The January CPI inflation report out Tuesday at 8:30 a.m. ET has been built up as a key data release for the Fed policy outlook and the S&P 500 direction. That’s way overblown. Sure, Wall Street might get a nice rally if the CPI inflation report comes in cooler than expected, or some selling pressure if it’s on the hot side. But the CPI is unlikely to have a shelf life of more than 24 hours.

X

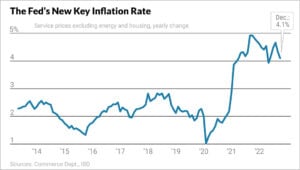

Federal Reserve chair Jerome Powell has made clear what he thinks is the most important category of inflation for Fed policy: core nonhousing services, a subgroup of the Commerce Department’s personal consumption expenditures price index. Inflation in those core services is closely linked to the tight labor market and strong wage growth. Economists will comb the CPI report for clues to the inflation outlook. But they won’t be able to confidently say what the new CPI data means for the direction of Powell’s favorite inflation measure when it’s released on Feb. 24. That uncertainty reflects the CPI’s serious shortcomings.

CPI Inflation Expectations

Economists expect the overall consumer price index to rise 0.5% in January, after December’s upwardly revised 0.1% gain. The annual rate should slip to 6.2% from 6.5%. The core CPI, excluding food and energy, is seen rising 0.3%. That would lower the core CPI inflation rate to 5.5%.

The S&P 500 will react to the headline and core inflation news, regardless of Powell’s focus. Some attention will be paid to CPI inflation for services less housing rent. Many people cite that as a proxy for Powell’s core nonhousing services, though it’s not even close.

Investors have been conditioned to respond to the CPI because data surprises really did produce some dramatic market swings last year, both when the CPI ran hot and when it cooled off. But it now has much less utility. If gas prices rise, the CPI lags by a month or so in reporting it. If rent falls, CPI tells you about it more than six months later. While the CPI does a good job of tracking goods prices, those are now falling and not much of a concern for the Fed.

CPI Inflation Report Shortcomings

So what’s the problem? Consider the services less rent of shelter category. First, it includes the energy services component, which isn’t part of core spending. Exclude that, and you’re left with tracking inflation for just 25% of household budgets. The category excludes spending at restaurants and hotels. It includes health insurance costs, but the Labor Department’s tracking methodology can yield some strange results. The latest 3-month annualized health insurance inflation rate is -38%.

If you subtract energy services and health insurance, then add food services and lodging, you can come up with a category that has some resemblance to PCE core nonhousing services. The latest revised data from December shows inflation in that category growing an annualized 5.7% rate in Q4, down from 7.4% in October. IBD will update those figures on Tuesday.

By comparison, the inflation rate for core PCE nonhousing services ran at 4.1% in December, easing from 4.7% in October.

The wide disparity underscores CPI data shortcomings. Not least, it only covers 30% of household budgets. By comparison, core PCE nonhousing services covers 50% of household spending.

Financial services is one big difference, accounting for 0.2% of CPI spending but nearly 5% of PCE. The latter includes the cost of financial services provided without explicit charges. Forgone or reduced interest on checking and savings accounts is an example.

Health Care: CPI Vs. PCE

The biggest difference between the PCE and CPI involves health care. PCE includes health spending covered by employers and the government. That’s why health care services represent nearly 16% of PCE spending, while medical services amounts to less than 7% of CPI budgets.

The best clue to PCE health services inflation won’t come from the CPI but from Thursday’s producer price index. The PPI medical services component feeds directly into the PCE, Deutsche Bank economists wrote in a Friday note. They added that the news on health care inflation might be positive. After big PCE health price increases in January of the past two years, the scaling back of a pandemic boost to Medicare physician fees starting Jan. 1 could contribute to more mild inflation.

S&P 500 Rallies Ahead Of CPI

The S&P 500 rallied 1.1% on Monday, climbing back above the 4100 level. Wall Street seemed to cast off fear of a hot CPI reading on Tuesday. Either way, though, the current rally’s upside may be limited near-term. Wednesday is expected to bring a hot retail sales report, which could fan fears that the U.S. economy has renewed momentum that will require still-higher interest rates.

As of Monday afternoon, markets are pricing in just over a 50% chance that the Fed will impose three more quarter-point rate hikes, to a range of 5.25%-5.5%.

But a lot of data will come out between now and then, and Tuesday’s CPI will be long forgotten. Powell sees the tight labor market as the biggest risk in the inflation outlook. If the job market slows and wage growth continues to moderate, a third rate hike won’t be needed. Still, a lot more progress will be needed before the Fed lets down its guard. Two more rate hikes are virtually assured and the extent of the slowdown needed to avoid a third isn’t yet clear.

Through Monday’s close, the S&P 500 has rallied 15.7% from its bear-market closing low but remains 13.7% below its all-time closing high.

Be sure to read IBD’s The Big Picture every day to stay in sync with the market direction and what it means for your trading decisions.

YOU MAY ALSO LIKE:

Stock Market Today: Three Buffett Stocks Near Buy Points As This Risk Looms

Join IBD Live And Learn Top Chart-Reading And Trading Techniques From The Pros

These Are The 5 Best Stocks To Buy And Watch Now

Catch The Next Winning Stock With MarketSmith

How To Make Money In Stocks In 3 Simple Steps