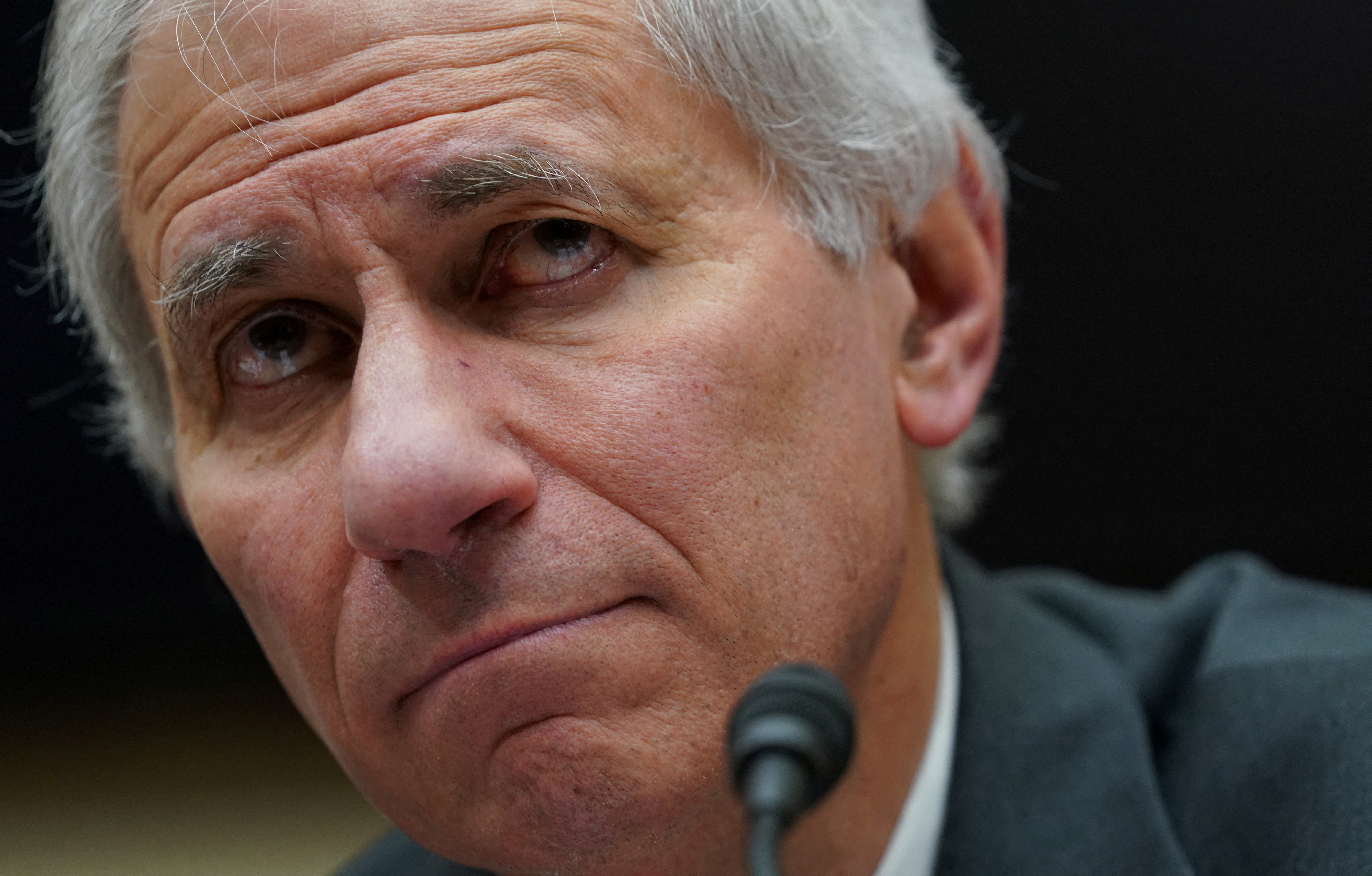

Federal Deposit Insurance Corporation Chairman Martin Gruenberg testifies at a House Financial Services Committee hearing on the response to the recent bank failures of Silicon Valley Bank and Signature Bank, on Capitol Hill in Washington, U.S., March 29, 2023. REUTERS/Kevin Lamarque/File Photo Acquire Licensing Rights

WASHINGTON, Aug 29 (Reuters) – A top U.S. banking regulator Tuesday unveiled a slate of proposed rules to ensure regional banks can be safely dissolved in times of stress, including one that requires them to issue billions more in debt as a cushion against potential losses.

The Federal Deposit Insurance Corporation (FDIC) was set to vote on five proposals later in the day aimed at ensuring banks with over $100 billion in assets are prepared for their own potential failures, and can be taken apart smoothly and quickly.

Among the proposals laid out by FDIC staff is one that will require banks of that size to issue more long-term debt, which could provide more funds to offset potential losses, reassure depositors, and encourage investors to closely monitor a bank’s operations, according to FDIC Chairman Martin Gruenberg.

That proposal would mean banks have to raise their long-term debt issuance by roughly 25%, or $70 billion, according to the FDIC. The agency said firms would have three years from the rule’s adoption to meet the new standard.

Specifically, the level required of each bank will be based on percentages of each firm’s risk-weighted assets, total assets, or total leverage, depending on what yields the highest number.

Regional banks like PNC Financial Services Group Inc, Fifth Third Bancorp, and Citizens Financial Group Inc are among those that would fall under the new, tougher rules.

The push comes in the aftermath of a tumultuous spring that saw three banks fail, forcing regulators to scramble to backstop depositors and tap billions of dollars from the FDIC’s insurance fund to sell off pieces of the firms to willing buyers.

“The failure of three large regional banks this spring…demonstrated clearly the risk to financial stability that large regional banks can pose,” Gruenberg said in a speech earlier this month previewing the proposals.

“It makes a compelling case for action by the federal bank regulatory agencies to address the underlying vulnerabilities that made the failure of these institutions possible.”

The regulator also rolled out a proposed overhaul to its rules on how banks must show regulators how they could be safely taken apart after failing.

The proposal would require firms to submit more detailed plans, including showing how they could be operated indefinitely as bridge banks by the FDIC after failing, and ensuring firms can quickly hand over key data to regulators and prospective buyers after a failure.

As banks failed last spring, the FDIC was unable to find immediate buyers for some firms, such as Silicon Valley Bank, in part due to struggles providing comprehensive data to potential acquirers in the immediate aftermath.

In the case of First Republic Bank, the FDIC ended up selling it to JPMorgan Chase, the nation’s largest firm, leading to rebukes from some big bank critics about allowing the Wall Street giant to grow even larger.

“Based on the spring banking turmoil and Gruenberg’s speech, it’s clear that the regulators want to avoid rushed, over-the-weekend bank sales that either take a big chunk out of the FDIC’s Deposit Insurance Fund or require selling to an already-giant bank,” Ian Katz, managing director of Capital Alpha Partners, wrote in a note.

The banking industry is already pushing back against the proposal and similar efforts, calling them unjustified and economically harmful.

“The FDIC and other regulators must demonstrate that all of these proposed changes…are justified by evidence and outweigh the significant costs to our economy,” Rob Nichols, head of the American Bankers Association, said in a statement in response to Gruenberg’s speech.

Reporting by Pete Schroeder; Editing by Megan Davies, Andrea Ricci and Philippa Fletcher

: .