday, money markets were pricing a rate cut from the Fed as soon as June, with the ECB seen hiking until September.

To be sure, the ECB’s relative hawkishness is partly a reflection of the fact that it only started lifting rates about four months after the Fed, and has the full brunt of higher energy prices to deal with. It may be only a matter of time until Europe shows significant signs of strain, according to Daniel Morris, chief market strategist at BNP Paribas Asset Management.

“If anything, the inflation dynamics are worse in the euro zone,” he said. “If you need a recession in the US to get inflation down, why not in Europe too?”

Euro-Zone Core Inflation Set for New Record in Test of ECB Nerve

For now, the European economy has proved far more resilient than predicted. Data last week showed the current account surplus increased, while the end of negative interest rates is luring capital back to Europe, providing a longer-term boost for the currency.

Core euro-zone inflation, which strips out food and energy, will rise to a fresh record of 5.8%, from 5.6%, in data this week, according to economists surveyed by Bloomberg. On Friday, Fed Bank of New York data showed a gauge of US inflation activity slowed to the lowest reading since 2021.

Further deterioration in sentiment toward Europe’s banks — after a fresh bout of market jitters focused on Deutsche Bank on Friday — could continue to weigh on the currency.

It may also prove a buying opportunity.

The euro fell to $1.0713, below the level Interbank traders had been watching to buy the common currency, according to two Europe-based FX traders. UBS Group AG has seen growing demand from “savvier, fast money” for options positions that would pay out if the currency strengthens, according to the head of FX strategy James Malcolm.

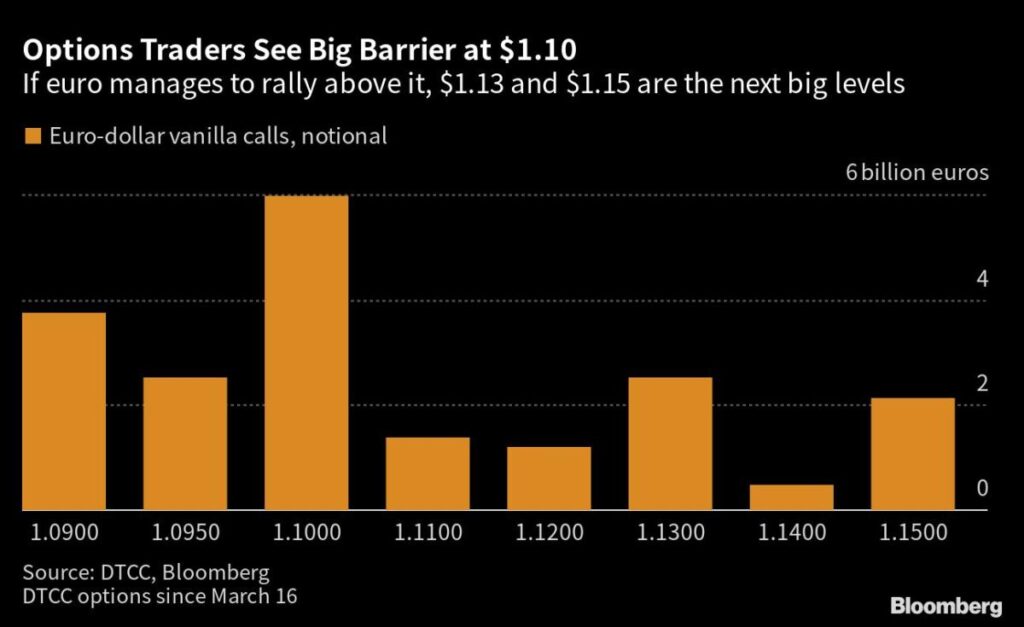

For Citigroup, the level of $1.10 per euro will be key. Once it’s breached, leveraged, real money and corporate accounts will be forced to chase the move higher, according to Vasileios Gkionakis, EMEA head of G10 strategy.

“A dovish Fed, an under-priced ECB as well as strong euro-area current account balance dynamics point to broad-based euro gains,” he wrote in a note. “EUR/USD upside is the simplest and purest expression of these market forces.”

This week:

-

Investors will be looking to a raft of inflation data across the euro-area this week, with Spanish and German figures due on Thursday ahead of those for the whole bloc on Friday

-

In the UK, investors may be looking to gauge the health of the housing market with data on mortgage approvals and house prices due this week. Investors will hear from Bank of England Governor Andrew Bailey on Monday, and he will testify Tuesday on Silicon Valley Bank

-

European Central Bank policymakers including ECB Executive Board member Isabel Schnabel, Bundesbank President Joachim Nagel and ECB Governing Council member Mario Centeno will also make appearances

–With assistance from Naomi Tajitsu, Libby Cherry, Greg Ritchie and Vassilis Karamanis.

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.