(Bloomberg) — China Evergrande Group wiped out international investors, roiled financial markets and left thousands of suppliers in the lurch. Yet it was the developer’s failure to pay households who invested in its wealth management products that may have provided the last straw for Chinese authorities.

Most Read from Bloomberg

Almost two years after Evergrande defaulted on its debt, its billionaire founder and chairman, Hui Ka Yan, is under police control on suspicion of committing unspecified crimes. Staff at the group’s wealth management business have been detained. Hui’s son Peter Xu, who once ran the firm’s wealth unit, was also taken into custody, local media reported.

The actions came after the company’s money management arm said it was unable to make payments in August on investments held by retail clients. Evergrande, like many other Chinese developers, sold high-yielding wealth management products to individual investors to help fund their operations when other financing avenues were becoming tougher to tap.

The detentions are consistent with the Chinese government’s priority to look after citizens rather than other stakeholders such as foreign bondholders, in line with President Xi Jinping’s desire to avoid social unrest and achieve “common prosperity.” They also send a signal to other debt-laden developers to focus on finishing apartments and paying consumers who are owed money.

“As the property sector is unlikely to provide an engine of growth, a prominent property tycoon makes a politically effective target,” said Rana Mitter, a professor of Chinese politics at Oxford University. “The Communist Party wants to demonstrate that what it views as anti-social business behavior will be penalized.”

Evergrande’s wealth unit ran into problems two years ago when a cash crunch meant it couldn’t make overdue payments on about 40 billion yuan ($5.5 billion) of investment products, sparking protests and prompting the company to offer reduced amounts of cash or discounted real estate instead.

Zhao was one of those investors. In the past two years she had waited for trickling repayments. After urging the police to investigate dozens of times without success, her luck finally turned this month when she received notice that her complaint was acknowledged.

To her bigger surprise, police and related authorities in the southern city of Shenzhen said they will work overtime through an eight-day national holiday, which starts Friday, to deal with leads from tens of thousands of retail investors. She quickly spread the word.

“It’s been two years, and I’ve almost been driven crazy,” said Zhao, who asked to be identified only by her surname for security reasons.

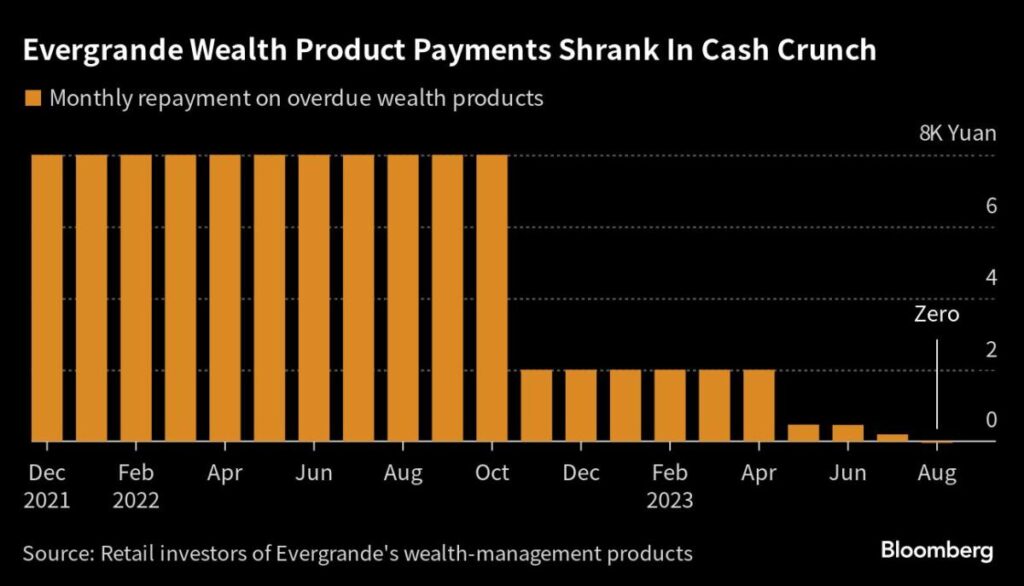

For those who chose to get repaid in cash, Evergrande’s wealth division initially promised to return 10% installments toward their principal on a quarterly basis. Three months later, the plan shrank to a monthly payment of 8,000 yuan. Almost a year after that, it was dialed back to 2,000 yuan a month, and then to around 500 yuan. For a 100,000 yuan investment, a full repayment at that pace would take almost 17 years.

When the latest installment was due on Aug. 31, nothing appeared in consumers’ accounts. That day, the money management arm said it couldn’t make payments due to a liquidity crunch and setbacks in disposing of assets.

Over the past two years, retail investors got the cold shoulder when seeking legal redress. Some were told by local police that their complaints couldn’t be submitted in a legal manner without consent from higher authorities, according to multiple individual investors who asked not to be identified.

Now they are being told that they can file complaints in various ways, ranging from in person to online. The easiest method is sending a formatted text message. Many quickly received notices that their cases were received. Police in Shenzhen, where Evergrande was based during its heyday, in mid-September publicly called on investors to provide leads to the authorities.

That’s also when a raft of headlines flashed on actions taken against Evergrande executives. On Sept. 18, police said they recently detained some staff at its wealth management unit. A week later, Caixin reported that former Chief Executive Officer Xia Haijun and former Chief Financial Officer Pan Darong, who both oversaw financing businesses, were also being held. On Sept. 28, Evergrande acknowledged that Hui is suspected of crimes.

Hui’s second son Xu was taken along with him, Yicai reported. Xu oversaw Shenzhen-based Evergrande Financial Wealth Management Co. for a while, according to Yicai. Earlier, Shenzhen police identified one of the detainees from the wealth division by the last name of Du. The unit’s general manager is Du Liang.

The involvement of off-balance sheet, unregulated wealth products has been a lightning rod for Evergrande, which has $327 billion in liabilities. Such offerings provided annualized interest rates of as much as 13%, and proceeds were to replenish working capital, Bloomberg reported earlier. The company even encouraged staff to purchase the products.

Regulators have been tightening rules on wealth management products and other parts of China’s shadow banking system for years. This month, China started a campaign against illegal fundraising to protect households. Li Yunze, who became head of China’s new National Administration of Financial Regulation in May, vowed in a September speech to deal with a number of major cases to protect the rights and interests of consumers.

How Wealth Products Helped Inflate China Real Estate: QuickTake

In addition to wealth products issued by developers, stress has emerged in similar offerings sold by trust companies.

Non-bank lenders that package investments for institutions and wealthy individuals are estimated to have sold more than 2 trillion yuan of products tied to property companies. In August, Zhongrong International Trust Co. missed payments, triggering protests and signaling that real estate risks are spreading to the country’s $60 trillion financial system.

For Evergrande’s wealth clients — along with everyone else owed billions by the fallen property giant — it’s likely to be a long road to recovery. Yet Zhao is optimistic.

“I hope there’s an end to all this soon and I can get my money back,” she said.

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.